by Carl Tannenbaum, Asha Bangalore, Northern Trust

Key Takeaways

- Bring On Brexit

- Lending Hits A Lull

- The Eurozone Still Isn’t Getting Enough Credit

In the time before Christ, Celtic peoples occupied most of Western Europe. They established a series of trade routes spanning from Great Britain in the northeast to Germany in the southwest. Lacking the organization of the Greeks that preceded them and the Romans that followed them, the Celts are not considered to be among the great civilizations of the ancient world.

The expansion of the Roman footprint into France and Spain forced the Celts to withdraw across the English Channel, where they set down deeper roots. The Celtic heritage is most keenly apparent in Ireland and Scotland, where forms of Gaelic, one of the Celtic languages, are still spoken. My recent trip to the region provided an interesting perspective on the United Kingdom’s pending withdrawal from the European Union (EU).

The British government is set to invoke Article 50 of the Lisbon Treaty next week, formally signaling its intention to separate from the EU. The final procedural hurdles were cleared last week, with approval from both houses of Parliament. Nine months after the fateful referendum, the march to Brexit is about to begin.

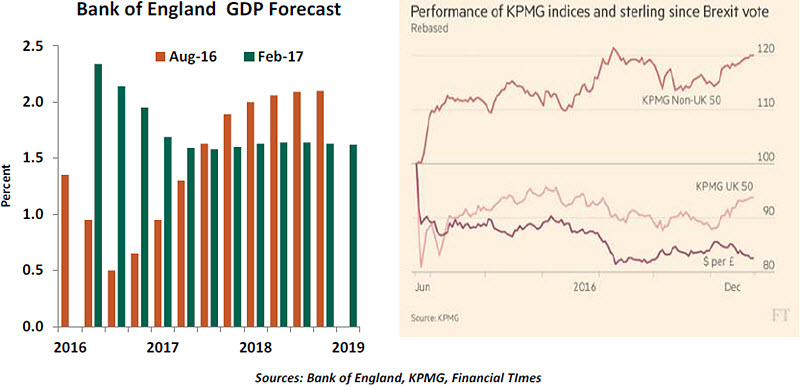

Outwardly, the U.K. economy and U.K. markets have held up well since last June, defying predictions of imminent demise. Forecasts for real growth this year have been upgraded several times, and the FTSE index of large capitalization stocks is more than 20% higher today than it was immediately after the balloting.

But a closer look reveals cracks in this reassuring veneer. Since the Brexit referendum, the British pound has weakened by more than 10% against the U.S. dollar and nearly 20% against a trade-weighted basket of currencies. This has caused inflation to rise, reducing the purchasing power of British consumers. Real personal spending, which makes up more than 60% of U.K. gross domestic product (GDP), may consequently grow more slowly in the coming quarters.

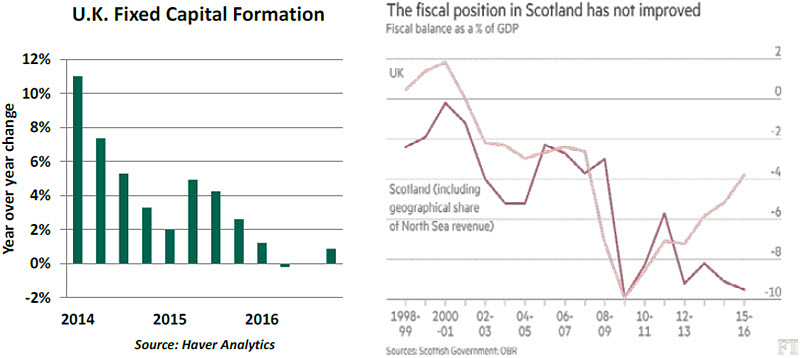

When it comes to business investment, British companies are slow-playing their hands. Instead of spending on R&D or equipment, they seem to be focused on contingent location strategies to prepare for changes in relations with the EU.

When it comes to business investment, British companies are slow-playing their hands. Instead of spending on R&D or equipment, they seem to be focused on contingent location strategies to prepare for changes in relations with the EU.

Equity market progress might also be viewed with some trepidation, as the gains seen since June have been concentrated in foreign companies whose shares are traded in London, as opposed to domestic companies. Relative fortunes may be due to the influence of currency rates instead of business prospects. The U.K. may not be entering this new phase with as much momentum as a surface reading of the data implies.

The declaration of intent to leave the EU begins a two-year period of negotiation that could be extended by mutual agreement. Once the terms of separation are established, the new arrangements will almost certainly be phased in gradually. So it will be quite a long time before the new relationship between Britain and the EU becomes a way of life.

That said, it is unlikely that those affected by the negotiations will simply watch and wait. U.K. companies, markets and residents will not prosper from prolonged uncertainty. Twists and turns in the negotiations, which could be frequent and severe, will test their collective patience.

U.K. leaders have tried to project an air of confidence, but their preparedness has been questioned. Prime Minister Theresa May said in January that “no deal is better than a bad deal,” but operating under World Trade Organization rules (which would be the default if negotiations fail) would place U.K. firms in a thick morass.

