by The Algonquin Team, Algonquin Capital

DON’T PANIC.

~ Douglas Adams,‘The Hitchhiker’s Guide to the Galaxy’

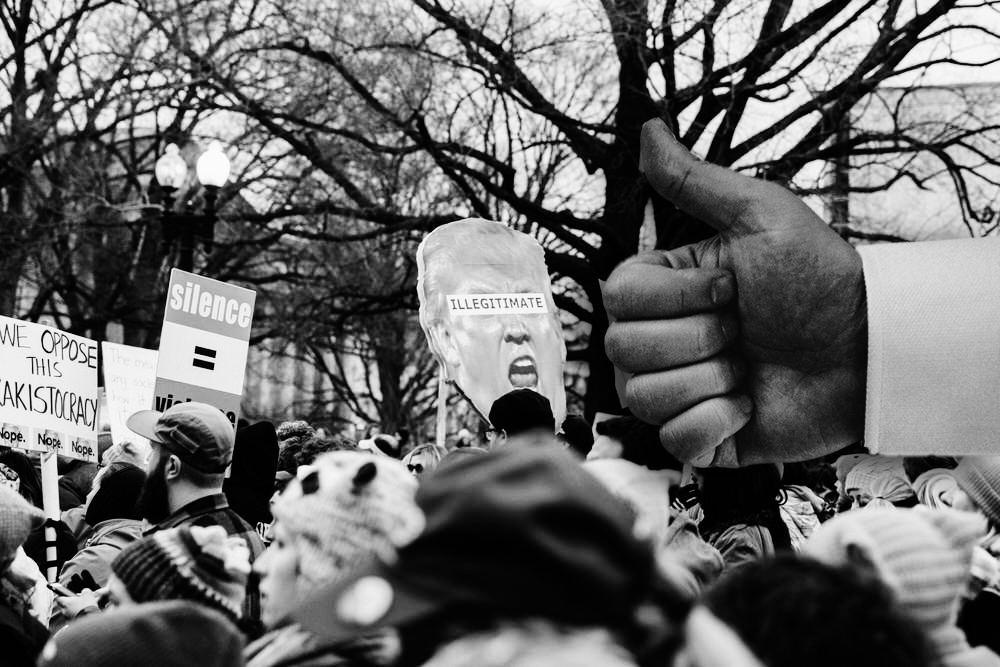

Through the early days of Trump’s presidency, we found ourselves reminded of Arthur Dent; regular Earth-person and protagonist of ‘The Hitchhiker’s Guide to the Galaxy.’ After discovering that both his house and planet are to be destroyed, Dent must negotiate a series of increasingly unpredictable and bizarre events.

Following some of the President’s more controversial first moves, many earthlings may even empathize with another of the book’s characters, Marvin the depressed robot, who held the view: ‘Loathe it or ignore it. You can’t like it.”

From an investment perspective, perhaps the relevant line is: ‘Like it or loathe it. You can’t ignore it.’ Or can you?

The investors’ predicament is a difficult one, and they don’t have the benefit of a handy guide for navigating the new administration. On the one hand, lower corporate taxes, deregulation, and fiscal stimulus bode well for business confidence. But against this backdrop are the President’s unpredictability and the potential for trade wars between the US and, well, the rest of the world.

Should the US employ trade tariffs, the reaction of the affected countries is impossible to predict. And while it may be ‘America First,’ the law of unintended consequences could cause ‘the First’ some pain. Business leaders don’t like uncertainty. So despite the government’s efforts to create jobs, companies may decide to ‘hunker down,’ and wait out the storm.

We expect all of this to lead to a challenging and volatile environment. Perhaps the best course of action is to ‘Ignore it or like it.’

Those following passive strategies can ignore the asset price gyrations and simply enjoy the circus show. After all, the markets have managed to deal with far more turbulent periods and have rewarded the long-term, patient investor, very well.

Active managers may face a dizzying array of opportunities and risks to manage. The opportunities should present themselves not only in general market levels, but also within sectors and individual companies. Events ranging from ‘twitter-attacks’ to changes in the tax code, regulations and trade agreements will change the playing field for many businesses. In this type of environment, with the potential for market overreactions, astute investors will likely be able to pick up a bargain or two.

The risk is that this is much easier said than done. It requires analytical rigour, objectivity, and a strong stomach, as ‘mistakes’ will be unavoidable. And when in doubt, or just dumbfounded, don’t panic, remember the answer is 42.

Copyright © Algonquin Capital