by Lance Roberts, Clarity Financial

There is little argument that Exchange Traded Funds, more commonly referred to as “ETF’s” have and will continue to change the landscape of investing. As my colleague Cullen Roche penned:

“The rise of low-cost indexing is one of the most transformational trends in modern investing…The rise of low-cost diversified index funds has changed the meaning of an important debate in finance – the active vs passive debate.“

Currently, the debate over “Active vs. Passive” is raging as article after article is penned discussing the money flows into ETF’s.

For example, the Wall Street Journal published an article entitled “The Dying Business of Picking Stocks” stating:

“Over the three years ended Aug. 31, investors added nearly $1.3 trillion to passive mutual funds and their brethren—passive exchange-traded funds—while draining more than a quarter trillion from active funds, according to Morningstar Inc.”

CNBC also jumped on the bandwagon with “Peak Passive? Money Is Gushing Out Of Actively Managed Funds.” To wit:

“Investors bailed on actively managed funds in record numbers during 2016, preferring the reliability and low costs of index funds over taking a chance on finding a stock picker who could beat the market.”

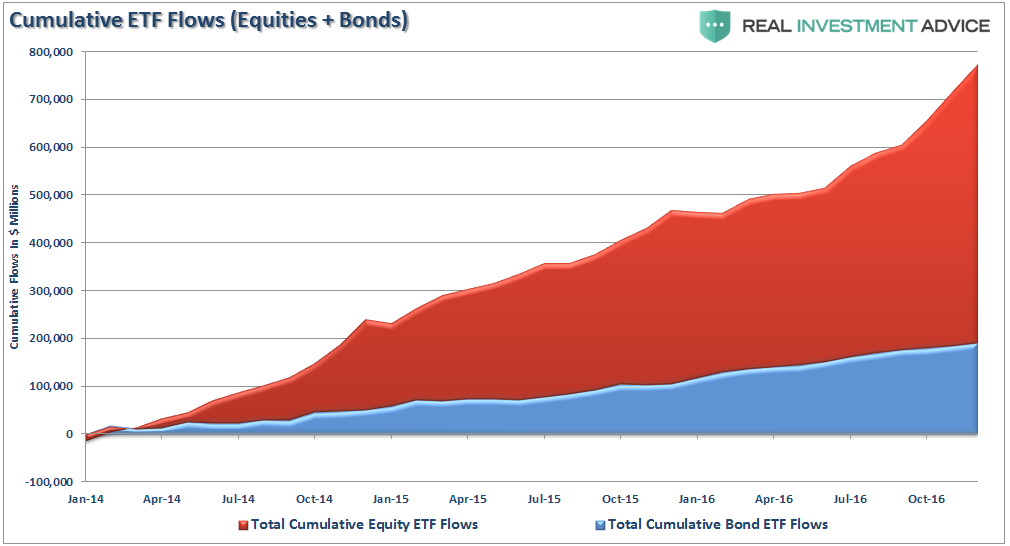

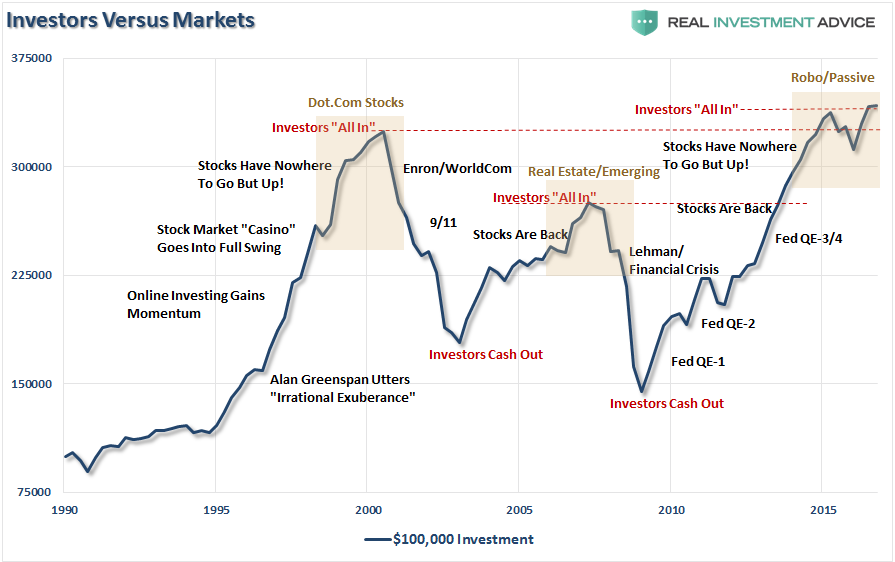

It would certainly seem to be the case given the flow of funds over the last couple of years in particular as noted by ICI and shown in the chart below.

The exodus from actively managed mutual funds is occurring for four primary reasons.

- Expenses: The management fees on passive funds are extremely low as the funds do not require investment analysis. In fact, an excel spreadsheet with a few lines of macro coding can replace a traditional portfolio manager. The WSJ article found that fees are almost eight times higher for active funds than passive ones (.77% vs. .10%).

- Relative Performance: Not surprisingly, in a market that has been fueled by massive Central Bank interventions, passive funds have outperformed actively managed funds. In the aforementioned article, the WSJ found that over the last five years a meager 11.2% of U.S. large-company mutual funds (actively managed) outperformed the Vanguard 500 passive index fund. Of course, this is due to expense difference as noted above.

