Greek Debt and European Disorder - Context

by Fixed Income AllianceBernstein

February 10, 2017

Fresh concerns about Greece’s debts have prompted new worries across Europe. But another compromise looks likely—European leaders can ill afford a full-blown Greek crisis amid so much regional political uncertainty.

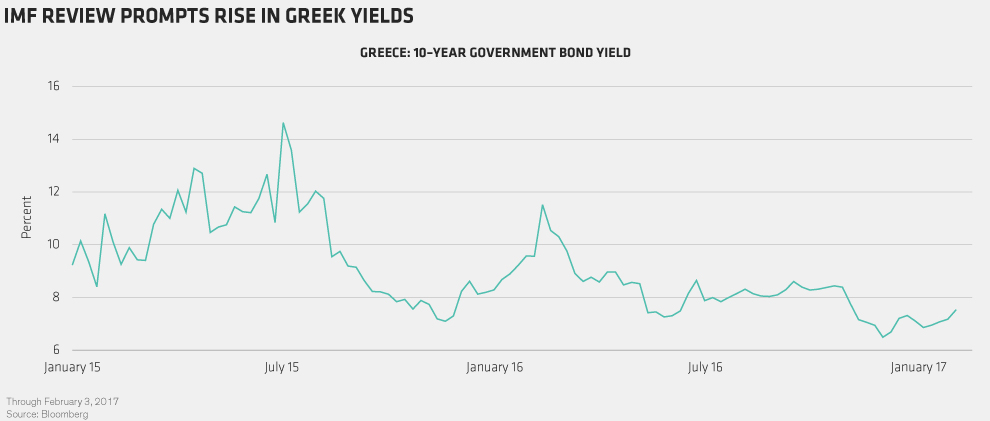

Yields on Greek debt surged this week as the International Monetary Fund (IMF) released a scathing review of the third Greek bailout agreed in the summer of 2015 (Display). In that deal, Greece’s European Union (EU) partners and the IMF realized that there was no way to reconcile their differences on debt sustainability and the associated need for debt relief. Instead, they agreed to “kick the can down the road” (again) in order to avoid Greece exiting the euro.

A Fudged Deal

The result is that the IMF still helps monitor the program to satisfy countries like Germany and the Netherlands. Yet it refuses to commit new funding until debt sustainability has been assured, via far deeper debt relief than the EU is willing to consider—particularly during a crucial electoral period.

But this fudge creates a recurring problem. Greek debt sustainability—and, ultimately, its place in the euro—comes into sharper focus every time we approach a program review, which normally precedes the release of fresh funding. That’s exactly what happened in the first review last spring and it’s happening again now during the second review.

Another Compromise?

Last year, it ended with a compromise. This year, regional leaders know they must prevent things from coming to a head. With Dutch, French and German elections on the horizon, Brexit negotiations about to start and uncertainty from the Trump administration, the last thing EU leaders need is another full-blown Greek crisis.

Reaching a compromise won’t be easy. Greece wants the second review completed as soon as possible. However, the gaps between Greece, the EU and the IMF remain wide. Indeed, there’s still a fundamental disagreement between the EU and the IMF on debt sustainability, the need for debt relief and overall program design.

In the past, Greek bailout reviews have tended to rumble on until there’s a debt redemption and potential bankruptcy to focus the mind. The next crunch won’t come until April—when €1.4 billion of bonds are due to mature—or, more likely, July—when €7.8 billion of bonds are due. So Greek “noise” is likely to persist for a few months.

US Position Could Add to Risks

But what if it’s not just “noise”? Could we be rapidly heading towards a Greek default and possible euro-area exit? We think this is unlikely—but the risk shouldn’t be entirely ruled out, not least because of shifting positions in Washington.

If the new US administration disapproves of the IMF’s involvement in the bailout, for example, it might force its withdrawal. Many (non-European) IMF members are already deeply concerned about the direction the program is headed in (see, for example, the recent Article IV Consultation). And while an IMF withdrawal wouldn’t inflict any direct financial damage, it would remove the political cover that some EU governments have used to get bailout loans through their parliaments. Indeed, German finance minister Wolfgang Schäuble said earlier this week that the IMF’s withdrawal would bring an immediate end to the Greek program.

Two Angles for Investors

What does all this mean for investors? There are two angles here: the impact on Greece and the impact on the rest of the EU. If another compromise is reached, as we expect, then the brinkmanship leading up to a deal is unlikely to have a big impact elsewhere—especially as markets now have bigger fish to fry (i.e., the French elections). By contrast, Greek bonds could come under considerable pressure—just as they did during similar periods in 2015 and 2016 (Display)—but would be expected to settle back again if an agreement was reached.

Things would, of course, look very different if the IMF quit the program and no agreement was reached. If that happened, the EU’s efforts to ring-fence Greece in order to limit the direct economic and financial impact of a bankruptcy and/or euro-area exit on other countries might not be enough to prevent market contagion.

Of course, the fact that Greece is now regarded as an isolated case by many investors might help limit the damage. But does anybody really want to test that theory out with the UK set to trigger Article 50 and quit the EU and fears that Marine Le Pen could be the next president of France? All things considered, we expect the EU to go to great lengths to avoid a Greek meltdown—at least for the time being.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams. AllianceBernstein Limited is authorised and regulated by the Financial Conduct Authority in the United Kingdom.

Copyright © AllianceBernstein