by William Smead, Smead Capital Management

At a recent industry conference, we were confronted by a chart, a presentation and a song. In early 2017, we find ourselves in an investment world where the merit of stock picking and “active” portfolio management are challenged regularly, which has contributed to a mass exodus of assets from “active” funds to low-cost index portfolios. Is there a place in this world for long-duration, concentrated portfolio management as practiced by Smead Capital Management?

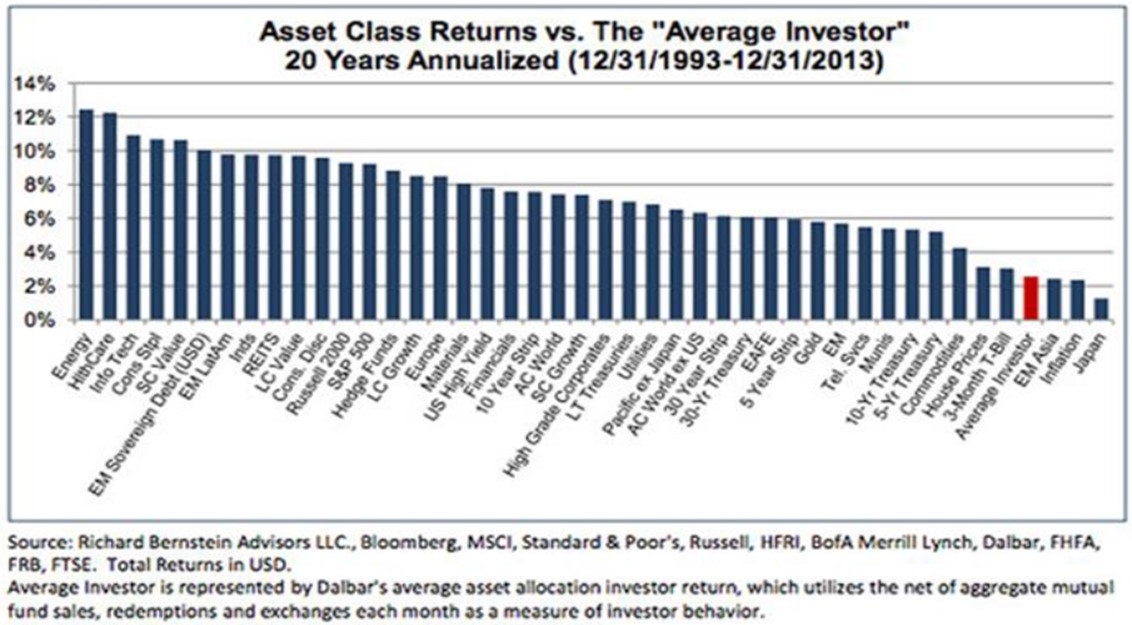

The chart below came from Richard Bernstein Advisors and simply shows how poorly the average investor has done in relation to almost all the investable asset classes:1

The economic need is easily identifiable on this chart. The average investor does much worse than the results of the asset classes they participate in and need to do much better than they have in the past. How can their long-duration returns improve?

The presentation came from Donald Miller, whose company, Story Brand, helps companies understand what their customers’ needs are and how to reach that audience by telling their own company’s story in an impactful way. He was speaking to a room full of financial advisors and registered investment advisors, who sincerely want to find clients and improve upon the results from the chart above.

He explained that a company has a story, much like a screenwriter of a movie. There must be a hero that has a problem which must be met on three levels, an exterior level, an interior level and on a philosophical level. For the advisors he was speaking to, the heroes in the story are the end investment clients who get the lousy results in the chart above. The exterior problem is poor investment performance, the interior is how they feel about the performance, and the third level of the problem is matching them philosophically with an ongoing solution, while shepherding them through the years.

The hero needs a guide (an advisor) if they are not themselves skilled in playing both hero and guide. The guide provides a plan, and in these advisors’ case, that plan includes choices on what to invest in and how to participate in U.S. large-cap equity investments. The philosophical challenge for heroes and guides alike is to stick to a plan for ten to twenty years, allowing investments to succeed on an exterior basis. To do this, our heroes and advisors must survive the interior feelings caused by the occasional stock market declines which can range from 10% annually to full blown bear markets that can average around 30%, and historically occur once every five to seven years.

