“For bubbles, I want a systematic way of identifying them. It’s a simple proposition. You have to be able to predict that there is some end to it. All the tests people have done trying to do that don’t work. Statistically, people have not come up with ways of identifying bubbles.”

– Eugene F. Fama, June 2016

Bubbles are like snowflakes. No two are exactly alike, but they all share similar features; innovation, a run up in price, increased volatility, and expanding multiples, to name a few. In an excellent new paper by Robin Greenwood, Andrei Shleifer, and Yang You called Bubbles For Fama, the authors accept his challenge, to systematically identify and profit from bubbles.

One of their interesting findings is that true bubbles are rare and not all of them burst. Of the *40 bubbles they identified since 1928, 21 **crashed and 19 did not.

For example, health care stocks, which rose by over 100% between April 1976 and April 1978, and continued going up by more than 65% per year on average in the next three years, did not experience a significant drawdown until 1981.

But when they do pop, they typically do so quickly. “In 17 of the 21 episodes in which there is a crash, the industry experiences a single-month return of -20% or worse during the drawdown period.”

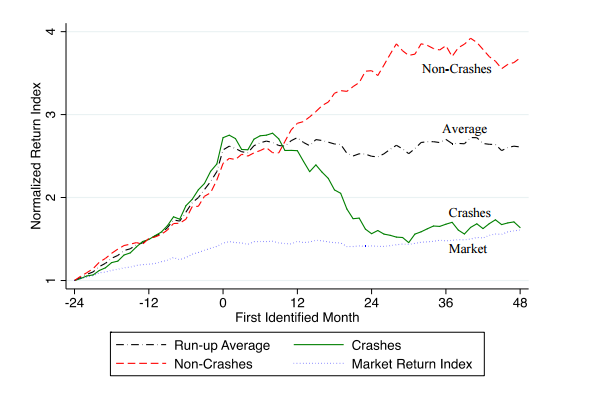

The chart below shows the paths that crash and non-crash bubbles take.

The larger the price increase, the higher the chances that a crash followed. If shares in an industry increased by 50%, the probability of a crash over the next two years is just 20%. A 100% return increased the odds of a crash to 53%, and a 150% return increased the odds of a crash to 80%. But does the crash wipe out all the gains experienced in the bubble? Not necessarily.

The larger the price increase, the higher the chances that a crash followed. If shares in an industry increased by 50%, the probability of a crash over the next two years is just 20%. A 100% return increased the odds of a crash to 53%, and a 150% return increased the odds of a crash to 80%. But does the crash wipe out all the gains experienced in the bubble? Not necessarily.

Even after Shiller first said that U.S. stocks were in a bubble in December 1996, prices doubled after that. The authors note that “At its low, in 2003, US stock price index was higher than when Shiller first called the bubble.”

The paper looks at thing besides just price to systematically identify bubbles, like volatility, turnover, age, issuance, book-to-market ratio, sales growth, CAPE and acceleration of price.

The whole thing is worth a read, check it out.

Source:

*The authors define a bubble as a 100% increase over a two-year period,

**A crash is a 40% decline in a two-year period.

Copyright © The Irrelevant Investor