6 Pressure Points for U.S. Stocks

The highly valued US equity market has served many investors well in recent years, but Neil Dwane warns investors should watch for several factors that could put downward pressure on prices. At the top: Trumponomics troubles and growing inflation fears.

by Neil Dwane, Chief Investment Strategist, Allianz Global Investors

Key Takeaways

- US equities have been among the top performers for years, and many long-term investors should continue holding this asset class

- With US stocks and the US dollar overvalued, however, it's reasonable to wonder when the market will pull back before starting a new cycle

- We believe several factors could cause negative market reactions, including a suddenly aggressive Fed, high debt-servicing costs and protectionist politics

- For alternatives, consider attractively valued assets in Europe and Asia, and look for developing nations making important structural reforms

US bulls on eight-year run

The eight-year US equity bull market has time and again confounded

The markets had high hopes for Mr. Trump's policies, but his health-care bill's failure has curbed some enthusiasm

its many detractors, helping US stocks remain among the top performers since the global financial crisis began. With such a history of strong results, it is easy to argue why many long-term investors should continue holding this asset class in their portfolios.

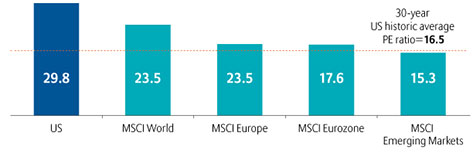

At the same time, the US equity market is highly valued – the current Case-Shiller price-to-earnings ratio of 29.8 is almost double its long-term average – leaving other investors to question whether this is currently the place to pursue growth potential and protect purchasing power.

US Equity Market Highly Valued

US price-to-earnings ratio is significantly higher than 30-year average

Source: Graham & Dodd CAPE/Schiller P/E

What might make the markets pull back?

The Dow Jones Industrial Average has fallen about 1% from its all-time high, set earlier this year, and a growing chorus of market watchers is calling for an additional pullback. For our part, we have identified six factors that may encourage investors overexposed to

A US border adjustment tax could hurt corporate profits and economic competitiveness by boosting the dollar

US equities to review their positions.

1. Trumponomics could provide limited lift

Although the markets initially had high hopes for stimulative new policies from President Trump, the recent failure of his health-care bill has curbed some enthusiasm. Moreover, not all of Mr. Trump's remaining proposals are measures that have historically been proven to boost the US economy. Tax reductions for corporations and the wealthy tend to offer only a small lift, while new infrastructure spending and tax cuts for lower-paid workers have proved to be substantially positive economic multipliers only in the medium term.

2. Higher inflation + higher rates = An unpleasant surprise?

US inflationary pressures could build much faster than the market expects, especially considering that the economy is almost at full employment and wages could soon start to rise convincingly. The US Federal Reserve is closely watching income and wage data – two data points that have historically been closely correlated. Depending on what it sees, the Fed could find itself "way behind the interest-rate curve" and move more aggressively, which would be an unpleasant surprise for the markets.

3. Trade could spell trouble for the US dollar

If Mr. Trump begins implementing protectionist trade policies, there could be negative implications for the US dollar. The same is true of the failure of the Trans-Pacific Partnership, China's expansion of its "one belt, one road" initiative and rising oil prices. The imposition of a potential US border adjustment tax could also hurt corporate profits and economic competitiveness by further boosting the dollar.

4. Cost of servicing debt stands to rise

The level of indebtedness in the US and around the world is significant, and it has been made affordable only because of extremely generous monetary policies. Even with a doubling of the US debt level in recent years, the annual cost of servicing it has remained around $425 billion. As interest rates move higher, Mr. Trump's financial wiggle room could diminish as the US government spends more to service its debt burden.

5. Demographics heading in the wrong direction

Ageing populations are a challenge all over the world, and the US is no exception. Its economy could increasingly feel the drag of productive older workers leaving the workforce, replaced by a younger generation that is less well paid and more exposed to the forces of globalization. Moreover, by subjecting immigration to the whims of politics, America's famously flexible workforce could become less of an economic advantage as lower levels of immigration, a shrinking talent pool and reduced relocational flexibility take their toll.

6. Technology is doing less with more

Despite some populists' assertions, it is not really globalization that hollowed out America's jobs market, but the rise of job-killing technology – a trend that is certain to grow as companies invest more in robotics and artificial intelligence. In addition, the multiplier effects of new technology and social media, where the US is a leader, are much smaller than those of previous industrial innovations – and much more disruptive to existing businesses. In the end, we may find that many high-tech innovations are better at creating vast wealth than vast employment.

Key considerations for investors

Even in a world where low interest rates have inflated valuations almost across the

Job-killing technology is on the rise as companies invest more in robotics and artificial intelligence

board, the US equity market is expensive. With an overvalued US dollar, the question may be when – and not if – the US equity market will pull back before starting a new cycle. With this in mind, here are several investment approaches to consider.

Copyright © Allianz Global Investors

The material contains the current opinions of the author, which are subject to change without notice. Statements concerning financial market trends are based on current market conditions, which will fluctuate. References to specific securities and issuers are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations to purchase or sell such securities. Forecasts and estimates have certain inherent limitations, and are not intended to be relied upon as advice or interpreted as a recommendation.

Allianz Global Investors Distributors LLC, 1633 Broadway, New York, NY