by Michael Batnick, The Irrelevant Investor

The pain threshold is different for everyone, but the trigger to sell is always the same, it’s overwhelming fear. We fear that the 20% correction becomes a 30% decline, that the 30% decline becomes a 40% crash, and that the 40% crash leads to a back-breaking 50% wipe out, and so on.

So you need a rules based system in place that supersedes these emotional reactions. Let me give you an example of what I’m talking about.

What if you have two separate accounts? One with the bulk of your assets, that you’ve locked and thrown away the key, and another that that’s a little more nimble, which gives you the flexibility to *attempt to dampen the deep market losses. Here is the strategy: after every 15% decline on a monthly closing basis, you take that portion of your portfolio to cash. You re-enter when the market is above the level at which you sold, a “coast is clear level,” if you will.

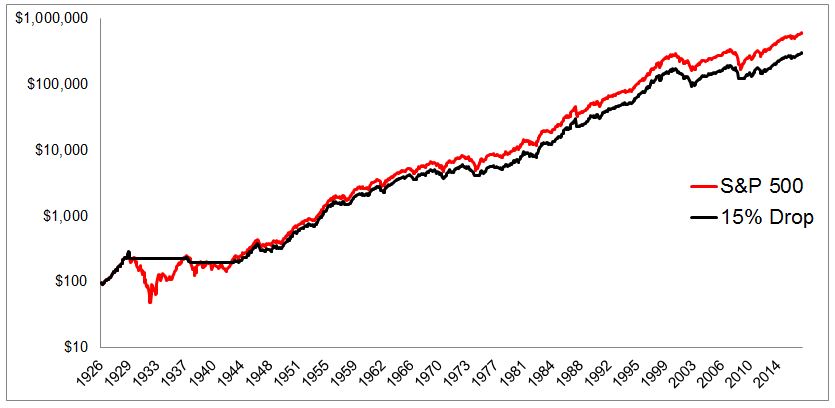

This is a bad strategy. I mean a really bad strategy. The model would have told you to sell in June 2008, after a 16% drawdown. It then would have told you to get back in at the end of August, only to sell two months later after another 24% loss. Sure you would have avoided another few months of selling, but you would not have gotten back in until July 2009, when stocks were already 40% off their bottom.

So how did this ridiculous, terrible, idiotic model perform? Since 1926, it returned 9.21% compared to the 10.05% return from the index.

I’m definitely not suggesting this is a strategy that you employ, in fact I would implore you to come up with something else, but the point is, having a sub-optimal emergency escape plan is a thousand times better than not having one at all.

I’m definitely not suggesting this is a strategy that you employ, in fact I would implore you to come up with something else, but the point is, having a sub-optimal emergency escape plan is a thousand times better than not having one at all.

Copyright © The Irrelevant Investor