by Burt White, Chief Investment Strategist, LPL Financial

KEY TAKEAWAYS

· We recommend that investors generally maintain balance across value and growth stocks.

· Improving economic and profit growth create a favorable backdrop for value.

· Our sector views point to balanced style views, particularly our positive views of both technology and financials.

Other factors to consider include relative valuations (favors growth) and technical analysis (favors value).

IS there still Value in value?

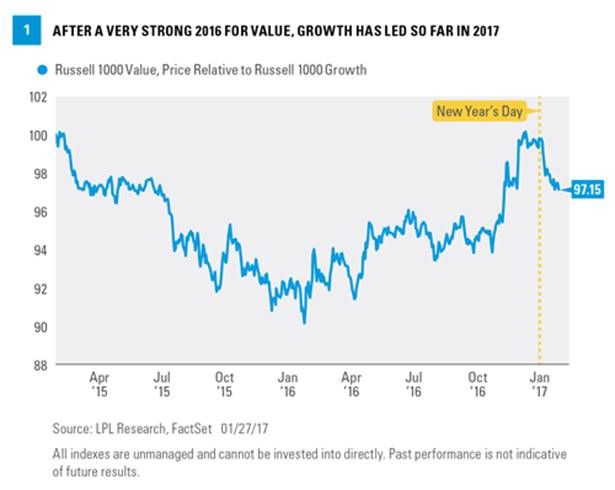

Despite a strong 2016, there may still be some value in value. While value has lagged growth so far in 2017, based on the Russell style indices [Figure 1], we see several reasons to like value stocks, including accelerating economic and profit growth, and an improving outlook for the financial sector. But the growth side has enough going for it that we recommend investors maintain balance across the styles. Here we discuss our latest style views.

Slow growth no more?

Economic and profit growth are both poised to improve in the coming months in our view, creating a more favorable backdrop for value stocks that have historically outperformed when growth is accelerating. Economic growth has been subpar during the entire economic expansion (approximately 2% growth on average in gross domestic product [GDP]), which is one of the reasons why growth stocks have outperformed value during the current economic expansion.

The logic here is that when economic and profit growth is scarce, you want to own stocks that can generate their own growth without the need for a macro tailwind. Value stocks tend to need help from the economy to grow. When all companies get a macro lift, and growth is plentiful, the market tends to prefer cheaper stocks to those that are more expensive.

The following analysis (annual data back to 1990) supports this logic:

When economic growth is slow (real GDP below 2.2% annually), growth outperforms value 60% of the time by an average of 3.1%. GDP came in below that pace in the fourth quarter of 2016, but we expect at least 2.5% in 2017. FAVORS VALUE

When the Institute for Supply Management’s (ISM) Manufacturing Purchasing Managers’ Index (PMI) is below average (less than 52), growth outperforms value 60% of the time by an average of 2.5%. The ISM, after accelerating four straight months, came in at 54.5 for December 2016. FAVORS VALUE

When S&P 500 profits grow at below-average rates (less than 7%), growth outpaces value 58% of the time by an average of 5.1%. S&P 500 year-over-year earnings growth is tracking right on that 7% number for the fourth quarter of 2016 (based on Thomson Reuters data). But it is early in earnings season, suggesting more upside may come, and consensus expectations are calling for double-digit earnings gains in 2017. Based on potential upside from policy (tax reform, infrastructure, deregulation, etc.), we believe earnings stand a good chance of eclipsing that 7% mark in 2017, particularly in the second half of the year. FAVORS VALUE

Accelerating growth is certainly not the whole story. We had accelerating economic and profit growth in the late 1990s, and the growth style outperformed. There are other factors to consider, such as sector positioning and valuations as we discuss below. We must also keep time frame in mind and consider that this dynamic may not last very long. The bump up in economic growth that most expect may not come through or may be short-lived, suggesting stints of growth and value outperformance are possible in the year ahead.

