Digging Deeper for Municipal Bond Income - Context

by Fixed Income AllianceBernstein

March 13, 2017

There’s a lot of uncertainty today for municipal bond investors: how do you hang onto the income you have in the face of rising rates and the potential for tax reform, and where should you look for more? We think muni credit is a good place to point the shovel.

Whether it’s the specter of rising rates, higher inflation or tax policy changes, municipal bond investors will need to navigate a number of challenges going forward. Munis endured a major sell-off last November, but have rallied since then, providing relief. Munis historically have tended to rebound in the months following a sell-off, though it’s too early yet to gauge the extent of this rebound.

But what’s next for muni investors? How do they add income without reaching for yield in a relatively low-yield environment, while still protecting their portfolio? It sounds like a good objective—but how exactly should investors go about it in today’s environment?

Favorable Landscape to Add Income with Credit

Credit is one place investors should look to increase the income-generating potential of their muni bonds—and muni credit may also help with playing defense.

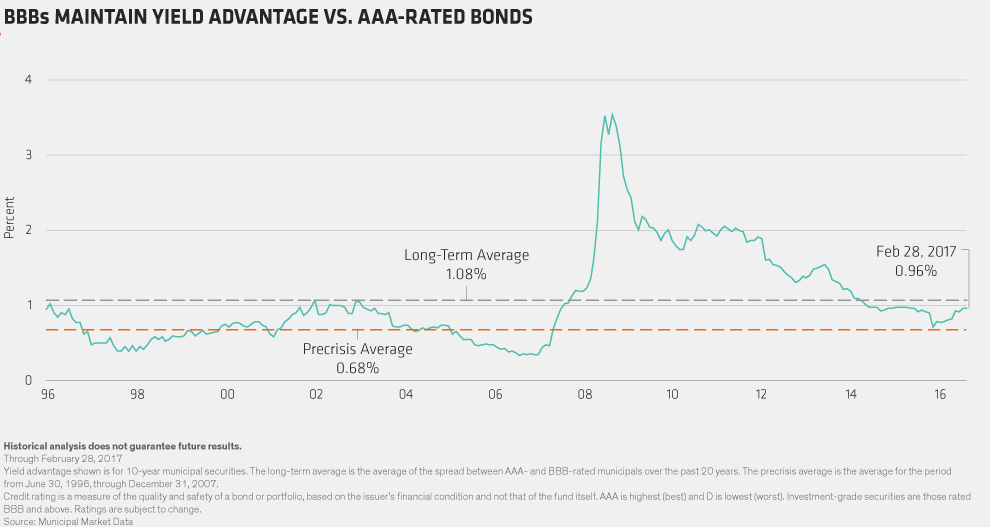

Yield spreads are wider. When municipal bonds sold off in the fourth quarter of last year, the relative yields on lower-rated investment-grade munis rose. The yield spread of a BBB-rated muni bond versus a AAA-rated muni is higher than it was a year ago—today, it’s near the long-term average (Display). That creates an opportunity to add income-generating potential.

The US economy is getting stronger. As the economy continues to grow, we think the underlying credit characteristics of these lower-rated municipalities will likely improve, and the yield spread should decrease. This trend, combined with the higher yield at purchase, will boost returns versus their high-grade counterparts.

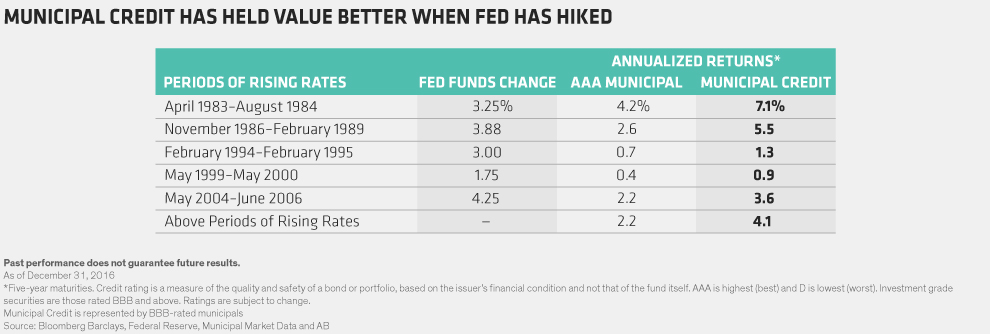

Credit can play defense, too. Credit can also be a buffer against rising rates. It may seem counterintuitive, but that’s exactly what has happened historically when the US Federal Reserve has raised the federal funds rate. In the past five periods during which the Fed has hiked interest rates, muni credit has held its value better, outperforming both US Treasuries and high-quality municipal bonds (Display 2).

A Better Path than Reaching for Yield

The way we see it, adding income with muni credit exposure is a better approach than the alternative: reaching for yield by buying longer-maturity bonds.

Sure, these bonds add some yield, but if inflation increases and yields rise—or if tax reform is passed—they’ll face the most downside risk. Suffice it to say that we don’t believe it’s a good time to buy longer-maturity bonds to increase income.

For muni investors, the flexibility to adapt to changes in the market landscape has never been more important than it is today, whether it’s finding opportunities to add income through credit, insulating against potential risks or being ready to retool as policy changes reshape opportunities and risks.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams.

Copyright © AllianceBernstein