by David Wolf, Portfolio Co-manager, Fidelity Investments Canada

Key Takeaways

-

Inflation shocks are a risk to the success of 60/40

-

Active asset allocation can mitigate the potential hit to risk-adjusted returns

-

We’re limiting bond duration while adding real assets and defensive currencies

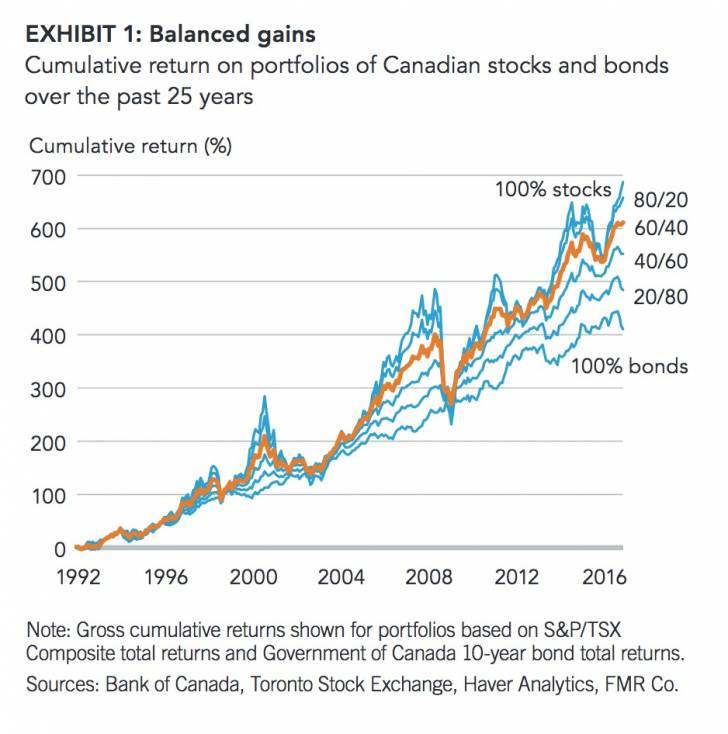

A balanced portfolio with a structure of 60% stocks and 40% bonds (60/40) has helped a generation of Canadian investors meet their goals. Stocks and bonds have both produced strong returns. Those returns have also tended to be negatively correlated over shorter periods, meaning that investors have also benefitted from reduced overall portfolio volatility by holding

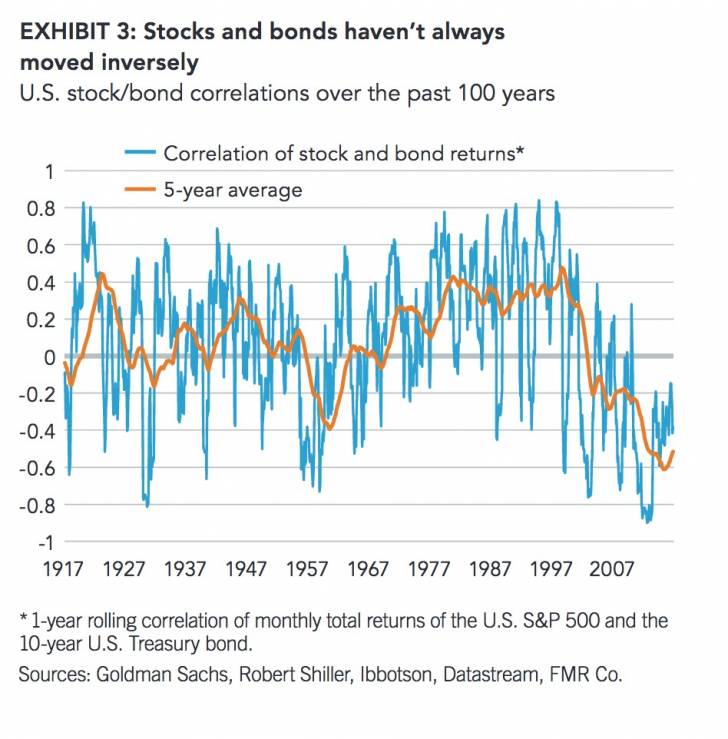

of market volatility. This has produced the observed negative correlation between stock and bond returns that has been so helpful to 60/40 investors, since stronger real economic growth tends to be good for stocks and bad for bonds (and vice versa).

But the move from high-and-volatile to low-and-stable inflation can only happen once; the boost that this process has lent to financial assets over time is done. And it could well go into reverse ahead. Cyclical inflation risk is rising, particularly (but not solely) in the U.S., reflecting the move towards demand-fueling and a mix of stocks and bonds. Indeed, as Exhibit 1 shows, the performance of balanced strategies like 60/40 has not been that far from a straight line up over the broad sweep of the past quarter-century.