Sector considerations

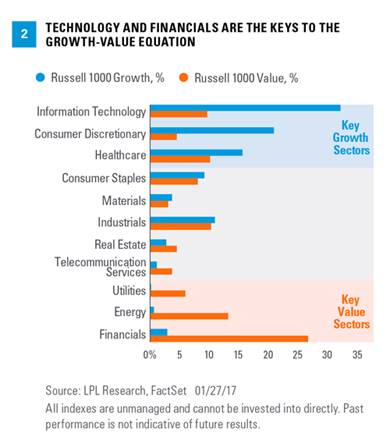

Sector outlooks are another important consideration in the growth-value decision. Performance of the biggest value sector, financials, relative to the biggest growth sector, technology [Figure 2], is a key determinant of style performance, as discussed below, but other sectors also play a role:

Financials: The outlook for the financials sector has been steadily improving in recent months. First, interest rates have been rising and steepening the yield curve, which benefits lending margins and returns on cash. Second, the Trump administration will likely roll back financial regulations, which is expected to stimulate lending and may open up more growth opportunities. Third, because of the sector’s domestic focus, the sector is one of the biggest beneficiaries of lower corporate tax rates (more global companies pay lower tax rates due to lower rates overseas). And finally, financials are very economically sensitive and economic growth expectations have improved lately. FAVORS VALUE

Technology: We maintain our positive view of the technology sector, which is enjoying solid growth, remains attractively valued, and will be a big beneficiary of an expected lower tax rate to repatriate cash overseas (based on the current tax code, companies must pay the corporate tax rate of 35% when deploying profits earned overseas for domestic purposes including share repurchases, dividends, reinvestment or acquisitions). Although we expect the technology sector to outperform the market in 2017, a potentially smaller immigrant labor pool, rising risk of protectionism, and less benefit from lower corporate tax rates than other sectors may make it difficult for technology to outpace financials. FAVORS GROWTH

Energy: We like the progress oil producers have made to balance supply and demand, with help from the OPEC agreement (plus Russia) to cut production. However, near-term upside to oil prices may be capped in the mid-to-high $50s, just a few dollars above current levels, because higher prices are likely to be met with more production. FAVORS VALUE

Utilities: We continue to recommend avoiding the utilities sector due to its interest rate sensitivity and our expectation that economically sensitive sectors perform better. The sector’s heavy debt usage is another cause for concern because tax reform may eliminate the deductibility of interest payments on corporate debt. FAVORS GROWTH

Consumer Discretionary: We maintain a negative view of consumer discretionary because the sector tends not to do well in the mid-to-late stages of business cycles, even though lower individual tax rates may arrive later this year. Other concerns include ecommerce disruption and a possible border adjustment tax out of Washington, D.C. that would hurt the many importing companies in the sector, including autos and apparel retailers. FAVORS VALUE

Healthcare: We continue to see value in the healthcare sector, although given the policy uncertainty, we recognize risk is high. The sector is as cheap as it has ever been relative to the broad market, but there is no guarantee that millions of individuals won’t lose their insurance once the Affordable Care Act (ACA) is replaced, and drug price scrutiny may linger. FAVORS GROWTH

Rolling this up, the sector score is a draw. We have positive views of two growth sectors (technology and healthcare) and two value sectors (financials and energy), and negative views of one growth sector (consumer discretionary) and one value sector (utilities). We would not make the style decision on sector views alone, but this exercise results in a fairly balanced picture.

Growth looks like a better value

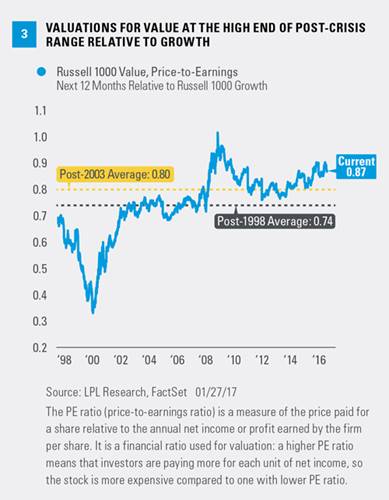

Valuations are another consideration in the style decision, and value stocks appear a bit expensive relative to growth. Although by definition value stocks are always cheaper than growth on an absolute basis because valuations are used to classify the securities, the relative relationship between the two changes. Currently, the Russell 1000 Value Index is trading at a smaller discount to its growth counterpart (13%) than its 20-year average (26%, Figure 3).

