by Jeffrey Saut, Chief Investment Strategist, Raymond James

“You have enemies? Good. That means you've stood up for something, sometime in your life.”

. . . Winston Churchill

I recalled the aforementioned quote while reading a rather interesting article by the always erudite Peggy Noonan. The article was titled “In Trump’s Washington, Nothing Feels Stable.” Ms. Noonan goes on to write:

We are living through big history and no one here knows where it’s going or how this period ends. Everyone, left, right and center, feels the earth is unsteady under their feet. Too much is happening. Democratic senators boycott confirmation hearings, Iran tests ballistic missiles, President Trump has testy phone calls with prime ministers and it’s quickly leaked to the press, the president tells Senate Majority Leader Mitch McConnell to “go nuclear” — meaning use the so-called nuclear option to get the new Supreme Court nominee through. . . . Everyone’s political views are now emotions and everyone now wears their emotions on their faces. People are speaking more loudly and quickly than usual. At parties, dinners and gatherings the decibel level hits the ceiling right away and stays there. No one can hear anything. It somehow seemed right that a 25-pound bobcat escaped from the National Zoo; a Washington Post columnist speculated it fled to Canada.

I used some of Ms. Noonan’s first paragraph in said article, because “Everyone, left, right and center,” does indeed “feel the earth is unsteady under their feet.” I have lived through 12 presidents in my life, and I have never seen anything like what is currently happening. I am sure somewhere in U.S. history there has been other protests against presidents, but I can’t recall anything like what we are seeing now. The acrimony is palpable and suggests the president is in trouble. That statement brings back memories of a market axiom from my departed friend Richard Russell (Dow Theory Letters) who used to write – when the president is in trouble, the stock market is in trouble – something participants might want to consider. Verily, there is the potential that the stock market may begin to realize that the unprecedented acrimony could impair President Trump’s agenda. Obviously, it took a step in that direction over the weekend when a federal judge ordered the halt of the president’s travel suspension executive order. It will be interesting to see the stock market’s reaction to that news this week.

