by Neil Dwane, Allianz Global Investors

Within hours of assuming office, Donald Trump began issuing executive orders to fulfill campaign promises. But if he really wants to "make America great again," Neil Dwane asks: Will Trump address the long-term structural problems that sorely need fixing?

Key Takeaways

- In the initial days of his presidency, Trump appears focused on trade and immigration; other issues popular with his constituents are waiting in the wings.

- Yet as in Europe and Japan, US policy needs a far-reaching overhaul, and it is unclear whether Trump will enact the structural reforms needed to restore the American dream.

- Among the areas in need of strategic reform are the soaring costs of education and health care, unsustainable pension promises and ballooning entitlements.

A new president's policy priorities

The US has a new president who has clearly set out his policy priorities for the first 100 days, including repealing “Obamacare,” reforming the tax code, boosting infrastructure and defense spending, renegotiating trade agreements and cracking down on immigration—measures that many view as “red meat” for his political base.

Yet while Trump vows to “make America great again”

The US economy needs long-term structural reforms that will re-energize the American dream

with these headline-grabbing initiatives, we believe the longer-term health of the US can only be addressed by long-term structural reforms that will re-energize the American dream, which has been somnambulant in recent decades. But this demands the kind of far-reaching and critical policy overhaul that has so far eluded Japan, Europe and the US as they all try to recover from the Global Financial Crisis.

Eight areas in need of strategic structural reform

1. Education

The US rightly has a great reputation for higher education, but it has become ruinously expensive. Costs for a college education have soared so high that the amount of government-backed education debt has reached $1.2 trillion, and more than 10% of it is as bad as a 2008 sub-prime loan—except these defaults can’t be wiped clean by bankruptcy. This has led to a situation where the average US student under 30 has negative net worth, and the average millennial has $30,000 in student loans.The irony is that all this debt has improved not the bargaining power of the students, but the pricing power of the education providers—many of whom overcharge for what they provide as they leave America’s youth unprepared to compete in the digital job market of the new millennium. Over the long term, this is one of the key issues hurting the United States’ ability to be “great again.”

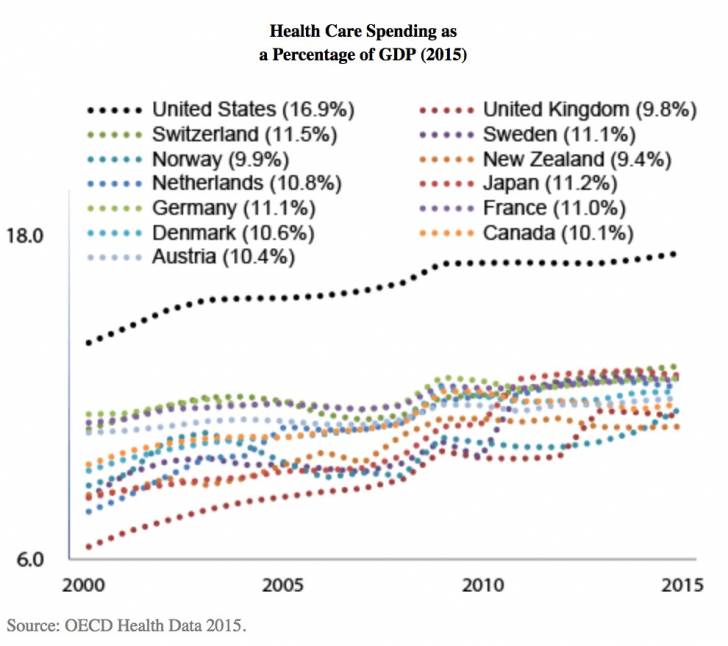

The US spends around 17% of GDP on health care, nearly twice the amount of other OECD countries. But are Americans twice as unwell or are there other important issues at stake? Neither Obamacare nor Trump’s proposed changes to the health-care system have successfully addressed many of the core problems: many health-care providers have profit margins over 20%; many patients do not see the final price of their treatments; and many drug and service providers have engaged in price-gouging.

With the US ageing rapidly, demands on health-care will keep rising. Unless the efficiency of providing health care is improved, health-care costs will prevent scarce resources from being strategically invested in other areas of the economy.

3.Consumption and trade

There is rightly much discussion, much of it understandably fearful, about where Trump will take US trade policy in the next few years.

The US trade deficit will receive increased attention given that other avenues for growth are losing steam

Yet it is clear why trade, and specifically the US trade deficit, should receive increased attention, given that other avenues for growth in the US are losing steam. Consumption is hovering around 70% of GDP, and housing is stuck near 5%. Wage growth has been slow to emerge, and we may not see more government spending or investment anytime soon. That leaves Trump focused on boosting net exports; however, the language being used in his tweets and policy proposals betrays a mercantilist view on trade relations, which may not actually end up promoting more trade.

Regardless of whether or not he is successful, it is clear that the current US business model of spend, borrow and spend some more has reached its logical conclusion, especially now that US consumers can no longer use their homes like ATMs to access stored capital.

4.InnovationUS R&D spending has been falling for decades, and it never truly recovered from NASA’s space shuttle failures.