- Technology Shifts: The advancement for algorithmic and computerized trading is leading to a migration of assets into ETF’s which are ideal for computer-driven allocation models.

- Media: One of the biggest reasons for the flows from actively managed mutual funds into ETF’s has been the increased press and media attention on ETF’s. As the markets have pushed higher, and the performance and expense differential exposed, the media has berated investors for not being invested regardless of the risk. Therefore, investors have been “psychologically pushed” to buy ETF’s as the “fear of missing out” has accelerated.

Yes, the world of investing has once again changed, and evolved, just as it has throughout history.

- 1960-70’s it was the “Nifty Fifty”

- 1980’s was the rise of the mutual fund industry and “portfolio insurance” as financial deregulation spread.

- 1990’s the evolution of “online trading” brought individuals into the Wall Street “Casino”

- 2000’s brought about the “real estate” investing boom.

- 2010’s Fed-driven liquidity boom and technology blend to create the “passive revolution?”

Of course, I probably don’t need to remind how each of those periods ended in 1974, 1987, 2000 and 2007. Importantly, each time was believed to “be different.”

The current rise of indexed based ETF investing, however, is not a sign of “passive” indexing.

The Myth Of Passive

There are many reasons why individuals SHOULD choose to use ETF’s versus either mutual funds OR individual equities.

- Costs related to the internal operating fees of mutual funds

- Trading costs for purchasing individual equities

- Turnover related to managing an individual equity portfolio

- Volatility risks

- Asset selection risks

- Allocation risks, and most importantly;

- Behavioral and psychological risks.

With ETF’s many of these problems can be avoided entirely or substantially reduced. Today, more than ever, advisors are actively migrating portfolio management to the use of ETF’s for either some, if not all, of the asset allocation equation. However, they are NOT doing it “passively.”

