by Frank Holmes, CIO, CEO, U.S. Global Investors

Share this page with your friends:

Please note: The Frank Talk articles listed below contain historical material. The data provided was current at the time of publication. For current information regarding any of the funds mentioned in these presentations, please visit the appropriate fund performance page.

March 1, 2017

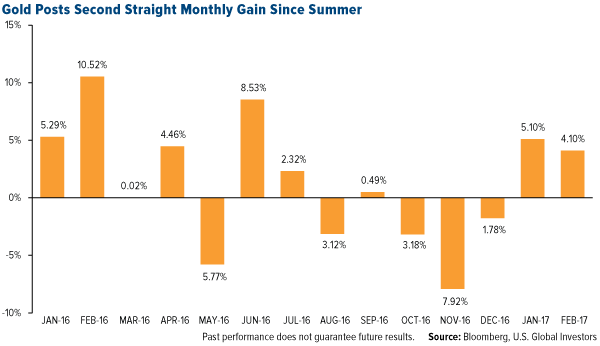

Gold posted its second straight monthly gain in February, the first such time it has done so since the summer, when Brexit-fueled uncertainty shook world markets. In 2017, the yellow metal has now advanced close to 9 percent, cracking the $1,260 an ounce ceiling on Monday for the first time since soon after the November election. Compared to the same number of trading days last year, gold was up 15 percent.

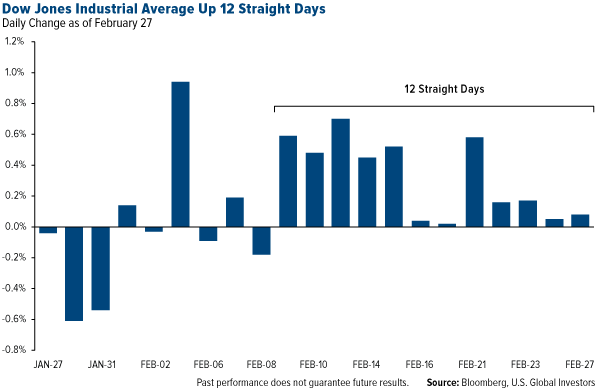

Lately we’ve seen money managers and hedge funds increase their net long position on gold. This is impressive considering that equities are still holding strong and regularly hitting new highs. As of February 27, the Dow Jones Industrial Average was up for 12 straight days, a winning streak we haven’t seen in 30 years.

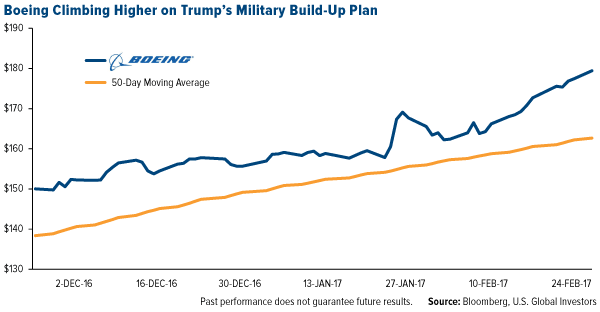

Gains in the large-cap index have been led by plane-maker Boeing, which stands to benefit “big league” from President Donald Trump’s proposal to boost military spending 10 percent, or $54 billion, announced yesterday.

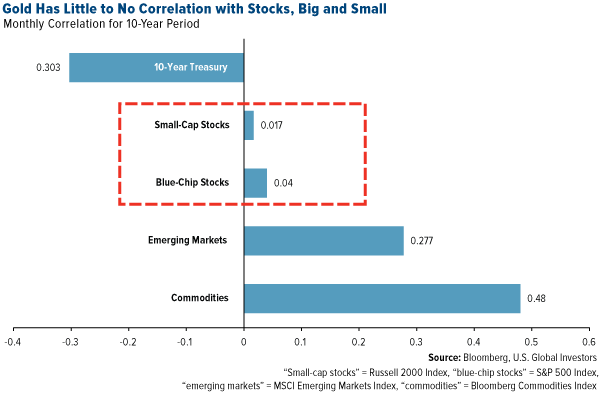

Money managers’ bullish bet on gold at this time shows that the precious metal continues to hold an important place in most investors’ portfolios. Over the past 10 years, gold has shown little to no correlation with blue-chip or small-cap stocks, making it an exceptional diversifier for investors who might fear stocks have risen too much, too fast, and are due for a pullback. In a note last week, UBS analyst Joni Teves said as much, writing that “gold interest on the back of diversification and hedging reasons are likely to be resilient as uncertainty and political risks linger.”

Worldwide, Gold Investment Is Encouraged

Gold’s well-known diversification benefits are among the reasons that prompted Islamic finance policymakers to develop the Shari’ah Standard on Gold, unveiled in December 2016, which finally opens up the precious metal as an investment tool in the global $1.88 trillion Islamic finance industry. Before now, there were no Shari’ah-compliant investments that could be considered “safe havens.” Permitting physical gold and gold-backed funds into the universe of allowable investments changes that.

More recently, the governor of Kyrgyzstan’s central bank, Tolkunbek Abdygulov, expressed his “dream” to see all 6 million citizens of the Central Asian country to own at least 100 grams, or 3.5 ounces, of physical gold.

Speaking to Bloomberg, Abdygulov said that the metal “can be stored for a long time and, despite the price fluctuations on international markets, it doesn’t lose its value for the population as a means of savings... We are hopeful that our country’s population will learn to diversify its savings into assets that are more liquid and—more importantly—capable of retaining their value.”

Here in the U.S., some states are taking action to diversify into gold and silver, thereby “breaking the Federal Reserve’s monopoly on money,” as Zero Hedge writes. The Texas Bullion Depository—the first such depository in the U.S.—is in its final stages of construction, and in Utah, legislation was just introduced that would expand on the state’s 2011 Legal Tender Act, which allows citizens, businesses and organizations to pay off debt using gold and silver. The proposed legislation would “authorize the investment of public funds in specie legal tender held in a commercial specie depository,” according to Zero Hedge. “Specie” refers to gold and silver coins. Therefore, it looks as though Utah aims to follow Texas’ lead by building a bullion depository and diversifying a portion of public funds in gold and silver.

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. By clicking the link(s) above, you will be directed to a third-party website(s). U.S. Global Investors does not endorse all information supplied by this/these website(s) and is not responsible for its/their content.

Diversification does not protect an investor from market risks and does not assure a profit.

The Dow Jones Industrial Average is a price-weighted average of 30 blue chip stocks that are generally leaders in their industry. The S&P 500 Stock Index is a widely recognized capitalization-weighted index of 500 common stock prices in U.S. companies. The Russell 2000 Index is a U.S. equity index measuring the performance of the 2,000 smallest companies in the Russell 3000. The Russell 3000 Index consists of the 3,000 largest U.S. companies as determined by total market capitalization. The MSCI Emerging Markets Index is a free float-adjusted market capitalization index that is designed to measure equity market performance in the global emerging markets. The Bloomberg Commodity Index is made up of 22 exchange-traded futures on physical commodities. The index represents 20 commodities, which are weighted to account for economic significance and market liquidity.

Holdings may change daily. Holdings are reported as of the most recent quarter-end. The following securities mentioned in the article were held by one or more accounts managed by U.S. Global Investors as of 12/31/2016: The Boeing Co.

This post was originally published at Frank Talk.

Copyright © U.S. Global Investors