by Michael Lebowitz, CFA, 720 Global Research

The New England Patriots pulled off a stunning come-from-behind victory in Super Bowl LI, and one that was truly unprecedented in American football. Throughout modern NFL history, playoff teams that had a 19 point lead or greater in the fourth quarter, as the Atlanta Falcons did, were 93-0. A Patriots comeback was deemed virtually impossible by the odds-makers. There is an important lesson here worth considering. The Patriots improbable victory follows a variety of other unlikely, but surprising high-profile events in the past several months, some of which will have far greater impact on our lives than we may realize.

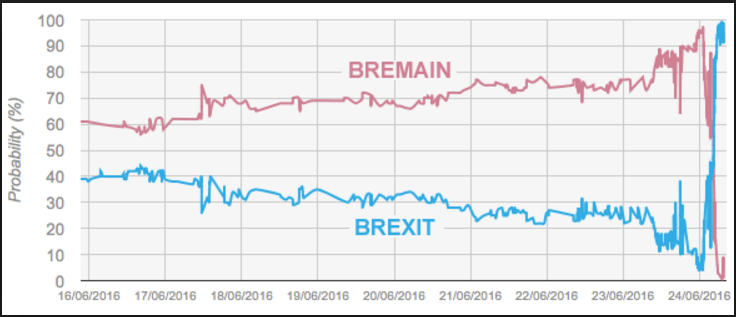

The British referendum to leave the Euro

Last summer, the odds of Brexit gaining a majority vote briefly dipped below 5% in the days preceding the vote. In a premonition to the upcoming U.S. election, The Sun newspaper in London mistakenly announced that the head of the Brexit campaign, Nigel Lafarge, conceded to the “Remain” vote.

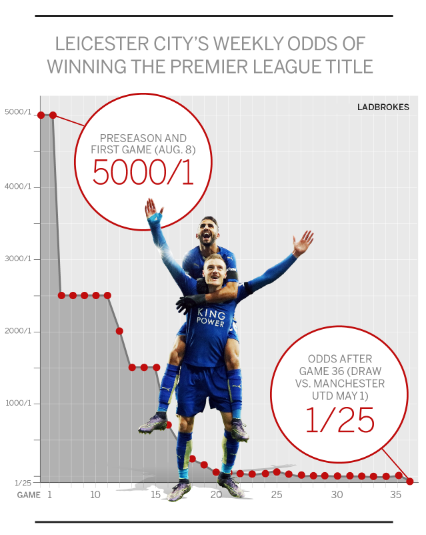

Leicester City’s improbable Premier League Championship

Leicester City entered the 2016 Premier League season as a 5,000 to 1 underdog to win the league championship. Fortunately for Leicester City, the existence of long odds bear no direct influence on outcomes as they went on to win the Premier League Championship. For the sake of comparison, the worst team in the NFL, the Cleveland Browns who finished the 2016 season with one win, started the year with odds of 200-1 to win the Super Bowl. According to odds-makers, the Browns were 25 times more likely to win the Super Bowl than Leicester City was to win the Premier League Championship.

Image Courtesy: ESPN

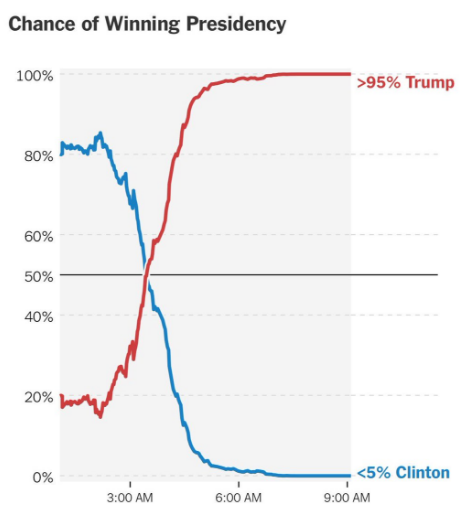

The U.S. Presidential Election

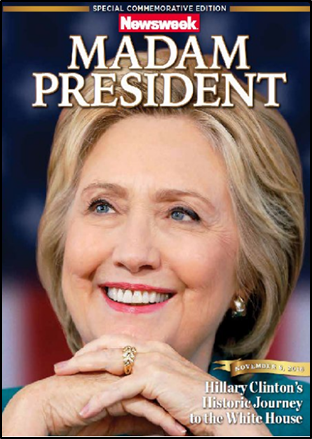

In the days leading up to the U.S Presidential election, Donald Trump was a serious underdog with only a 20% chance of winning the election. Even after some states had closed their polls and results were trickling in, a Hillary Clinton victory was all but a foregone conclusion. Newsweek infamously released their upcoming issue with a picture of Hillary Clinton under the words “Madam President.”

