by Scott Brown, Ph. D., Chief Economist, Raymond James

January economic data are relatively unreliable, but recent figures paint a fairly consistent picture of where we are headed in the near term. While there is reason to be optimistic, it’s still a mixed bag, with some concerns about what we’ll see coming out of Washington over the next several months.

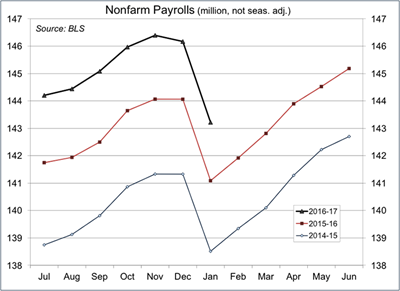

The economy shed nearly three million jobs in January, a bit less than we saw a year ago. Construction fell by 241,000, retail by 546,000, couriers by 184,000, and education (public and private) by 683,000. None of this seems out of line. The bigger question is what will happen over the next few months. The hiring outlook is strong, but may be restrained.

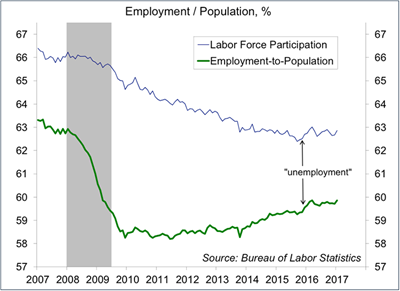

Labor force participation picked up in January, but one should take that with a grain of salt. Judging by the employment/population ratio, there is likely some slack remaining in the job market. However, demographic changes and increased educational enrollment make it difficult to compare where we are now with where we were a decade ago.

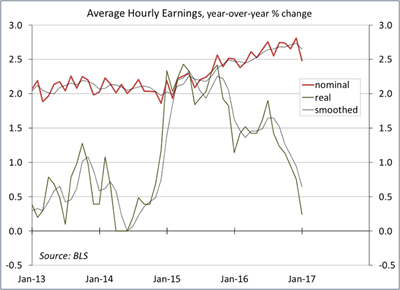

Fed officials see an economy that is nearing full employment. We should hear more of that when Fed Chair Janet Yellen delivers her monetary policy testimony to Congress on February 15. Note that tight labor markets are usually reflected in faster wage growth. Average hourly earnings rose a meager 0.1% in January, up just 2.5% from a year earlier (the same pace as we saw in the 12 months ending January 2016). However, the monthly figures are often uneven, seasonal adjustment is difficult, and there appeared to be an odd quirk in finance (-1.0% m/m, perhaps as income was shifted into 1Q17 to take advantage of an expected drop in personal tax rates).

For the household sector, real (that is, inflation adjusted) income is what matters. The impact of lower gasoline prices is fading, leaving much slower growth in real wages. Moreover, the middle class has faced higher rents and healthcare costs.

The personal income and spending figures for December showed good momentum at the end of the year. However, unit motor vehicle sales fell in January, and the softening in real wage growth suggests more moderate gains in consumer spending into the early part of 2017. Increased consumer confidence isn’t going to help if the household sector doesn’t have the cash (or ability to borrow) to spend.

In contrast, orders and shipments of capital goods appear to be picking up. Business fixed investment should add to overall economic growth in the near term, likely enough to offset a moderate slowing in consumer spending growth.

Financial market participants will focus on Washington. Tax cuts and a rollback of regulations are encouraging for investors, but the timing, size, and character of tax cuts are uncertain. Business leaders are concerned about trade policy. There’s a clear need to rework how foreign earnings are taxed, but there are major risks if Washington gets it wrong – especially at a time when the global economy appears poised for improvement.

Copyright © Raymond James