by Ryan Detrick, LPL Research

There are so many different measures of stock market sentiment that it can make your head spin. Some are surveys such as the American Association of Individual Investors (AAII) Bull-Bear survey, which tells us how individual investors feel about stocks, and the National Association of Active Investment Managers (NAAIM) survey, which tells us how money managers are moving actual dollars.

Flows data, the derivatives markets, and the VIX measure of implied (future) S&P 500 market volatility can help gauge fear levels in the markets.

Valuation metrics like price-to-earnings ratios are also sentiment measures, showing how optimistic (or pessimistic) market participants are about an investment.

Still others look at market value relative to economic indicators, corporate balance sheets, or even relative to the amount of margin debt investors hold (which we will tackle in a future blog).

There are many other sentiment measures, but the one we want to focus on today is insider sentiment: that is, what corporate executives are doing with their own company’s stock. Thanks to our friends at Ned Davis Research (NDR), we have access to a measure of what these insiders are doing that can be used as a sentiment gauge. The theory is that the people who know their companies best are smarter buyers and sellers.

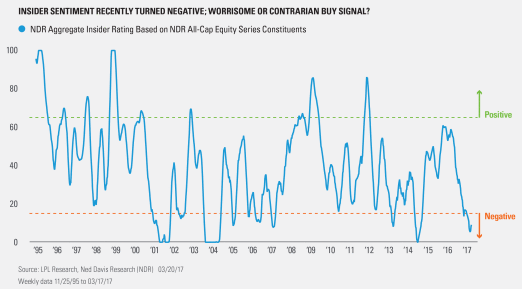

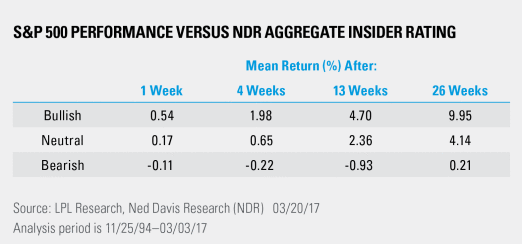

Figure 1 shows the NDR insider score* is quite negative now, implying that more insiders are selling than buying. Is this cause for concern? Perhaps, but the numbers in Figure 2, which show S&P 500 performance when NDR’s insider score is in their bullish (buying) zone, the bearish (selling) zone or neutral, should help ease concerns. As you can see, stocks fare better when the reading is positive. However, the weakness following negative readings has historically been minimal.

This indicator does suggest stocks need a pause. But when we look at sentiment measures broadly, we do not see excessive optimism that can lead to big near-term corrections. Remember, negative sentiment, which is not difficult to find across the universe of sentiment indicators we watch, can be a positive contrarian signal. As LPL Research Chief Investment Officer Burt White and Market Strategist Jeffrey Buchbinder noted in this week’s Weekly Market Commentary: “Our analysis of investor sentiment reveals signs of increasing worry. From a contrarian perspective, this could be a positive sign.” So while insider sentiment does suggest some nervousness, and we may get a pickup in volatility after an unusually calm period, we would not be alarmed by this one indicator. Look for more from us on sentiment here in the coming weeks.

*****

IMPORTANT DISCLOSURES

*The NDR Aggregate Insider Rating uses advanced statistical techniques to capture meaningful changes in corporate insider buying or selling activity across the approximately 3,000 largest U.S. publicly traded companies.

Past performance is no guarantee of future results. All indexes are unmanaged and cannot be invested into directly.

The opinions voiced in this material are for general information only and are not intended to provide or be construed as providing specific investment advice or recommendations for any individual security.

The economic forecasts set forth in the presentation may not develop as predicted.

Investing in stock includes numerous specific risks including: the fluctuation of dividend, loss of principal and potential illiquidity of the investment in a falling market.

Stock investing involves risk including loss of principal.

This research material has been prepared by LPL Financial LLC.

To the extent you are receiving investment advice from a separately registered independent investment advisor, please note that LPL Financial LLC is not an affiliate of and makes no representation with respect to such entity.

Not FDIC/NCUA Insured | Not Bank/Credit Union Guaranteed | May Lose Value | Not Guaranteed by any Government Agency | Not a Bank/Credit Union Deposit

Securities and Advisory services offered through LPL Financial LLC, a Registered Investment Advisor Member FINRA/SIPC

Tracking # 1-592952 (Exp. 3/18)

Copyright © LPL Research