by Frank Holmes, CIO, CEO, U.S. Global Investors

Stocks had their worst day in months last Tuesday. The S&P 500 Index retreated more than 1 percent for the first time since October, and the small-cap Russell 2000 Index gave back more than 2 percent for the first time since September. As of Friday, the Dow Jones Industrial Average was down nine out of the past 10 days.

Throwing a monkey wrench into the Trump rally was fresh uncertainty House Republicans could successfully repeal and replace Obamacare, one of their headline campaign promises for seven years now. Failure to do so, it’s believed, could seriously push back tax reform. And the promise of tax reform—along with deregulation and infrastructure spending—is arguably what’s driven the Trump rally.

This uncertainty was confirmed Friday when President Donald Trump asked House Speaker Paul Ryan to pull the new health care bill from consideration—a stunning setback for the new president, who largely ran on his credentials as a master negotiator and closer.

Trading the “Trump Slump"

The thing is, the selloff was a huge overreaction. That’s the opinion of Marko Papic, geopolitical strategist with BCA Research, who visited our office last Thursday and briefed us on the investment implications of the domestic and European political climate. As always, Marko dazzled us with his deep intellect, quick wit and infectious enthusiasm.

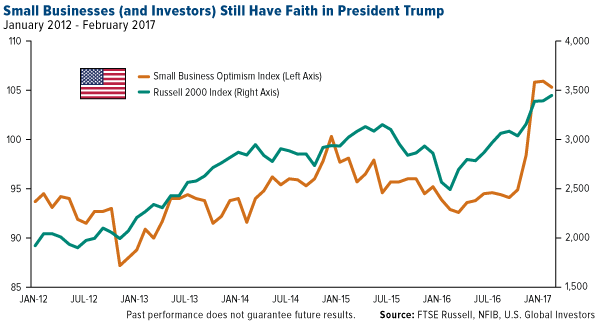

In his view, the market rally that immediately followed the election of President Donald Trump is still the “right” response. Among the companies that saw impressive returns were domestic, small-cap names, which have the most to gain (and less to lose) from Trump’s pledge to lower corporate taxes, slash regulations and raise tariffs. Small business optimism, meanwhile, posted its highest readings since 2004.

Investors, according to Marko, are making too much of the Obamacare issue. Regardless of its failure to be repealed, tax reform is on its way. On Friday, Treasury Secretary Steven Mnuchin reassured Americans that we could still expect “comprehensive” tax reform by August. It’s also worth recalling that, even though he failed to reform health care during his eight years in office, President Bill Clinton still managed to tackle tax reform with the Omnibus Budget Reconciliation Act of 1993.

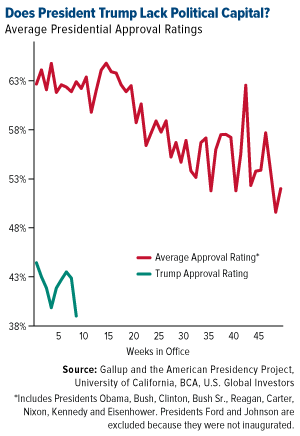

Increasing the likelihood that tax reform and infrastructure spending can be brought to light is, paradoxically, President Trump’s historically low approval rating. As you can see, he significantly trails the average rating of nine previous presidents during their same weeks in office. Congress’ job approval fares even worse at 28 percent, as of February.

Increasing the likelihood that tax reform and infrastructure spending can be brought to light is, paradoxically, President Trump’s historically low approval rating. As you can see, he significantly trails the average rating of nine previous presidents during their same weeks in office. Congress’ job approval fares even worse at 28 percent, as of February.

What this means is the sound of the clock ticking is deafening. Midterm elections are less than 20 months away, and Trump could very well be a one-term president. According to Marko, this gives Trump tremendous political capital among those who share his vision and urgently wish to pass legislation toward that end.

Trump is seeking high growth now, not in 2020 or 2024, and I think it’s a mistake for investors to dismiss him,” Marko said, adding that the president’s goal of 4 percent GDP growth is more than attainable. But how?

Get Ready for Inflation

I’ve written about the inflationary implications of Trump’s more protectionist policies before. Over the past 30-plus years, free trade agreements (FTAs) such as NAFTA have certainly been easy on consumers’ pocketbooks. But the downside is that many U.S. companies have found it challenging, if not impossible, to compete with overseas companies whose operating expenses are a fraction of the cost, forcing them to shut down or move production out of the country.

There’s disagreement among economists and policymakers about the extent of FTAs’ impact on jobs and wages here in the U.S., but the case can be made that they’ve been negative. Certainly this is the case Trump and his supporters made during his campaign.