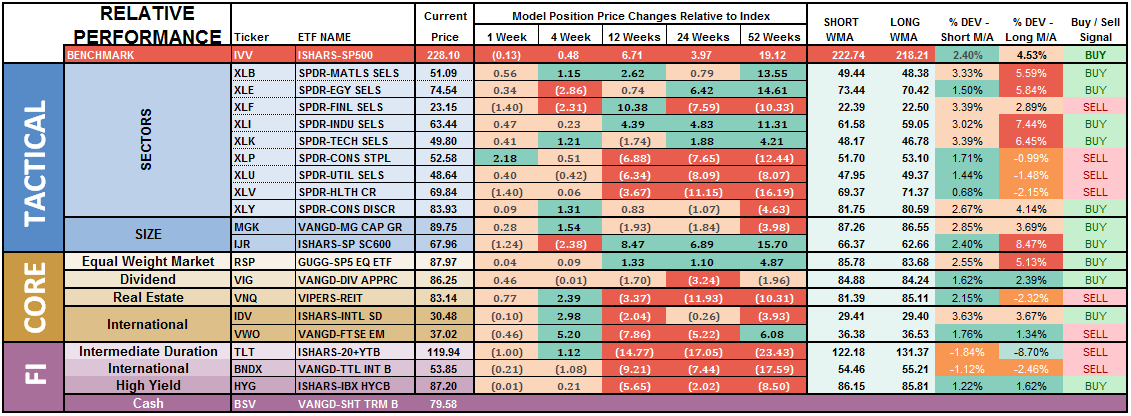

For example, in our own portfolio management practice, we offer an entirely ETF driven asset allocation model which is actively managed against the variety of “risks” that arise from asset rotation to inflation, interest rate risks, momentum shifts and inter-market analysis.

We also run a model that is a blend between individual equities, individual bonds (which provide principal protection and income) and ETF’s for both asset allocation diversification and hedging.

However, we are not unique within the overall industry of providing lower cost solutions for clients as the industry continues to press annual management fees below 1% and bring a much-needed focus on fiduciary responsibility.

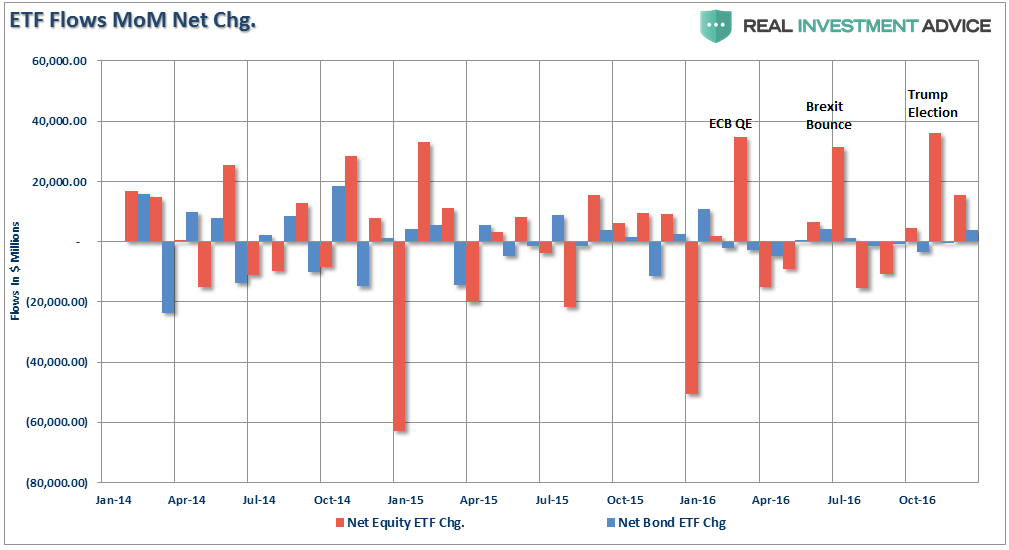

But, this does NOT MEAN investors, or advisors, have opted to be “passive” investors. They have simply changed the instruments by which they are engaging in “active” trading. This can be seen in the changes of flows between equities and bonds as shown below.

As Cullen noted:

“The rise of index funds has turned us all into ‘asset pickers’ instead of stock pickers. The reality is that we are all discretionary decision makers in our portfolios. Even the choice to do nothing is a discretionary decision. Therefore, all indexing approaches aren’t all that ‘passive’. They’re just different forms of active management that have been sold to investors using clever marketing terminology like ‘factor investing’ and ‘smart beta’ in order to differentiate the brands.”

He is correct. “Active” investing is quite alive and well and being facilitated by the variety of online “apps” and platforms which allow for trading ETF’s with the click of a button. A recent email noted an important point about this shift.

“My whole office uses it [the app], and we are always talking about how our investments are performing. It’s created a social element to investing.”