Adding to the unknowns is the composition and posture of those on the other side of the table. German interests will certainly be central to the EU side, but elections set for this fall in that country may defer the formulation of strategy. Continental negotiators will have to balance the desire to preserve economic ties with the need to be punitive enough to discourage others from customizing their participation in the common market.

Ironically, the potential withdrawal of the U.K. from the EU has prompted one member of the U.K. to reconsider its relationship with London. Scotland, which houses 8% of the British population and accounts for about 8% of U.K. GDP, is exploring another referendum on independence. The 2014 vote on Scottish sovereignty failed by a margin of ten percentage points.

The economic calculus for Scotland hasn’t changed much since then, and may even have gotten worse. An independent Scotland would be deeply indebted and have the twin challenges of initiating its own currency and striking a new trade relationship with the remainder of the U.K. North Sea oil revenues have diminished with the fall in crude prices and a production decline that is now 17 years old. Those favoring independence may not be deterred by such cold calculus. But they could be scared off as they witness the difficult negotiations surrounding Brexit.

The economic calculus for Scotland hasn’t changed much since then, and may even have gotten worse. An independent Scotland would be deeply indebted and have the twin challenges of initiating its own currency and striking a new trade relationship with the remainder of the U.K. North Sea oil revenues have diminished with the fall in crude prices and a production decline that is now 17 years old. Those favoring independence may not be deterred by such cold calculus. But they could be scared off as they witness the difficult negotiations surrounding Brexit.

The separation could also affect the Republic of Ireland, whose prosperous economy has been the envy of many in Europe and means the nation is much less dependent on trade with the U.K. than it was 25 years ago. Its key concern is the potential for a harder border with Northern Ireland, which might rekindle tensions between the regions and awaken memories of the “Troubles.”

The Brexit discussions are unprecedented. There will be difficult moments during the process. But we should not rule out the possibility that the two sides will find an equilibrium that sustains productive relations between Britain and the EU. And such accord might prove a good outline for others seeking greater control over their borders and less interference from Brussels.

Anyone who has visited Ireland or Scotland will agree that the Celtic identity is alive and well. Preserving local identity while pursuing global ambitions has required careful balancing. As the U.K. seeks similar balance, we can only hope that the road will rise up to meet it.

U.S. Bank Lending Stalls

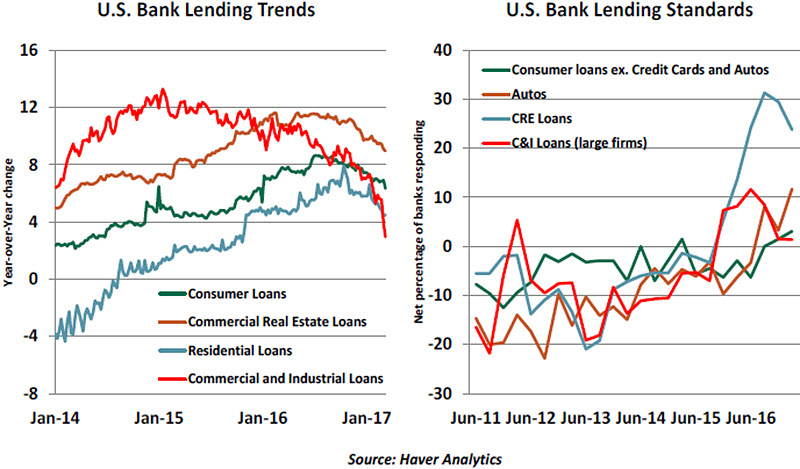

The role of bank lending in the United States is significantly smaller today than it was a few decades ago. Nonetheless, trends in bank credit can provide important insight into economic performance. Of late, lending has stalled, sending a signal that runs counter to messages from other reports.

Bank loans constitute only 15% of total liabilities of U.S. non-financial corporations, as debt and equity financing dominates funding of operations of U.S. firms. But lending trends remain a good leading indicator of economic shifts.

Currently, outstanding bank loans are 40% higher than the level seen in 2010. But after advancing briskly for five years, overall loan growth declined 0.4% during the three months ended February, compared to the nearly 7.0% growth for the full year of 2016. Although there is a broad-based deceleration of loan growth, disaggregating total outstanding loans by loan categories reveals important differences.

Commercial and industrial loans have been virtually flat since December. Activity in the commercial real estate (CRE) sector has run hot in the post-expansion period, but recent data show a marked slowing of CRE lending growth. Residential loans recovered late in the current business cycle; not surprising, as the global financial crisis originated in this sector. Consumer loan growth has slowed; its weakest sub-component is auto loans.

There are different reasons cited for the deceleration of loan growth. One view is that firms are selling bonds to lock in low rates before the Fed raises interest rates further. Year-to-date, debt issuance has risen more than 40% from a year earlier. But because this assessment is calculated from a low base last year when there was global market turbulence, it should be treated with caution.

