by Dr. Brian Jacobsen, CFA, CFP®, Wells Fargo Asset Management

Investors’ confidence has been on the rise. The Wells Fargo/Gallup Investor and Retirement Optimism Index is approaching the high it reached in November 2000. The index hit 126 in the first quarter of 2017.

People are feeling better about the broader economy, through their outlooks on growth, unemployment, the stock market, and inflation. They’re also feeling better about their personal economies, meaning their own income and investments.

But what’s on investors’ minds, when it comes to the future—be it the prospects of tax reform, higher interest rates, or their own personal plans for how they’d react to major macro events?

Investors’ expectations on tax reform

In the Wells Fargo/Gallup survey, people were close to evenly split on whether the percentage of income they pay in taxes will go up, down, or stay the same over the next few years:

- 39% expect their taxes to go up

- 29% think their taxes will go down

- 31% believe they’ll stay the same

To me, investors’ wide range of expectations on tax reform suggests their increased optimism wasn’t fully predicated on potential policy changes coming from Washington. And that’s good, as we’ve all learned that Washington can sometimes disappoint. Tax reform can take a long time. It took four years for President Reagan and Congress to get to the 1986 tax reform.

So what did drive optimism in the first quarter of 2017? Very likely, it was continued improvements in the U.S. labor market, higher U.S. wages, and better performance by non-U.S. economies.

Investors’ expectations on interest rates

In the survey, investors were asked whether the Federal Reserve (Fed) hiking rates would be a good thing for the economy. A third said it would be good, a third said it would be bad, and a third said it wouldn’t make much difference. This brings to mind an aphorism called Miles’s Law (named after a Truman-era cabinet official) that suggests, “Where you stand depends on where you sit.”

So where do investors sit?

Investors who are holding a lot of cash may be thinking that Fed rate increases would be good, because they could boost their interest income. Those who owe money may be thinking that higher rates would be bad, leading to increased debt servicing costs. However, the reality is that interest rates reflect what’s going on in the market for loans and debt.

When the Fed hikes its target for the federal funds rate, it means credit becomes a little less available for borrowers. That’s not necessarily a good thing for economic growth; it can be good for some, but bad for others. One potentially good outcome of Fed rate hikes relates to what they signal versus what they do. I think that Fed rate hikes endorse the view that things are getting better.

What will investors do if the Fed hikes rates?

When investors were asked how they’d respond to higher interest rates, 37% said higher rates would make them very or somewhat likely to transfer money out of the stock market and into more conservative investments. When the Fed embarked on its quantitative easing program, it was partially designed to push investors out of their comfort zones. Former Fed Chairman Ben Bernanke called this the “portfolio rebalancing channel” where the Fed could make conservative investments—like Treasury security purchases—that were relatively less attractive to investors, enticing people to take on more risk.

I believe the Q1 Wells Fargo/Gallup survey’s results vindicate the Chairman’s theory, in that the policy likely worked. This doesn’t mean it’s viewed as a good thing by investors; while it’s sometimes good to step out of one’s comfort-zone, many people want to get back into that comfort zone. Even as the stock market and other riskier assets have done well, different people have different appetites for taking on risk and some have been reluctant beneficiaries of risk assets’ price increases. Meanwhile, some investors may have just sat in cash, biting the bullet of having inflation slowly erode the purchasing power of their nest eggs, rather than lose sleep over whether their portfolio was bouncing around.

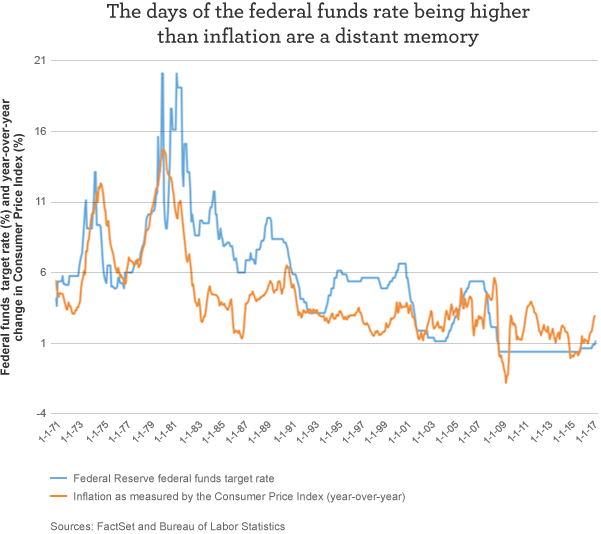

For those who are waiting for rates to revert to their historical averages, they may be waiting in futility. Inflation is lower than it’s historically been and the Fed is likely only going to slowly hike the federal funds rate up to 3%. That means that it may take three years for the real federal funds rate (the nominal rate adjusted for inflation) to reach 1%.

The heyday of a 4% real federal funds rate that allowed people to simply buy certificates of deposit and live comfortably off the income are a distant memory—and likely nowhere on the horizon. But maybe the low rates investors have endured have helped them dip their toes in the water, seeing that higher-yielding parts of the fixed income market can potentially help beat inflation.

Final thoughts

Just because higher interest rates and inflation are on the horizon doesn’t mean investors need to fret. It means they should think about the benefits of having a plan.

Only 37% of non-retired investors and 40% of retired investors who responded to the Wells Fargo/Gallup survey said they had a financial plan—less than half, overall. As for those survey respondents who do have a plan, 43% said they are “highly confident” they’ll have enough to maintain their lifestyle. Meanwhile, less than a quarter of investors (23%) who have no written plan said they highly confident. That’s a noteworthy contrast.

In my view, having a confidence-inspiring roadmap is much better than winging it—and far more strategic than waiting for macro events like rate hikes and Washington policies to pan out. Here are some thought-starters for investors interested in making a plan, with links to posts that explore ways to plan and save:

- A financial professional like an advisor can help investors craft a plan and stick to it. What’s the point of having a plan if the plan is ignored?

- Budgeting is an important part of a financial plan. A good budget can help identify ways to boost savings.

- Investors should make a note of revisiting their plans periodically. Major life events, like changing jobs, a new child or grandchild, or any other milestone could require a modified plan.

Copyright © Wells Fargo Asset Management