Facebook, although one of the largest companies in the world by market cap, has only 13,000 employees

The social media explosion certainly seems innovative, yet it has created vast wealth rather than vast employment: Facebook, although one of the largest companies in the world by market cap, has only 13,000 employees. This is exacerbating the larger issue of wealth inequality, and there are legitimate questions about whether this high-tech innovation is actually resulting in productivity gains or contributing more to distraction and depression.

For its part, government has been suppressing innovation for years with unnecessary regulations.

China is currently filing the most patents of all the major economies and also training the most engineers

Consider a recent survey from the Weidenbaum Centre, suggesting that the cost of enforcing government regulation adds up to around $60 billion per year, not to mention the $400 billion it costs per year to comply with the US tax code. Meanwhile, China is filing the most patents of all the major economies, while its corporations are acquiring much of the prime intellectual property in robotics, automation and other high-tech fields. China has also been training the most engineers and addressing its longer-term strategic needs to move up the global value chain, even as the US has outsourced much of its production capacity to Mexico and Asia.

5.State and government pension obligationsHidden by local politics, a huge and deepening liability has been growing unseen and unaddressed. During the heady days of exceptional investment returns, politicians offered pension members packages and cost-of-living adjustments that are now simply unaffordable. With budgets and cash flows already strained, city and state pension funds are facing diminished solvency and falling returns masked by inappropriate return expectations. As in "old Europe", the real costs of welfare and pensions in the US are being hidden by pay-as-you-go accounting.

Managing this dynamic—and the social triage needed between pensioners, pension members, taxpayers and government—will be one of the key strategic generational challenges of the Western World. In the meantime, only slightly more than half of the full-time workers in the US participate in any workplace retirement scheme, and the average 401(k) holds only around $130,000—a demonstrably insufficient amount to retire on.

6. The Federal Reserve and US banks

Trump has rightly criticized the influence of the Federal Reserve and may soon be able to significantly change the membership of its Board. Yet with so many ex-investment bankers on his staff, he is not addressing the excessive “financialization” of the US economy. Since the early 1980s, the share of US profits derived from financials rose from 7% of GDP to more than 20%, which can be a drain on the US economy: One IMF study showed that an oversized financial sector lowers GDP by two percentage points per year.

Moreover, even as the US still feels the sting of the huge costs associated with the Global Financial Crisis, many of the largest Wall Street banks still show they are too big to fail, too big to manage and detrimental to the smaller regional banks that support job-creating small businesses. Quantitative easing and other loose monetary policies, as well as regulatory blind spots, suggest that US monetary policy has been co-opted by the finance industry, for whom lower interest rates mean more leverage and elevated asset prices. In this environment, large corporate entities are favored over typical homeowners, who are facing soaring housing costs, higher lending standards and even underwater mortgages.

7. Entitlements

It is entirely bizarre that the Democrats have so forsaken their traditional supporters that Trump, a billionaire, holds so much appeal with ordinary working-class voters.

In the US, transfer payments from government to inpiduals represent 20 % of personal incomes

Regardless, income inequality is now so bad in the US that a European-style welfare state is emerging, with transfer payments from government now representing 20% of personal incomes. Moreover, these transfer payments in the US are—as in Europe—building a huge and unfunded government liability, estimated at $8 trillion to $10 trillion. Of course, don’t forget the Medicare and Medicaid liabilities of around $60 trillion that will be due in the coming decades.

8. DC politics

One trend that has been building momentum for years is America’s frustration with government gridlock and the Washington DC “bubble”. This has led to dismal approval ratings for the US Congress and a growing suspicion that special-interest groups have more influence over policy than the electorate. Trump has promised to “clear the swamp” to address entrenched and nepotistic government bureaucracies by imposing limits on how long legislators can serve and how quickly they can then move to the more lucrative private sector, so it will be interesting to see if this can be achieved in only one term of office.

Will the president’s populist prescription work?

As befits a country that boasts both the world’s largest economy and one of its best-established democracies, the challenges facing modern America are complex and deep-rooted. Many presidents and public servants before Donald Trump have tried to solve its issues, with varying degrees of success.

Yet in the minds of Trump and his supporters, the status quo is a failure and a direct result of politicians who have been busy protecting their own self-interested goals—not the people they were charged to lead. As a result, we are witnessing new policies and proposals that pander to popular concerns in not just Trump’s America, but in the post-Brexit UK and, potentially, in other countries to come. Whether these populist policy prescriptions actually result in the body politic’s short-term revival or its long-term health remains to be seen.

Don’t be Trumped by short-termism; invest for the long term

Some of Trump’s proposals may work, but they may also be short-sighted by design. In our view, unless governments and other institutions address much-needed long-term structural reforms— whether in the US, the European Union or elsewhere—we believe economic growth will remain low, debt levels will increase and interest rates will stay lower for longer. All the while, ageing populations will continue to draw down on their entitlements while the working class continues to struggle.

Of course, inpiduals can always circumnavigate some of these strategic challenges by doggedly saving for themselves, investing in their own futures and reducing their reliance on the system for welfare, health care and education. Owning high-quality companies with good pidends and returns on equity – and tapping into the power of long-term compounding—is a solid strategy that can also help buffer against burgeoning inflationary threats. More immediate-term saving, more long-term investing: That is one way to return at least some power to the people.

Copyright © Allianz Global Investors