What the email highlights is the “gambler effect.” When we gamble, and the reason we become addicted to it, is the “winning” causes our brain to release “dopamine.” As humans, that release makes us feel good and the “social element” created from the approval of others, and the competition bred by it, feeds into our addictive natures.

Therein Lies “The Trap”

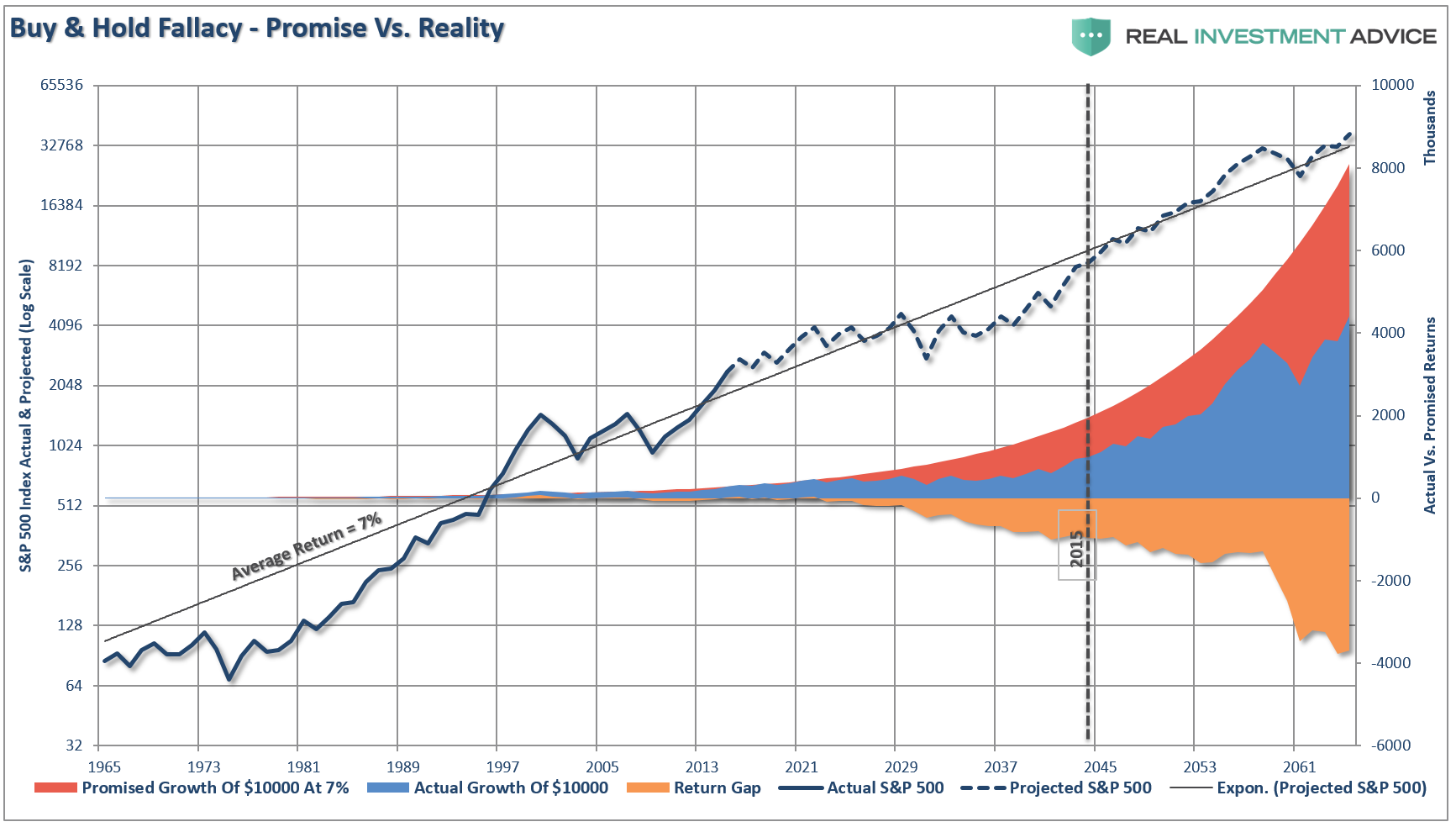

The idea of “passive” investing is “romantic” in nature. It’s a world where everyone just invests some money, the markets rise 7% annually and everyone one’s a winner.