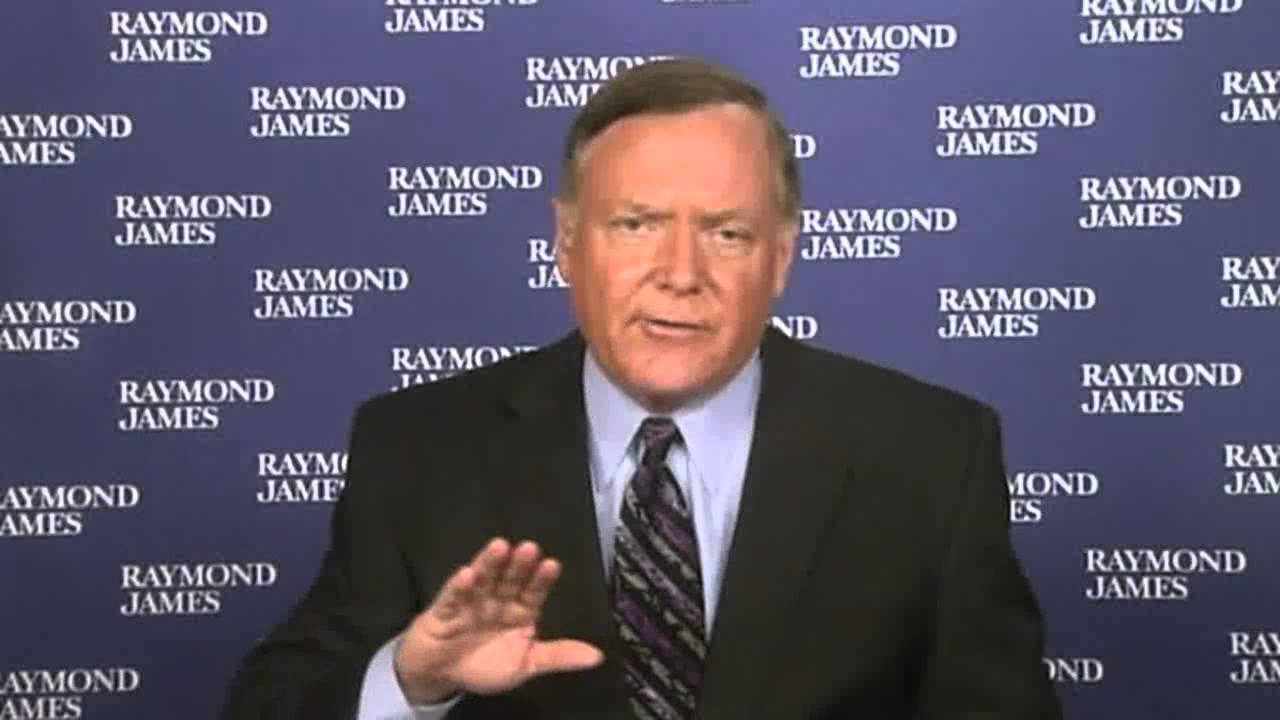

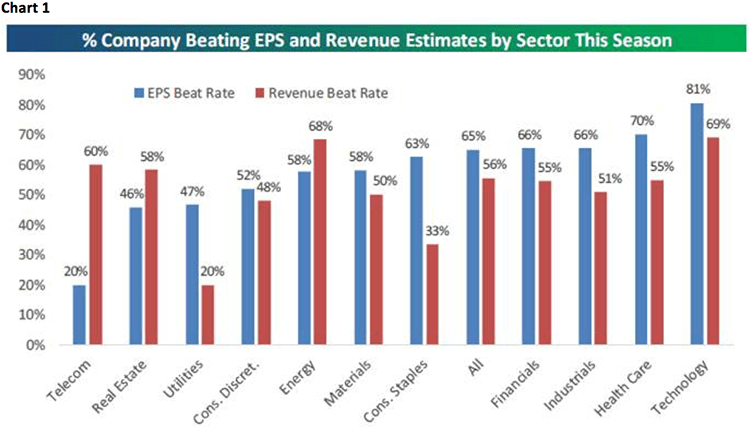

Last week, however, the equity markets were on their “heels” until Friday’s better-than-expected employment report saved the day. The Friday Fling, of roughly 187 Dow points, left the senior index virtually flat for the week. But that “fling” was driven almost entirely by the financial sector. For example, the rally in Goldman Sachs’ shares accounted for 72 of the Dow Wow points and, when combined with three other financial stocks, accounted for 124 of the Dow’s ~187 point gain. Of course, that sits well with Andrew Adams and me, since financials, energy and technology are three of the macro sectors we have suggested overweighting in portfolios. Speaking to technology, it is worth noting that, so far in this earnings season, 81% of the reporting companies in the tech sector have beaten the consensus earnings estimates, and 69% have bettered the consensus revenue estimates by (chart 1). As for the energy sector, 58% of reporting companies came in above earnings’ estimates and 68% beat the revenue estimates. Meanwhile, the financial sector saw an earnings and revenue beat rate of 66% and 55%, respectively. Overall, with some 1,000 companies reporting, 65% have beaten earnings estimates and 56% have better revenues estimates (chart 2). All of this “foots” with our sense that the secular bull market is transitioning from one that is interest rate driven to one that is earnings driven.

Continuing with this earnings season theme, there were more triple plays last week. That would be companies that beat earnings and revenue estimates and raised forward guidance. In addition to those companies for your consideration offered in last Monday’s missive that are triple plays, favorably rated by our fundamental analysts, and screen positively on our models (NFLX/$140.25/Outperform, NOW/$89.47/Strong Buy, BABA/$100.39/Strong Buy), last week, these companies also met those same metrics: MarineMax (HZO/$20.70/Strong Buy), American Financial (AFG/$90.81/Outperform), and Cavium Networks (CAVM/$66.95/Strong Buy).

