Margin Debt: Worry or Overblown Anxiety?

by Ryan Detrick, LPL Research

New York Stock Exchange (NYSE) margin debt is back in the news, as levels reached yet another new all-time high in February 2017 of $528 billion. Margin debt is viewed as a potential contrarian indicator; when margin debt is high, this suggests investors are potentially over-leveraged and therefore too bullish. Per Ryan Detrick, Senior Market Strategist, “Many have speculated for several years now that high margin debt would lead to lower equity prices, but it hasn’t yet proved to be a useful market signal. In fact, margin debt first broke out to new highs in April 2013, and we’ve been hearing since then that this is a potential warning sign. For those scoring at home, the S&P 500 Index has been up nearly 70% since then.”

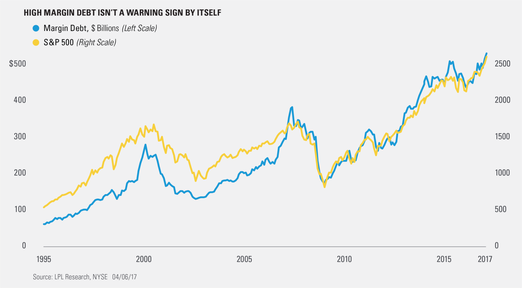

The figure below shows margin debt as it relates to the S&P 500 Index. As you can see, the two are highly correlated and margin debt looks more coincident than leading. In other words, the two tend to move in the same direction at the same time, so margin debt levels have not been a good predictor of future movements in the index.

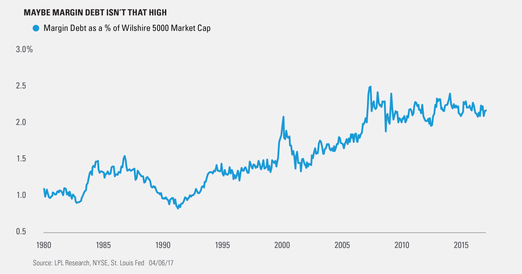

Viewing margin debt by itself isn’t telling the full picture, however. Yes, the total value of margin debt may be higher now than at the 2000 and 2007 peaks, but the entire stock market’s value is also much higher. To get a more apples-to-apples take on this, we use margin debt as a percentage of the Wilshire 5000 (market capitalization of the total U.S. stock market). This ratio currently sits at 2.2% versus the 2007 peak of nearly 2.5%. In fact, margin debt as a percentage of the overall stock market value has trended in a range over the last 10 years and currently sits near the midpoint of that range, which is not particularly worrisome at this point, in our view.

Last, we’ve seen many analyze margin debt as a percentage of the U.S. economy (gross domestic product [GDP]), but we don’t think this is relevant. The reality is that the U.S. has become much more productive and profitable for a given level of economic activity, and thus, using historical GDP data won’t tell an accurate story.