Another key factor in the recent deceleration of lending is underwriting standards. Lenders started tightening underwriting standards for CRE loans in late 2015, and have remained very cautious. Since the third quarter of last year, bankers have become more careful about lending to consumers. Loan underwriting standards are more stringent for purchases of cars than for with non-auto consumer loans and credit cards. Bankers have treated commercial and industrial loans favorably, and borrowers face fewer constraints. In this context, the lack of stronger loan growth is inconsistent with an expanding economy. In the post-election months, bank lending growth has slowed even as consumer and business sentiment measures have advanced.

Analysts suggest that firms have postponed borrowing while they seek clarity on how interest expense and capital purchases will be treated in the Trump administration’s tax reform legislation. Lenders may be waiting for a reduction of regulations before extending loans. While these are valid arguments, these postures may have only intensified the already slowing trend of bank lending that was underway before the U.S. presidential elections.

Analysts suggest that firms have postponed borrowing while they seek clarity on how interest expense and capital purchases will be treated in the Trump administration’s tax reform legislation. Lenders may be waiting for a reduction of regulations before extending loans. While these are valid arguments, these postures may have only intensified the already slowing trend of bank lending that was underway before the U.S. presidential elections.

Bank stocks shot up about 32% from the eve of the elections to early March based on expectations of a strong economy, rising margins, and easier regulations. But the pickup in bank equity prices is at odds with bank lending data. In recent days, bank shares have lost ground as investors revise their bullish outlook.

If uncertainty influences bankers’ lending decisions and firms’ expansion operations in the months ahead, it could translate into weaker economic growth. Bank lending trends may warrant another look at the rosy post-election outlook adopted by many.

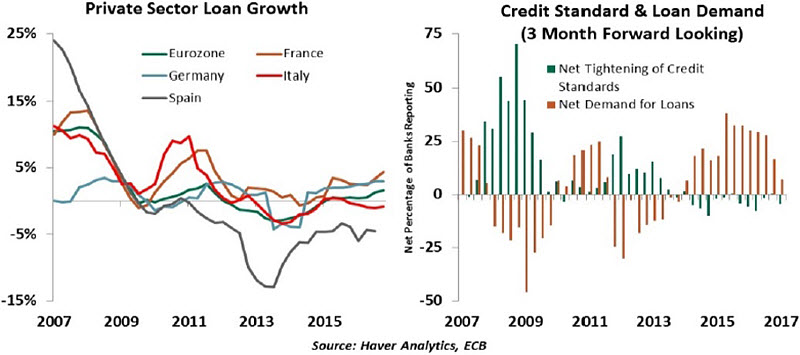

Debt Overhang Weighs on Europe

One of the surprises of the global economy over the last few months has been the steady improvement in Europe. Headline inflation sits neatly at 2% — at the top end of ECB’s asymmetric inflation target. Private sector credit is growing at its fastest pace in more than five years, while credit standards remain easy. Add the steady, if slow, expansion of the economy and the buoyant Purchasing Managers Index (PMI) readings into the mix, and the eurozone economy hasn’t looked this strong since the sovereign debt crisis spread throughout the continent in 2011.

But scratch beneath the surface, and there is reason to be cautious. Credit growth is driven by core countries such as France and Germany, masking the continued credit contraction in the periphery. The private sector is still deleveraging in almost all major eurozone economies, hardly the sign of strong expansion.

Net demand for loans is positive, but the latest bank lending survey shows that funds are being used primarily for inventory and working capital management instead of fixed capital formation. On the supply side, the banking sector has not tightened standards for almost three years now. Encouragingly, the cost of funds and balance sheet health are not reported to be constraining credit supply — Italy and Spain are notable outliers.

This week’s strong take-up of the ECB’s final targeted long-term refinancing operations (TLTRO) — a subsidized funding program for banks — suggests that there could be some improvement in the medium term, especially since more than 50 percent of the demand is estimated to have come from Italian and Spanish banks.

This week’s strong take-up of the ECB’s final targeted long-term refinancing operations (TLTRO) — a subsidized funding program for banks — suggests that there could be some improvement in the medium term, especially since more than 50 percent of the demand is estimated to have come from Italian and Spanish banks.

In absence of a credit creation bonanza, growth appears to be coming from absorption of excess capacity and modest productivity growth. An upside of this is that the eurozone economy can continue on the path of recovery — and the ECB can proceed with accommodative policy — without stoking medium-term inflation. The downside is that the eurozone could continue to struggle with tepid post-crisis performance.

*****

Information is not intended to be and should not be construed as an offer, solicitation or recommendation with respect to any transaction and should not be treated as legal advice, investment advice or tax advice. Under no circumstances should you rely upon this information as a substitute for obtaining specific legal or tax advice from your own professional legal or tax advisors. Information is subject to change based on market or other conditions and is not intended to influence your investment decisions.

© 2017 Northern Trust Corporation . Head Office: 50 South La Salle Street, Chicago, Illinois 60603 U.S.A. Incorporated with limited liability in the U.S. Products and services provided by subsidiaries of Northern Trust Corporation may vary in different markets and are offered in accordance with local regulation. For legal and regulatory information about individual market offices, visit northerntrust.com/disclosures.