Graph and magazine cover courtesy: New York Times and Newsweek respectively

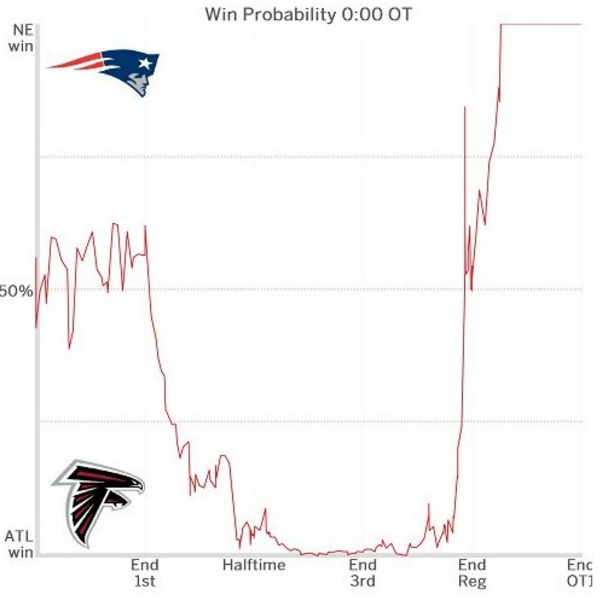

Super Bowl LI

With the Patriots trailing 28-3 mid-way through the third quarter, the odds of a Patriots Super Bowl victory were placed at 0.3% or 333 to 1. The Falcons were a virtual lock to win. The graph below charts the progression of the in-game odds for each respective team winning.

Graph Courtesy: Matthew Cascio @mattcascio

Why?

Given that “impossible” events are seemingly occurring with regularity, we must ask, “Why?”

Maybe another question that should be entertained is why the favorite, at any point in the contest, is given such commanding status? Given what we have seen out of Tom Brady in his illustrious career, why would experts count him out with a seemingly eternal 23:29 remaining to play in the biggest game of the biggest sport in America?

To apply this concept to another great global sport, do U.S. equity market valuations imply similar false confidence in future outcomes for the pace of earnings and economic growth?

The Dow Jones Industrial Average just crossed the 20,000 mark with great fanfare. Immediately following the celebration, the media and market “experts” began discussing the next benchmarks they expect to fall, Dow 25,000 and 30,000. Like those supporting the aforementioned clear favorites, everyone seems to be caught up in euphoria and the absolute certainty of an outcome. Like the attitudes that prevailed in 1929 and 1999, market experts appear to be convinced that the equity markets are moving in one direction, higher.

Spot VIX, an indicator that conveys confidence or concern about future equity price moves, is near-record lows. This implies tremendous confidence that stock prices will indeed move higher. Conversely, however, lesser followed VIX futures currently trade at historically steep premiums which suggest more than a few market participants harbor anxieties about the future.

We have been vocal in our thoughts about the confluence of historically high valuations, economic headwinds and the uncertainties of a new administration. It is hard for us to get on a bandwagon that is not supported by fundamentals. We feel like the sole Patriots fan listening to everyone around us debate whether Falcon’s quarterback Matt Ryan or star receiver Julio Jones will be the MVP.

Like all of the instances listed above, the odds are clearly wrong. The fundamentals governing each event were carelessly neglected, and probabilities radically miscalculated, sending the experts and their followers, in the wrong direction. While sports or politics may not be your thing, we urge you to pay attention.

The odds of equity market victory are very near 100%. What could go wrong?

Michael Lebowitz, CFA

Investment Analyst and Portfolio Manager for Clarity Financial, LLC. specializing in macroeconomic research, valuations, asset allocation, and risk management. RIA Contributing Editor and Research Director. Co-founder of 720 Global Research.

Follow Michael on Twitter or go to 720global.com for more research and analysis.

Copyright © 720 Global Research