by Lance Roberts, Clarity Financial

Let me suggest a warning.

Two week’s ago, I discussed the failure of Congress to get the Affordable Care Act (ACA) repealed, much less replaced. The problem, of course, is the failure to repeal the ACA leaves in question the ability to pass other agenda based items such as tax reform, border wall construction, repatriation or immigration reform.

“Reaching an agreement on the FY budget resolution will not be easy; in the past, conservatives have demanded a balanced budget within ten years but this would require endorsing spending cuts (in non-binding form) that some centrist Republicans might oppose along with the BAT.

Of course, while Wall Street believes ‘tax reform’ will be a much easier process than repealing health care, the reality is it could be just as tough as government entitlement programs, funding for Planned Parenthood, and other programs central to the Democrats, and some left-leaning Republicans, come under attack.”

This past week, while Congress still hasn’t made any advance towards solving the current health care debate, Paul Ryan, House Majority Leader, confirmed my discussion on the rising risk of tax reform failure. To wit:

“U.S. House of Representatives Speaker Paul Ryan said on Wednesday that tax reform will take longer to accomplish than repealing and replacing Obamacare would, saying Congress and the White House were initially closer to agreement on healthcare legislation than on tax policy.

‘The House has a (tax reform) plan but the Senate doesn’t quite have one yet. They’re working on one. The White House hasn’t nailed it down. So even the three entities aren’t on the same page yet on tax reform.’“

Just to remind you, the entire catalyst behind the post-election rally has been the “hope” that tax cuts will boost earnings enough to support current market valuations. However, interestingly, while the markets continue to hope for “fiscal policy” reforms, according to the release of the FOMC minutes there is little consideration being given to Trump’s agenda. From the minutes:

“Participants continued to underscore the considerable uncertainty about the timing and nature of potential changes to fiscal policies as well as the size of the effects of such changes on economic activity. However, several participants now anticipated that meaningful fiscal stimulus would likely not begin until 2018. In view of the substantial uncertainty, about half of the participants did not incorporate explicit assumptions about fiscal policy in their projections.”

Furthermore, the FOMC also raised concerns over the level of valuations in the markets.

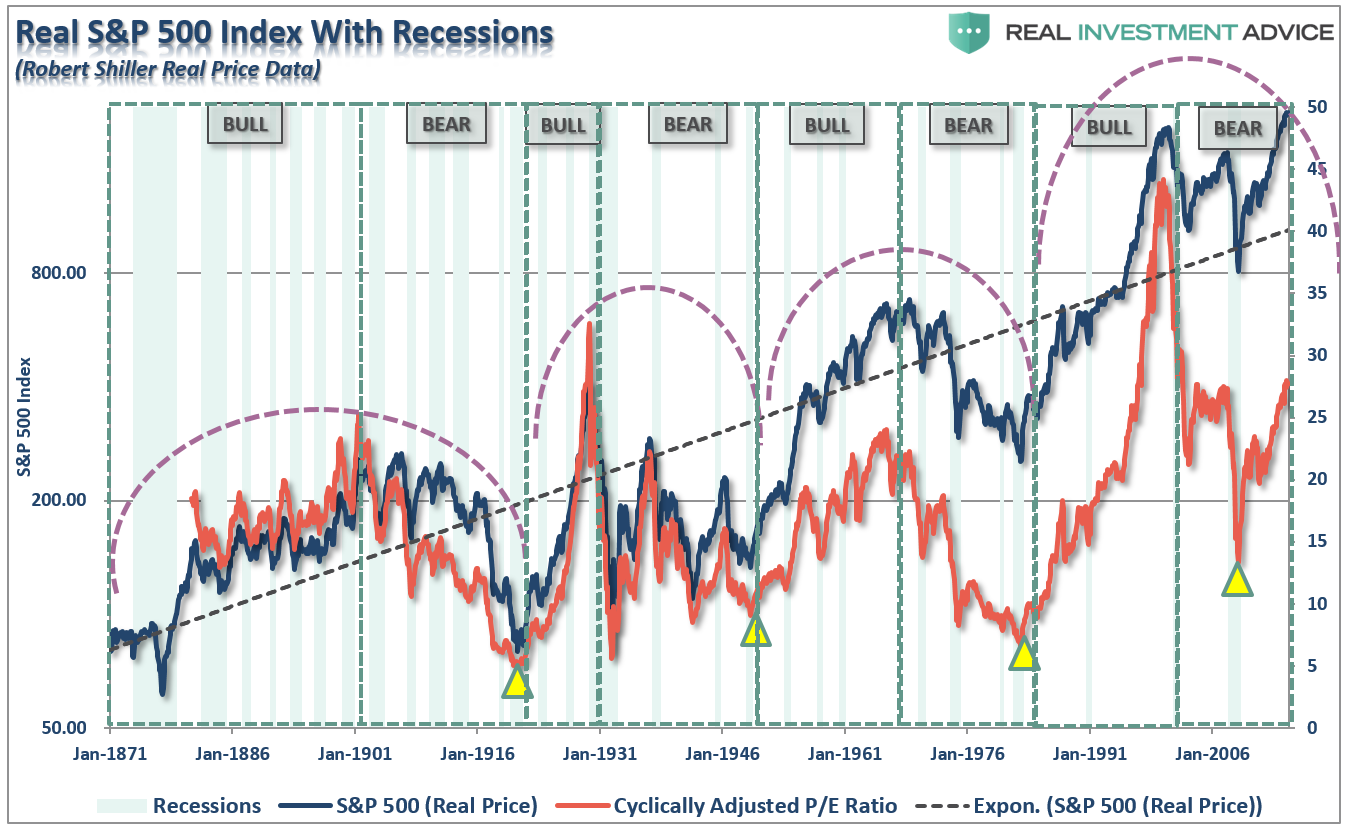

“Broad US equity price indexes increased over the intermeeting period, and some measures of valuations, such as price-to-earnings ratios, rose further above historical norms. A standard measure of the equity risk premium edged lower, declining into the lower quartile of its historical distribution of the previous three decades. Stock prices rose across most industries, and equity prices for financial firms outperformed broader indexes.“

Of course, valuations have been a topic of great debate in recent months particularly as they pushed into levels only witnessed prior to the 1929 and 2000 crashes.

This leaves markets with the “hope” trade in peril as Congress continues to trip itself up in moving legislative agenda forward while, at the same time, the Fed has decided accelerated the pace of monetary tightening and sending clear warnings to the markets.

This has “bad” written all over it.

Copyright © Clarity Financial