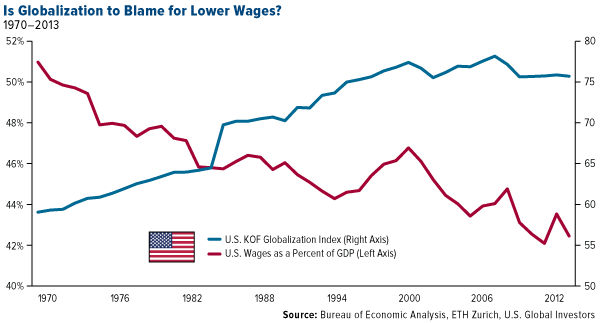

In the chart below, I compare U.S. wages as a percent of GDP between 1970 and 2013 and the KOF Globalization Index, which measures the economic, social and political dimensions of globalization on a scale from one to 100. The closer to 100, the more globalized a country is. As you can see, there’s at least a strong correlation between rising globalization and falling wages in the U.S.

Trump’s director of the National Trade Council, Peter Navarro, argued in January that “there is no question” the U.S. needs a border adjustment tax (BAT) to bring jobs back and grow wages:

“Would you rather have cheap subsidized… goods dumped into Walmart and not have a job and not have your wages go up in 15 years, or would you like to pay a little bit more—not much—a little bit more, and have a job and have your wages going up? I think the American people are going to make that choice.”

Whether you agree with Trump and Navarro on this point, it’s important to recognize that inflation is poised to surge in the coming years. Consumer prices rose 2.7 percent year-over-year in February, the seventh straight month they’ve advanced. And if Trump manages to restrict immigration and raise trade barriers, we can expect prices to rise even more—along with manufacturing activity, wages and ultimately GDP growth.

Bullish on Europe

A final thought I want to share from Marko’s visit is his bullishness on Europe right now. “Forget about what you see in the news about Europe,” he said, “and look at the data.”

He has a point. For one, the Markit Flash Eurozone PMI, released Friday, showed the region’s manufacturing activity growing at its fastest pace in six years. For the month of February, its PMI rose to 56.7.

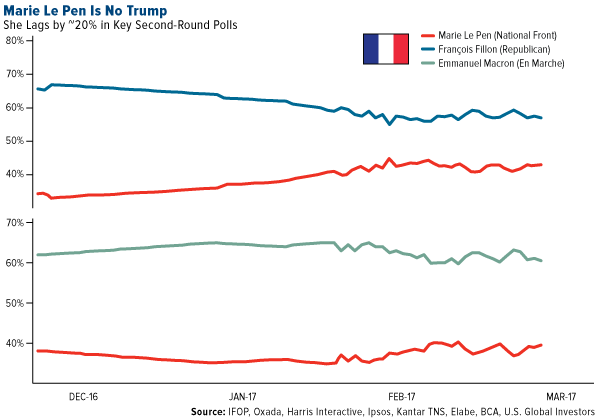

Terrorism remains a concern, as we saw in London last week, but the Syrian refugee crisis is emphatically done. Also overblown are Euroscepticism—or criticism of the European Union and its currency, the euro—secessionism and Trump-like populism. Geert Wilders’ far-right, anti-Muslim Party for Freedom (PVV) failed to secure an electoral victory in the Netherlands last week. Meanwhile, in France, the far-right Marie Le Pen still struggles to close the gap between herself and her two rivals, former prime minister of France François Fillon—currently being investigated on charges of corruption—and the socialist Emmanuel Macron.

With only one month remaining before France’s presidential election, Le Pen trails both rivals by about 20 points, throwing her candidacy into doubt. At this point in the U.S. presidential election, Trump had proven himself a very competitive candidate, trailing the much more politically experienced Hillary Clinton by single digits.

The key risk, according to Marko, is the upcoming Italian election, to be held no later than May 23. More and more, Italians are turning against the euro, and Euroscepticism is alarmingly high relative to other European Union countries. Whereas productivity is rising in Germany, France and Spain, Italy’s has stagnated since 2000.

Whatever happens, it’s important to monitor the eurozone’s PMI because, as I’ve often pointed out, it’s a precursor to commodities demand.

Some links above may be directed to third-party websites. U.S. Global Investors does not endorse all information supplied by these websites and is not responsible for their content. All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every invest.

Holdings may change daily. Holdings are reported as of the most recent quarter-end. None of the securities mentioned in the article were held by any accounts managed by U.S. Global Investors as of 12/31/2016.

The S&P 500 Stock Index is a widely recognized capitalization-weighted index of 500 common stock prices in U.S. companies. The Dow Jones Industrial Average is a price-weighted average of 30 blue chip stocks that are generally leaders in their industry. The Russell 2000 Index is a U.S. equity index measuring the performance of the 2,000 smallest companies in the Russell 3000®, a widely recognized small-cap index.

The Consumer Price Index (CPI) is one of the most widely recognized price measures for tracking the price of a market basket of goods and services purchased by individuals. The weights of components are based on consumer spending patterns.

The Purchasing Manager’s Index is an indicator of the economic health of the manufacturing sector. The PMI index is based on five major indicators: new orders, inventory levels, production, supplier deliveries and the employment environment.

The KOF Globalization Index, which measures the economic, social and political dimensions of globalization, observes changes in the globalization of a series of countries over a long-term period. Based on 23 variables, the KOF Globalization Index 2016 covers 187 countries and relates to the period 1970 to 2013. The Index comprises an economic, a social and a political component and measures globalization on a scale from 1 to 100.

This post was originally published at Frank Talk.

Copyright © U.S. Global Investors