Unfortunately, the markets simply don’t function that way.

Just as the initial speculators via online trading learned heading into 2000, or the real estate speculators learned heading into 2008, there is no “guaranteed winner.”

Today, Millennials who watched their parents get decimated twice by the financial markets have unwittingly been lured back into the casino through apps, Robo-advisors, and platforms with the promise of long-term success through “passive approaches” to investing.

Again, the markets simply don’t function that way.

To quote Jesse Felder of the Felder Report:

‘Embracing passive investing is exactly this sort of ‘cover your eyes and buy’ sort of attitude. Would you embrace the very same price-insensitive approach in buying a car? A house? Your groceries? Your clothes? Of course not. We are all very price-sensitive when it comes to these things. So why should investing be any different?'”

While the idea of passive indexing works while all prices are rising, the reverse is also true. The problem is that once prices begin to fall the previously “passive indexer” becomes an “active panic seller.” With the flood of money into “passive index” and “yield funds,” the tables are once again set for a dramatic and damaging ending.

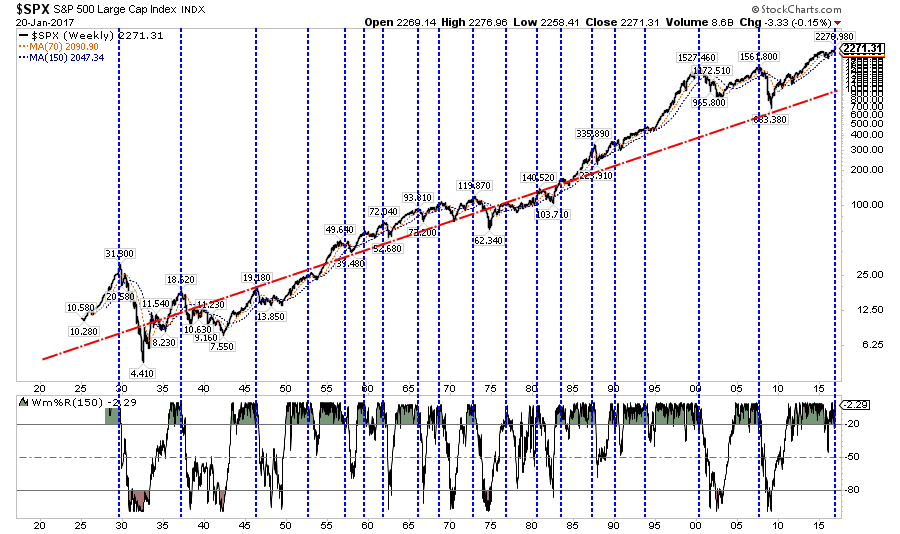

It is only near peaks in extended bull markets that logic is dismissed for the seemingly easiest trend to make money. Today is no different as the chart below shows the odds are stacked against substantial market gains from current levels.

As my partner, Michael Lebowitz, noted in a recent posting:

“Nobody is going to ring a bell at the top of a market, but there are plenty of warped investment strategies and narratives from history that serve the same purpose — remember internet companies with no earnings and sub-prime CDOs to name two.”

Investors need to be cognizant of, and understand why, the chorus of arguments in favor of short-sighted and flawed strategies are so prevalent. The meteoric rise in passive investing is one such “strategy” sending an important and timely warning.

Just remember, everyone is “passive” until the selling begins.

Lance Roberts

Lance Roberts is a Chief Portfolio Strategist/Economist for Clarity Financial. He is also the host of “The Lance Roberts Show” and Chief Editor of the “Real Investment Advice” website and author of “Real Investment Daily” blog and “Real Investment Report“. Follow Lance on Facebook, Twitter and Linked-In