by Jeffrey Saut, Chief Investment Strategist, Raymond James

Around the turn of the century a bandit rode in from Mexico, robbed a small Texas bank, and fled back across the border. A Texas Ranger picked up his trail and nabbed him in a Mexican village. The bandit spoke no English and the ranger no Spanish, so another villager was asked to interpret.

“Ask him his name,” said the ranger.

“He says his name is Jose,” said the interpreter.

“Ask him if he admits robbing the bank.”

“Yes, he admits it.”

“Ask him where he hid the money.”

“He won’t tell me.”

Leveling his pistol at Jose’s head the ranger said, “Now ask him again where he hid the money.”

Jose quickly blurted out in Spanish, “The money is hidden in the well in the village square.”

“What did he say?” demanded the ranger.

The interpreter replied, “Jose says he’s not afraid to die!”

The translation and interpretation of the news can play a crucial role on Wall Street. This is especially true when it comes to public perception. Importantly, the financial media plays a dominant role when it comes to shaping the investing public’s perception; and, for the most part their modus operandi is clear. For instance, everyone has heard the classic – is the glass half full or half empty? Well, much of the time when it comes to media translation and interpretation of the news it’s often “half empty” because bad news sells more newspapers and gets more radio/TV time, while good news doesn’t. It’s reminiscent of the famous newspaper mantra, “If it bleeds it leads!” So let’s reflect back on the “glass is half empty” news about the President since the election. Indeed, according to CBS News, “Majority of Americans think the press has been too critical of President Trump,” according to a new poll. In fact, only 3% of NBC and CBS reports depicted President Trump positively. Moreover, a lot of the negative press has had to have been leaked by the Deep State and the intelligence community. However, that could be coming to an end since last week one of my contacts on “The Hill” hinted that the FBI has the names of the “leakers.”

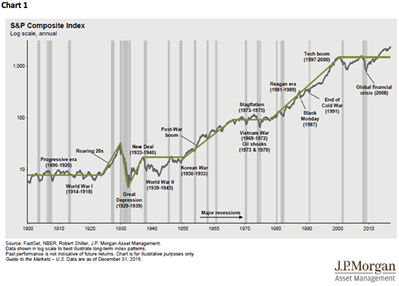

Over the weekend there was another allegation by the President in that he tweeted the previous administration had “tapped” his phones at Trump Tower. I too have heard that rumor over the past few weeks, but I am challenged to believe it. As for the “Russian Connection,” last week House Intel Committee Chair Devin Nunes (R-CA) said, “We have not seen any evidence” of contacts between the Trump campaign and Russia. Whether true or not the stock market does not seem to care as the D-J Industrial Average (INDU/21005.71) gained another nearly 184 points. Similarly, the S&P 500 (SPX/2383.12) was lifted by 0.67%. Those results caused many pundits to trumpet that as we approach the eighth birthday of the bull market on March 9, 2017, we are moving in on the second longest bull market in history. Of course readers of these reports know that is patently untrue because said pundits are using the wrong measuring stick. They tend to cut the 1982 to 2000 secular bull market off in 1987 and the 1949 to 1966 secular bull market off in 1956. Yet as anyone can see (chart 1 on page 3) those end-points did NOT end the secular bull market. Then there is the Shiller Cyclically-Adjusted PE (CAPE) that the “bears” always point to. Last week it crossed above 30x for only the third time. The first time was in 1929 and led to a crash and the Depression. The second time was in 1997, however, and the market ran another 80%+. In past missives I have stated why I believe the CAPE is a flawed indicator, but suffice it to say the CAPE would have kept you out of the market for the past seven years. I don’t have much use for an indicator that would have kept me out of a rally by the SPX from 1000 to 2400!

While the bears focused on the CAPE, the real event of last week was President Trump’s address. As CBS News noted, “It was a very different speech for President Trump. He repeatedly reached across the aisle to the Democrats.” CNN’s Van Jones even went one better when he said, “He became President of the United States in that moment, period!” Obviously the stock market liked the address as the senior index tacked on some 300 points. In fact, stocks actually ignored the hawkish Federal Reserve comments and the heightened probability of a rate hike in March. That further reinforces our observation that DJT is driving the equity markets and not the Fed, which is a distinct change from the past 10 years.

Other “sound bites” from last week include: 1) China’s factory activity expanded faster than expected; 2) China’s Congress is kicking off. Remember, China’s Congress elects the Central Committee, who elects the Politburo that elects the all-important Standing Committee; 3) Chinese wages are now higher than Brazil, Argentina, and Mexico; 4) Real Personal Income in the U.S. declined by the most since 2009 (-0.3% m/m); 5) Our president called for a “merit-based” immigration system; 6) the EU escalated the “visa wars” with Americans set to lose visa-free travel to Europe; 7) IRS, FDIC, and Commerce Department agents are involved in the Caterpillar investigation; 8) Construction Spending declined 1.0% in January; 9) 1Q17 GDP estimates were cut; 10) Macron is on course to beat Le Pen in the French presidential election; 11) U.S. pending home sales in January tumbled 2.8% to a 12-month low; 12) Wendy’s to install ordering kiosks in 1,000 stores this year in a brewing minimum wage disaster; 13) Russian diplomats keep dying unexpectedly. I guess I will stop at a “baker’s dozen.”

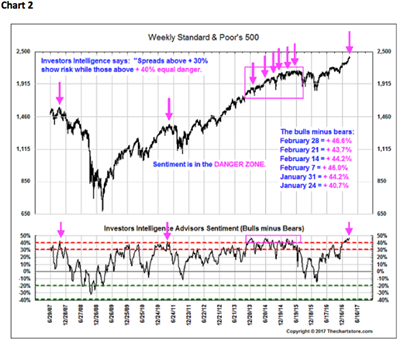

The call for this week: Andrew and I are at the 38th Annual Raymond James Institutional Investors Conference in Orlando, where there will be some 1,000 portfolio managers and approximately 300 presenting companies. We will be seeing companies’ CEOs, CFOs, COOs, etc. Interestingly, such corporate insiders sold $7.8 billion of their companies’ stock in February, which was the most in roughly six years. What do they know that we don’t know? Maybe they know that the Daily Sentiment Survey of Futures Traders shows a 92% Bulls reading. In the three times the reading has been that high since 2011 it has led to declines of 7% (2/11), 8% (5/13), and 3% (11/13). Also of note is that late last week the number of stocks making new 52-week highs on the NYSE collapsed by some 80%. Then there are the bullish sentiment figures that are at danger levels (chart 2 on page 3). All of this continues to leave us in a cautionary stance despite the fact that stance has been wrong for three weeks. An important point to watch, however, is the upside gap in the charts created by last Wednesday’s “Moon Shot.” Usually such gaps are filled within three sessions, which would be today. That single-point number to watch is 2363.64 on the SPX. That “gap” was not filled on Friday. This morning the SPX preopening futures are off 7 points at 5:00 a.m. as North Korea launches four missiles, one of which is capable of reaching the U.S., and DJT’s escalating war on the Deep State, the intelligence community, and now BHO. We think the equity markets are at an inflection point. The next few sessions should tell if this is the case.

Copyright © Raymond James