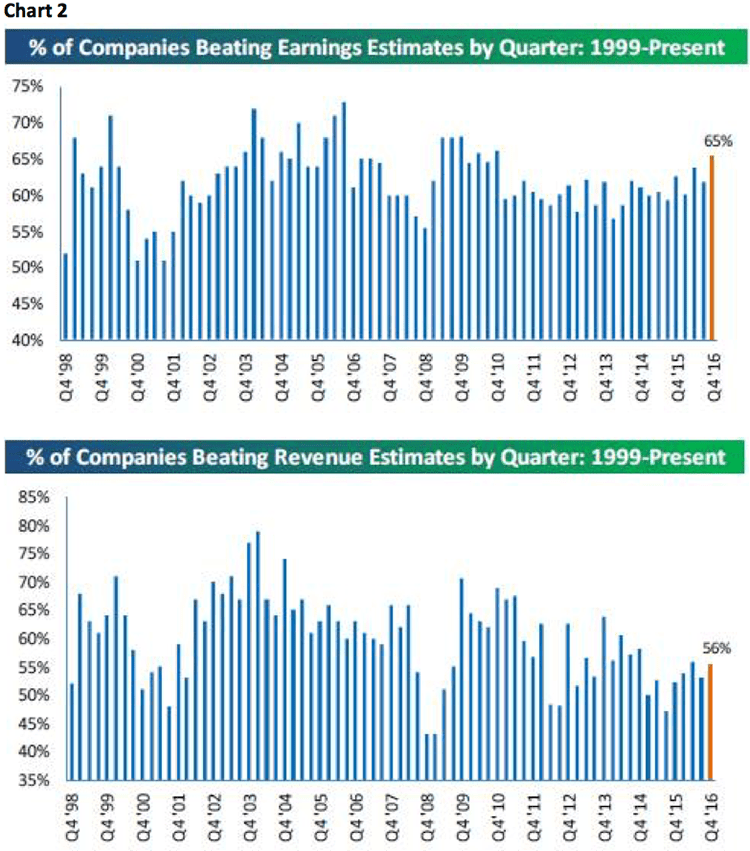

Plainly, last Friday’s employment report breathed new life into the recently-sagging equity markets. Indeed, nonfarm Payrolls rose by 227,000, well above the median forecast of +175,000, with some anticipation of an upside surprise (chart 3). To that report, our economist, Scott Brown Ph.D., writes:

A good report, but this is January data (payrolls fell by 2.95 million before seasonal adjustment). (Adjusted) payrolls exceeded expectations, although largely offset by downward revisions to the previous data. The increase in labor force participation is a good sign, but still little changed over the last year. Average hourly earnings rose mildly, but these figures are choppy (the trend is gradually higher). Nothing here to suggest that the Fed needs to slam on the brakes, but consistent with a gradual pace of policy normalization (that is higher short-term interest rates). Market reaction is likely to be a bit mixed. The economic calendar will be thin until March 15, when we get CPI, retail, sales, industrial production, and more importantly, Yellen’s monetary policy testimony.

In addition to the strong employment report, we would note that the overall economic numbers are getting better. As the Bespoke organization writes:

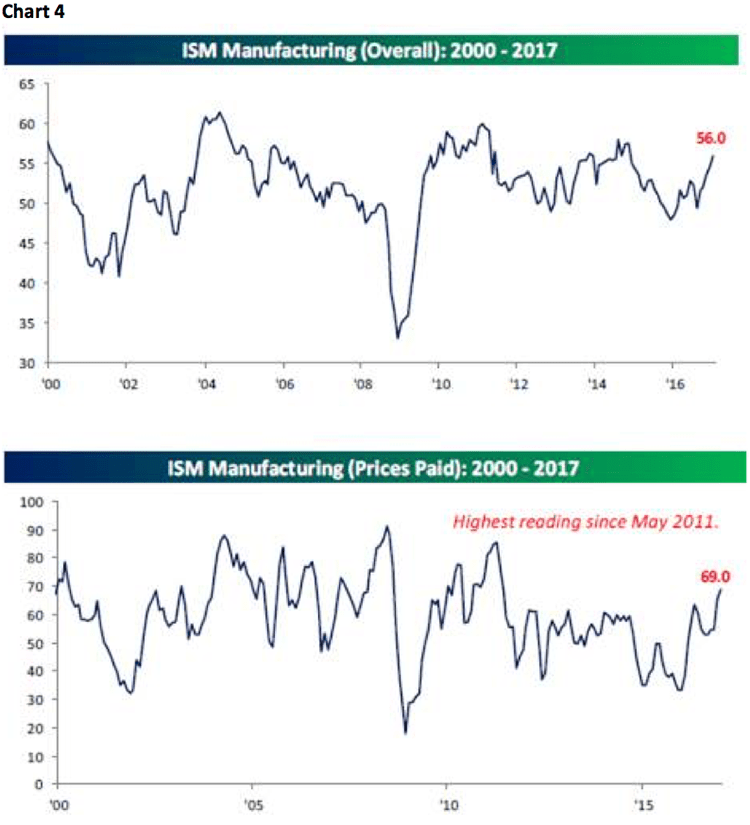

Earlier this week we got the monthly ISM Manufacturing reading, and it posted a very strong number of 56. As shown in the chart below [chart 4], this is a sharp move higher from levels seen a year ago. Unfortunately, the Prices Paid inflation reading in this month’s ISM Manufacturing report spiked up to 69 as well, which was the highest reading seen since 2011. Surely the Fed took notice.