Even if we eliminate the tech boom — a period when growth was dramatically overpriced — value is still 7% more expensive than its average (a 13% discount vs. the post-2003 average discount of 20%). So although we do not put a lot of weight on valuations for short-term decisions, over the next year or two valuations may present a headwind for value outperformance.

Technical picture

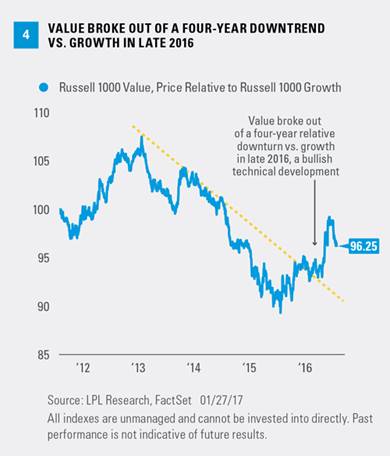

Taking a technical analysis perspective, we observe that the value relative performance line versus growth broke out of a four-year downtrend in late 2016. We believe this positive technical development favors value, although the Russell 1000 Value Index does appear to be working off short-term overbought conditions (a technical way of saying in the short-term, relative performance may be a bit ahead of itself). Nonetheless, strictly from a technical perspective, the extended value underperformance suggests a potential long-term opportunity in value [Figure 4].

Conclusion

We see several reasons to like value stocks, including accelerating economic and profit growth, the better outlook for financials, and the breakout versus growth from a technical analysis perspective. But the growth-heavy technology sector looks good to us, the value-oriented utilities do not, and value looks expensive relative to growth. Bottom line, the growth side has enough going for it that we suggest investors maintain fairly balanced style allocations.

IMPORTANT DISCLOSURES

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. To determine which investment(s) may be appropriate for you, consult your financial advisor prior to investing. All performance referenced is historical and is no guarantee of future results.

The economic forecasts set forth in the presentation may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

Investing in stock includes numerous specific risks including: the fluctuation of dividend, loss of principal, and potential liquidity of the investment in a falling market.

Because of their narrow focus, specialty sector investing, such as healthcare, financials, or energy, will be subject to greater volatility than investing more broadly across many sectors and companies.

Commodity-linked investments may be more volatile and less liquid than the underlying instruments or measures, and their value may be affected by the performance of the overall commodities baskets as well as weather, geopolitical events, and regulatory developments.

All investing involves risk including loss of principal.

DEFINITIONS

Gross Domestic Product (GDP) is the monetary value of all the finished goods and services produced within a country’s borders in a specific time period, though GDP is usually calculated on an annual basis. It includes all of private and public consumption, government outlays, investments and exports less imports that occur within a defined territory.

Purchasing Managers Indexes are economic indicators derived from monthly surveys of private sector companies, and are intended to show the economic health of the manufacturing sector. A PMI of more than 50 indicates expansion in the manufacturing sector, a reading below 50 indicates contraction, and a reading of 50 indicates no change. The two principal producers of PMIs are Markit Group, which conducts PMIs for over 30 countries worldwide, and the Institute for Supply Management (ISM), which conducts PMIs for the U.S.

The Institute for Supply Management (ISM) Index is based on surveys of more than 300 manufacturing firms by the Institute of Supply Management. The ISM Manufacturing Index monitors employment, production inventories, new orders, and supplier deliveries. A composite diffusion index is created that monitors conditions in national manufacturing based on the data from these surveys.

INDEX DESCRIPTIONS

The Standard & Poor’s 500 Index is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

The Russell 1000 Index measures the performance of the large cap segment of the U.S. equity universe. It is a subset of the Russell 3000 Index and includes approximately 1000 of the largest securities based on a combination of their market cap and current index membership. The Russell 1000 represents approximately 92% of the U.S. market.