Going Nowhere Fast

by Blaine Rollins, CFA, 361 Global

If you thought surprise air strikes in Syria, a “nuclear option” in the U.S. Senate, and Fed talk of shrinking the U.S. balance sheet in 2017 would be enough to get a 1% move in the market, then you were wrong. The S&P 500 remains stuck in the mud no matter what the tape throws at it. It will get tested again this week as U.S. corporate earnings begin, Secretary Tillerson travels to Russia and the White House is given all options on North Korea. Congress is off for the next two weeks as they recover from all of the work that they accomplished in Q1. Next up for them will be a budget battle that will decide if the U.S. Government will continue to operate or shut down. No pressure.

It is a shortened holiday week for the markets that will be packed with bank earnings on Thursday and then economic data on a ‘closed market’ Friday. Last week we had a volatile jobs Friday with Non-Farm Payrolls coming up short but the Unemployment Rates surprisingly strong (and following Wednesday’s ADP jobs data). While the NFP numbers were weaker (weather?), there is no denying that the job market is tight in the major metro areas and employers are needing to work hard to find workers. Expect employee/wage issues to get top billing during Q1 earnings calls for the upcoming weeks. As we wait for earnings, the market seems stuck. Any outperformance is being led by fewer and fewer names and unfortunately, those stocks seem to be larger and larger in market cap. My momentum and flow screens are drying up as buyers pause and wait for reasons to buy that next move. It is very difficult to get excited about much right now outside of some individual names, geographies or individual assets. I am looking forward to the earnings period hoping that the news will shake up the markets, in either direction. Just do something. Anything.

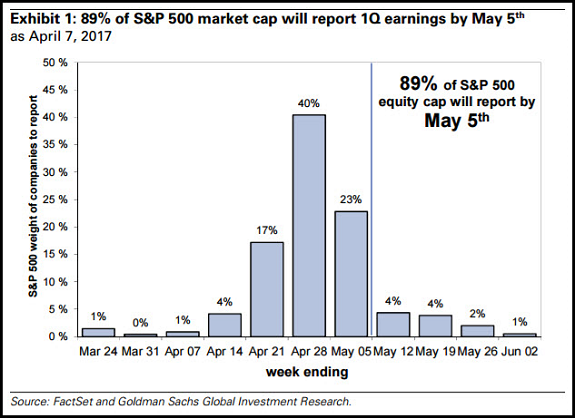

The next three weeks are going to be FULL of data points as 80% of the S&P 500 reports earnings…

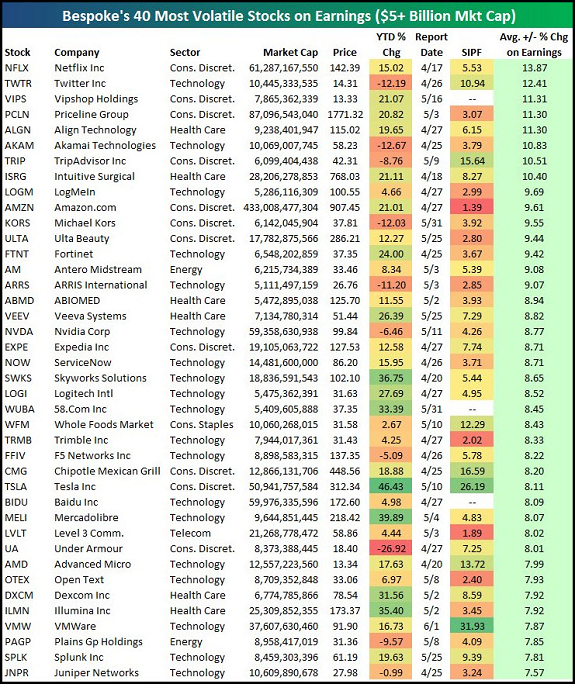

If you are dying for volatility, Bespoke has an upcoming earnings movement list for you…

(@bespokeinvest)

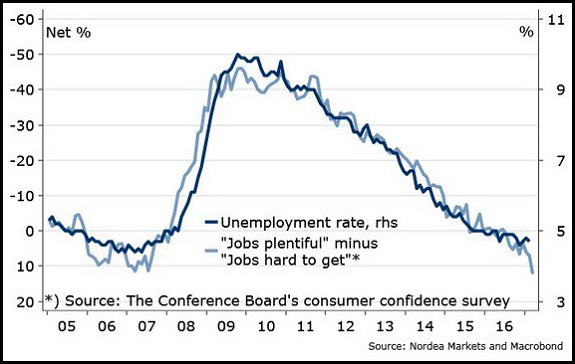

As mentioned, Friday jobs data was mixed, but the tightness in the labor market shows that the unemployment rates are still headed lower…

Especially with immigration issues now a question mark.

