by Ryan Detrick, LPL Research

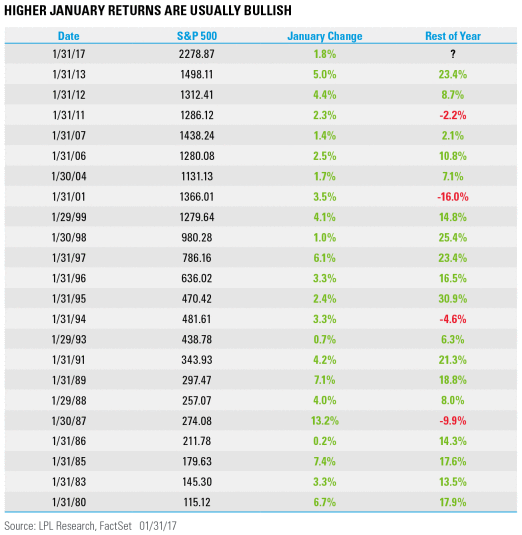

The first month of the year is in the books, and the S&P 500 gained 1.8% for the third month in a row of gains. This of course brings up the discussion of the January barometer. This popular trading axiom says that the performance in January can predict what will happen in the rest of the year and was first mentioned by Yale Hirsch in 1972 in the Stock Trader’s Almanac. It is better known as “So goes January, so goes the year.”

First things first: January has been lower in the previous three years, and the S&P 500 bounced back to finish the remaining 11 months positive all three times. In other words, this potential warning sign didn’t work so well recently. Last year, for example, was one of the worst Januarys ever, with the S&P 500 losing 5.1%; meanwhile, the S&P 500 jumped more than 15% in the final 11 months of the year.

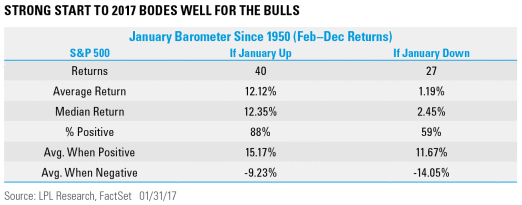

Turning to the years when January was in the green like this year, since 1950* the rest of the year was higher an impressive 88% of the time with an average return of 12.1%. Compare that with a 1.2% gain in the final 11 months when January has been lower, and it is safe to say a higher January tends to bode well for future gains.

Per Ryan Detrick, Senior Market Strategist, “Although the January barometer hasn’t been so accurate in the past few years, where January weakness wasn’t a warning of coming lower prices, the bottom line is a strong January has a nice track record for future gains. With another solid quarter of earnings growth taking place, accelerating earnings growth the next few quarters, and the chance of a recession in 2017 very minimal, this all should bode well for this old trading mantra to be correct once again with higher prices in the final 11 months of the year.”

Last, don’t forget that the Santa Claus rally and first five days of the year were also higher this year, along with the month of January. To see all three higher is rather rare, with 2013 the last time this trifecta took place. In fact, all three have been higher only 28 times since 1950, and the final 11 months have finished higher 25 times (89.3%) with an average return of 12.7%.

IMPORTANT DISCLOSURES

*Please note: The modern design of the S&P 500 stock index was first launched in 1957. Performance back to 1950 incorporates the performance of predecessor index, the S&P 90.

Past performance is no guarantee of future results.

The opinions voiced in this material are for general information only and are not intended to provide or be construed as providing specific investment advice or recommendations for any individual security.

The economic forecasts set forth in the presentation may not develop as predicted.

Investing in stock includes numerous specific risks including: the fluctuation of dividend, loss of principal and potential illiquidity of the investment in a falling market.

The S&P 500 Index is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries

Indices are unmanaged and cannot be invested into directly. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment.

This research material has been prepared by LPL Financial LLC.

To the extent you are receiving investment advice from a separately registered independent investment advisor, please note that LPL Financial LLC is not an affiliate of and makes no representation with respect to such entity.

Not FDIC/NCUA Insured | Not Bank/Credit Union Guaranteed | May Lose Value | Not Guaranteed by any Government Agency | Not a Bank/Credit Union Deposit

Securities and Advisory services offered through LPL Financial LLC, a Registered Investment Advisor Member FINRA/SIPC

Tracking #1-578011(Exp. 1/18)

Copyright © LPL Research