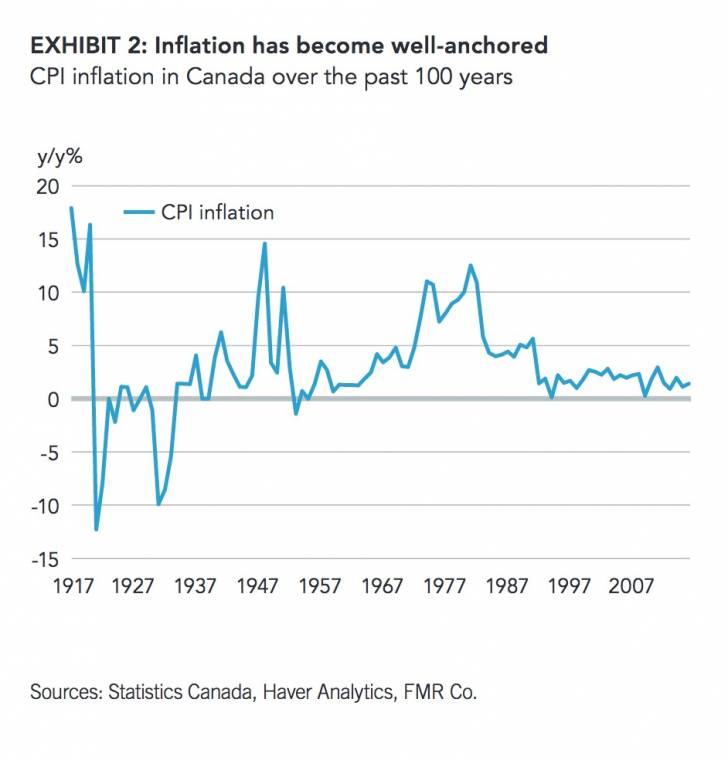

In my view, there has been no greater macro driver of the success of 60/40 in recent decades than the entrenchment of low and stable inflation (see Exhibit 2). This has been the biggest factor behind the observed secular decline in interest rates, which has both increased the present value of future cash flows and made them more predictable, thus raising the value of bonds, stocks and all other financial assets. A further consequence of well-anchored inflation is that ‘growth shocks’ have replaced ‘inflation shocks’ as the primary macro driver supply-sapping policies in what is already a late-cycle environment (see New era, old cycle).

In addition, with populism on the rise, I fear the norm of technocratic central banks pursuing strict inflation targets with full independence will prove more fragile than has generally been assumed. In this context, the strong anchoring of expectations that prevents cyclical inflation pressures from becoming structural cannot be taken for granted. I take only limited comfort from the fact that this risk seems more remote in Canada than elsewhere.

It seems likely, therefore, that ‘inflation shocks’ will become more common in the years ahead. This not only poses a threat to the valuations of financial assets, but also to the negative shorter-term correlation between stock and bond returns, since higher inflation is bad for both asset classes. Indeed, as Exhibit 3 shows, that strong negative correlation in recent years is as unusual historically as the inflation stability that fostered it.

In this environment, a passive 60/40 portfolio of stocks and bonds simply isn’t going to work as well. Investors will likely need to take a more active approach to asset allocation to achieve their goals. Our management process within the Fidelity multi asset class funds is well-designed to meet this challenge. We have available a much broader range of asset classes than generic stocks and bonds with which to provide portfolio diversification, enhance returns and manage risk. And we employ an active approach to allocating across those asset classes over time, adjusting our positioning as the market environment evolves. In the current environment, with inflation shocks becoming more of a risk, we have made the following adjustments to our allocations:

First, we are carefully managing our fixed income duration, in order to reduce the vulnerability of the portfolios to rising interest rates. As part of that strategy, we have established a new short-duration Canadian bond sleeve for use in our multi asset class funds, and increased our out-of-benchmark exposures to U.S. floating rate notes.

Second, we are tilting the equity components of our funds away from bond proxies and towards strategies that are particularly well-positioned to take advantage of the abrupt change in market regime we’ve seen in recent months. We expect this regime to be more favourable for active equity management in general, given the positive historical relationship between rising interest rates and stock market diversity.

Third, we are tilting the portfolios towards asset classes that can be expected to outperform if and when inflation picks up, notably real assets like inflation-linked bonds and commodities.

And fourth, we are making greater use of foreign exchange exposures to manage overall portfolio risk (see Currency Management) in this environment where the traditional protective role of bonds may be less reliable.

In closing, I must note that active asset allocation is not a panacea. If returns across asset classes are lower and less diversified in the years to come, then portfolio risk-adjusted returns will tend to be lower even with an effective active asset allocation approach. But, in such an environment, that approach is more likely to make the difference between investors’ meeting their goals and falling short.

David Wolf, February 14, 2017

Author

David Wolf | Portfolio Manager

David Wolf is portfolio co-manager of Fidelity Managed Portfolios, Fidelity Canadian Asset Allocation Fund, Fidelity Canadian Balanced Fund, Fidelity Monthly Income Fund, Fidelity U.S. Monthly Income Fund, Fidelity U.S. Monthly Income Currency Neutral Fund, Fidelity Global Monthly Income Fund, Fidelity Dividend Fund, Fidelity Global Dividend Fund, Fidelity Income Allocation Fund, Fidelity Balanced Managed Risk Portfolio and Fidelity Conservative Managed Risk Portfolio.

He is also portfolio co-manager of Fidelity Conservative Income Private Pool, Fidelity Asset Allocation Private Pool, Fidelity Asset Allocation Currency Neutral Private Pool, Fidelity Balanced Private Pool, Fidelity Balanced Currency Neutral Private Pool, Fidelity Balanced Income Private Pool, Fidelity Balanced Income Currency Neutral Private Pool and Fidelity U.S. Growth and Income Private Pool.

For Canadian investors

For Canadian prospects and/or Canadian institutional investors only. Offered in each province of Canada by Fidelity Investments Canada ULC in accordance with applicable securities laws.

Before investing, consider the funds’ investment objectives, risks, charges and expenses. Contact Fidelity for a prospectus or, if available, a summary prospectus containing this information. Read it carefully.

The information presented above reflects the opinions of David Wolf as at February 14, 2017. These opinions do not necessarily represent the views of Fidelity or any other person in the Fidelity organization and are subject to change at any time based on market or other conditions. As with all your investments through Fidelity, you must make your own determination as to whether an investment in any particular security or securities is consistent

with your investment objectives, risk tolerance, financial situation and your evaluation of the security. Consult your tax or financial advisor for information concerning your specific situation.

Investing involves risk, including the risk of loss.

© 2017 Fidelity Investments Canada ULC. All rights reserved.