(@jbjakobsen)

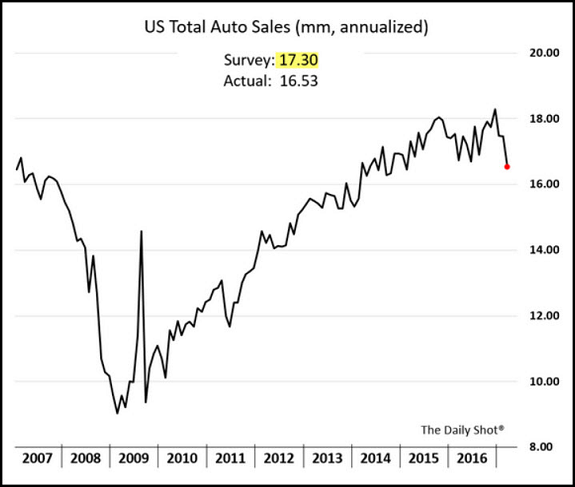

One of the most interesting data surprises last week was the slowdown in U.S. auto sales…

Some blamed tightening lending standards, falling prices and even reduced interest in car ownership.

(@SoberLook)

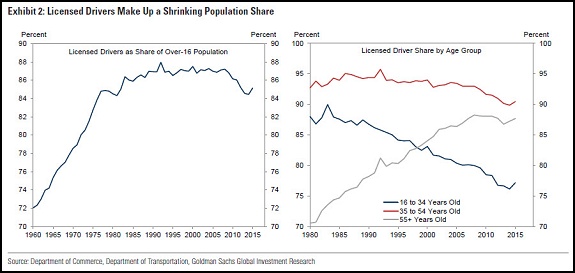

Kids these days just don’t want to drive…

“The trend of more and more young people finding that they do not need a car will likely continue to weigh on demand.” (Goldman Sachs)

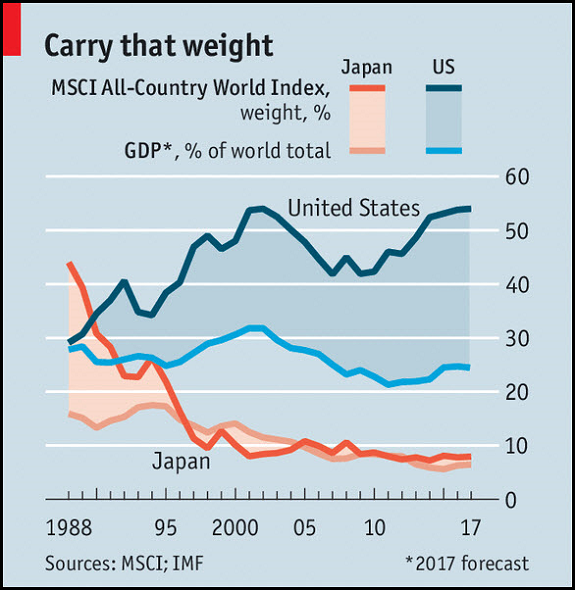

Very interesting chart…

Has to make you scratch your head about that long Japan/short U.S. equity trade?

Great article about how Mexico has protected its economy and lowered its borrowing costs by hedging its energy exposure…

A great read for anyone looking to understand the role of hedging for any participant. I was unaware that other major oil countries did not actively hedge their exposures.

Mexico’s oil hedge has real economic significance. Until fairly recently, the country relied on oil for about a third of its income, leaving it dangerously exposed to boom-and-bust price cycles. According to current and past government officials, the main purpose of the hedging is not to pad the country’s coffers but rather to protect the federal budget from fluctuations in oil prices.

What’s more, it’s a fiscally responsible exercise that ¬reduces the country’s borrowing costs, says Fabián Valencia, a senior IMF economist in Washington who follows Mexico. “The hedge means Mexico pays about 30 basis points less on its sovereign debt,” he says. Hedging is like buying insurance, says Guillermo Ortiz, who was governor of the country’s central bank from 1998 to 2009: “You buy it hoping you won’t need it.”

For its part, Mexico has shown a Wall Street-style wizardry in trading oil. It usually makes money on its hedges—sometimes a lot of money, as in 2008-09. From 2001 to 2017, the country made a profit of $2.4 billion; its hedges raked in $14.1 billion in gains and paid out $11.7 billion in fees to banks and brokers.

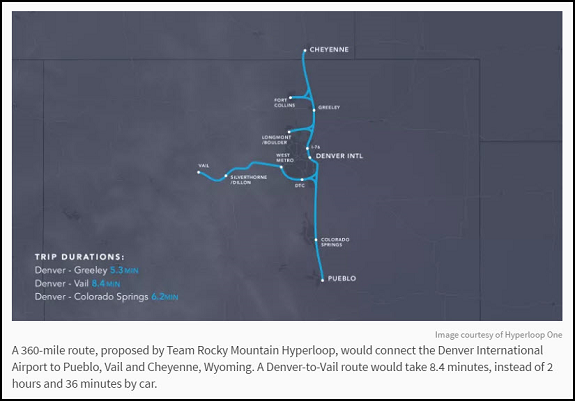

Colorado has three irons in the hyperloop finals proposal. Most interesting is a Denver to Vail trip in 8.4 minutes. Skiers will just love that commute!

Three Colorado proposals are among 11 U.S. finalists in a private company’s sci-fi-like transportation challenge that aims to move ground-based passengers at speeds of 700 mph.

The finalists announced Thursday by Los Angeles-based Hyperloop One join 24 proposals outside the U.S. and were picked from more than 2,000 worldwide. The company eventually will pick three winners to work with to further explore development.

Copyright © 361 Global