by Doug Drabik, CFA, Fixed Income, Raymond James

The Federal Reserve Bank (Fed) raised short-term interest rates by 25 basis points (bp) last Wednesday, March 15th. We are often asked, “when will the rate hike be reflected in…(the yields paid on various types of bonds)”? The bond market is typically ahead of the action, right or wrong. The Fed was very forthright with their intentions to hike short-term rates well ahead of the FOMC meeting. Investor sentiment began influencing rates on these early indications. As a matter of fact, the immediate post-action of the actual event was that interest rates moved lower. As Kevin Giddis, head of Raymond James fixed income, put it, “what we saw was a market that was prepared for the worst, and got the best.” The early anticipation that moved interest rates up was reassessed not because the projected event occurred, but because the tone of the accompanied Fed message was less hawkish than the market had accounted for. In other words, interest rates moved up “ahead” of the actual Fed hike and the market corrected the “over-reaction” based on future anticipation of the Fed being less aggressive going forward.

| Treasury Yields | 12/30/16 | 03/20/17 | Net Chg |

|---|---|---|---|

| 1mo | 0.416% | 0.669% | +25bp |

| 3mo | 0.497% | 0.726% | +23bp |

| 6mo | 0.610% | 0.860% | +25bp |

| 1yr | 0.811% | 0.980% | +17bp |

| 2yr | 1.188% | 1.317% | +13bp |

| 3yr | 1.451% | 1.601% | +15bp |

| 5yr | 1.927% | 2.023% | +10bp |

| 7yr | 2.245% | 2.311% | +7bp |

| 10yr | 2.444% | 2.508% | +6bp |

| 30yr | 3.065% | 3.120% | +6bp |

Source: Bloomberg LP, Raymond James

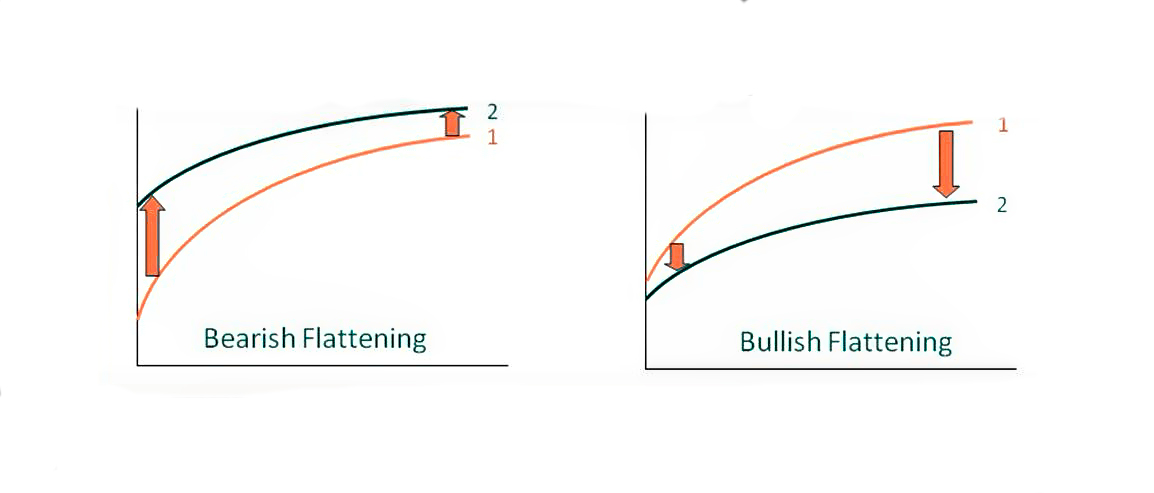

The Fed, to some degree, was able to manipulate interest rates during quantitative easing programs with open-market purchases of bonds in varying maturities. Now that the intent is to remove stimulus from the market, they may be able to primarily influence only the short-end of the yield curve. Recall that early anticipation was for the first of three 2017 rate hikes to be in May, not March. The market has paved the way and in many respects, pushed the Fed’s agenda ahead of schedule. Not surprisingly, the Fed has been influential in pushing Treasury Bill (short-term) rates up; however, the medium and long-end of the yield curve are up a mere 6-10bp on the year.

Going forward, the Fed is going to have to balance the speed at which it scales back stimulus with how healthy the economy really is. If it scales the stimulus too quickly, it could impede growth or even spiral us backwards. The market’s reaction was not as enthusiastic about the economy and thereby keeping longer term rates mostly static. Inflation has also not been a driving force. The net result is a flattening yield curve as short-term rates close the gap from medium and long-term rates. Should this eventually turn into a flat or specifically inverted curve, history suggests we should take notice. The Treasury curve inverted prior to the recessions experienced in 1981, 1991, 2000 and 2008.

Copyright © Raymond James