The song came from Grammy-winning performer, Michael W. Smith. One of his first blockbusters hits was a 1990 song called “Place in this World.”2

The wind is moving

But I am standing still

A life of pages

Waiting to be filled

A heart that’s hopeful

A head that’s full of dreams

But this becoming

Is harder than it seems

With the pressure applied by the move to passive indexes, “active” managers feel forced to succeed every single year. It feels like “the wind is moving and we are standing still.” Our portfolio strategy has beaten the market soundly over five years and since inception, but long-duration strategies like ours lose some of the hero and guide investors whenever performance temporarily suffers, which is inevitable in all stock picking strategies, including indexing. The internal feelings are torpedoing heroes and guides alike. “This is becoming harder than it seems.”

There are three factors affecting everyone’s hero—the end investor. At the “active” manager level, Petajisto and Cremers have concluded that high active share (low index overlap), portfolio concentration and low portfolio turnover lead to “exterior” long-duration success for the hero and the guide. Ironically, it is impossible to smooth return volatility and practice low turnover. Morningstar adds lower annual fees and meaningful personal ownership of the manager’s fund as additional performance enhancers.3

The second and internal factor is determined by courage and patience. Heroes and guides need to stay put with meritorious disciplines. Hero investors get terrible results because they buy high and sell low. We predict they will be just as good at doing poorly when it gets rough for the indexes and worse in many cases. Remember, I personally spent the first twenty years of my career as a guide and stock picker!

If there are millions

Down on their knees

Among the many

Can you still hear me?

Hear me asking

Where do I belong?

Is there a vision

That I can call my own?

Show me I’m

Looking for a reason

Roaming through the night to find

My place in this world

My place in this world

The game breaker in favor of the practitioner of meritorious long-duration stock picking disciplines is hinted at by Smith. In his song, he mentions prayers (“millions down on their knees”) to God as an important means of communication. The picker of the approximately 500 companies in the S&P 500 Index will virtually never communicate with the guide or the hero. And the index pickers certainly won’t write or call our heroes or guides the next time that a bear market or an extended stretch of terrible index performance like 1966-1982 or 2000-2003 occurs.

If you read most of the media (like The Wall Street Journal, The New York Times and Financial Times) and have listened to John Bogle for decades and Warren Buffett lately, you’d think a prayer is all “active” managers have. Buffett doesn’t even let the stock pickers he hired communicate with us as shareholders of Berkshire Hathaway. He better hurry up, because when he is gone someday, shareholders will demand communication. A single annual report is unlikely to cut the mustard. Notice how little we heard a few years ago when his stock pickers were having a dismal performance year.

We actually know “our place in this world” because of the belief we have in our three core tenets of investing and the eight criteria we use for stock selection. We know that there will be many years that we underperform the index and it is as critical a part of long-duration success as the years we do extremely well. A study of five of the greatest long-term investors of all time (John Templeton, Phil Carret, Warren Buffett, Peter Lynch and John Neff) showed that they underperformed the stock market 35% of the time.

Lastly, we are reminded of what Don Phillips said at Morningstar a few years ago. In my paraphrasing of his comments, he alluded to the fact that mutual funds are a public vehicle and the score is tallied every day. However, he said that only the mutual fund managers communicate into the marketplace in a way the passive indexes never will. It is up to the shepherd guides and their end client heroes to stand up to the pressure, showing courage and patience when it is enticing to sell or buy at the wrong times.

We’d like to think our “place in this world” is set and we thank you for joining us for the ride.

Warm Regards,

William Smead

1Source: Hays Market Outlook, January 5, 2017. REIT = Real Estate Investment Trust.

2Source: Lyrics

3Source: Petajisto

The information contained in this missive represents Smead Capital Management’s opinions, and should not be construed as personalized or individualized investment advice and are subject to change. Past performance is no guarantee of future results. Bill Smead, CIO and CEO, wrote this article. It should not be assumed that investing in any securities mentioned above will or will not be profitable. Portfolio composition is subject to change at any time and references to specific securities, industries and sectors in this letter are not recommendations to purchase or sell any particular security. Current and future portfolio holdings are subject to risk. In preparing this document, SCM has relied upon and assumed, without independent verification, the accuracy and completeness of all information available from public sources. A list of all recommendations made by Smead Capital Management within the past twelve-month period is available upon request.

© 2017 Smead Capital Management, Inc. All rights reserved.

This Missive and others are available at www.smeadcap.com.