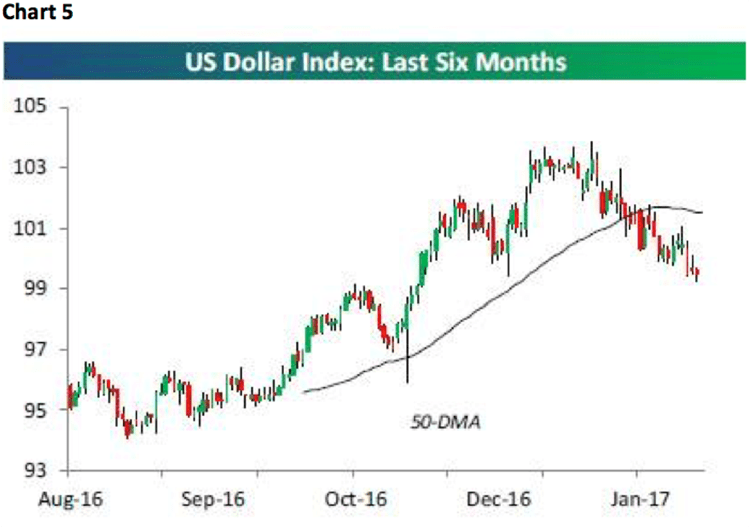

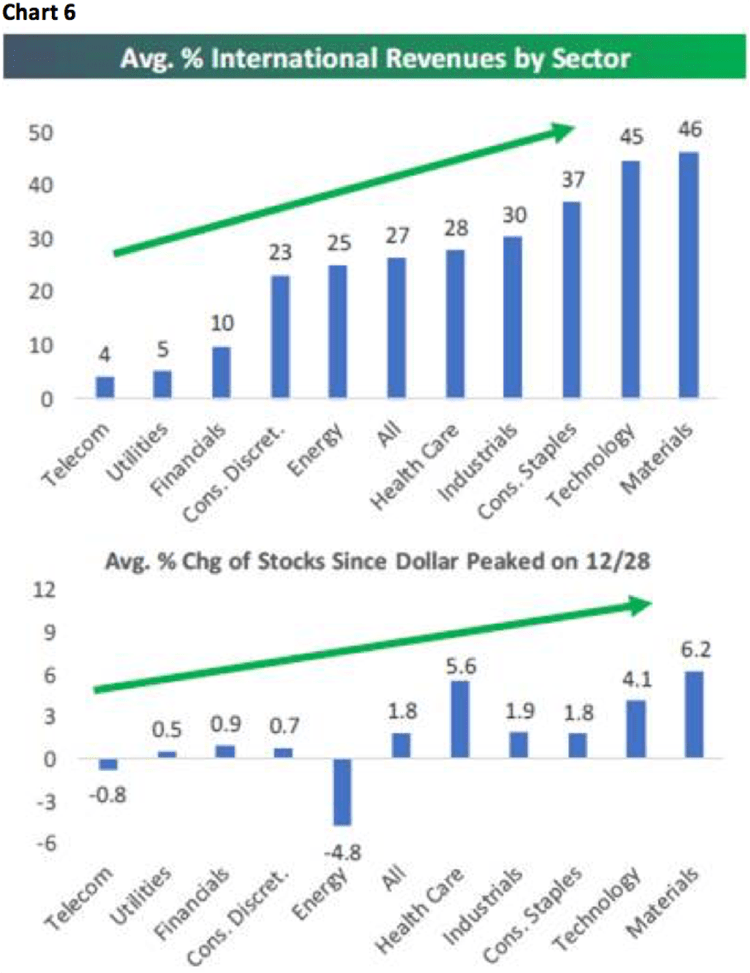

Clearly the reflation trades should continue to have upside “legs.” Bolstering the “reflation trade” is the recent weakness in the U.S. Dollar Index (chart 5), which could put a bid under the sectors with more international revenue exposure (chart 6).

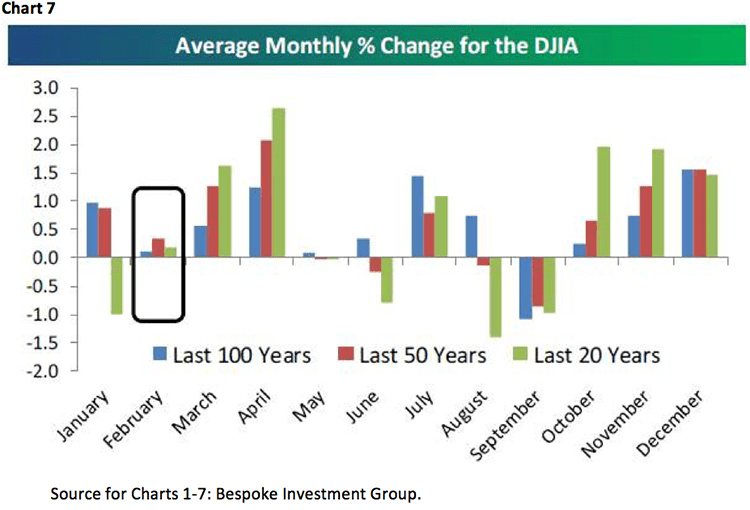

The call for this week: Bullish sentiment across all venues is extreme (read: bearishly). Selling Pressure rose last week as Buying Power declined. According to the astute Lowry’s service, there has not been a 90% Upside Day since November 7, 2016. The stock market is overbought on a short-term basis. Our method of measuring the stock market’s “internal energy” is down to levels rarely seen (out of gas), and our short/intermediate models continue to counsel for caution. That said, Friday’s Fling may extend the rally attempt, but we do not think the S&P 500 gets very far above the 2300 mark. And remember, February historically tends to be a tough month for the equity markets (chart 7).

P.S.: Helene Meisler @hmeisler: Holy cow. ETF put/call ratio was 44% [Extreme optimism/panic buying]

Copyright © Raymond James

d2.jpg)