by Mawer Investment Management, via The Art of Boring Blog

President’s Message

You may have heard us say, on more than one occasion, that market volatility and unpredictability are entirely normal. Our experiences over the last 40+ years have certainly reinforced that lesson. Yet even for us, 2016 felt unusual, with significant political game changers occurring such as Brexit and the election of Trump. But such a year serves to remind us that the best approach to investing in this unpredictable and rapidly changing world is to focus on the things we can control.

First and foremost, this means continuing to build diversified portfolios of high quality companies—portfolios constructed to be resilient no matter what the future holds. Unpredictable markets’ reinforce our resolve to stick to our time tested investment strategy.

It also means increasing depth and capabilities of our team—we have now grown to 130 employees across our Calgary, Toronto, and Singapore offices as we search for investment opportunities globally. Given our growth, nurturing our strong culture remains a top priority. It is our belief that our unique culture is a key differentiator and vital to our investment success. And while we have consistently been recognized as one of Focus Consulting Group’s “Focus Elite” (an award given to high performing cultures based on an industry survey), we know that our culture must continue to be an area of emphasis.

And our focus remains on you, our clients—by helping you meet your investment objectives and by continually improving your experience with Mawer.

While years such as 2016 are reminders that we live in interesting and ever changing times, you can be sure that some things will always stay the same. At Mawer, we remain unwavering in our commitment to deliver long-term investment excellence and to earn your ongoing trust.

We wish you all the best for 2017.

Michael Mezei

Market Overview

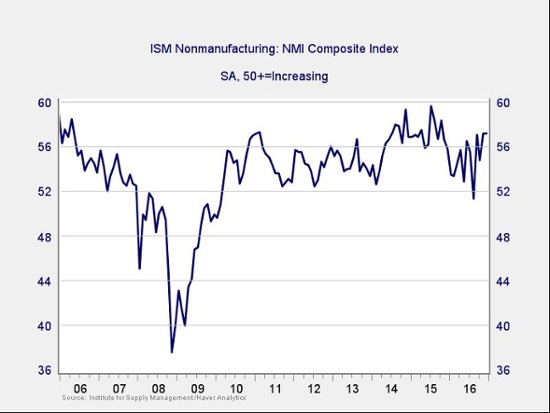

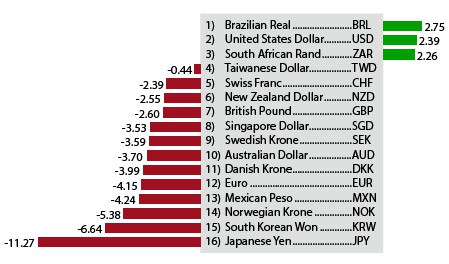

After an extended period of highly correlated markets, (i.e., equities and bonds delivering positive returns in tandem) the fourth quarter was characterized by divergences. Bond markets moved in reaction to growing expectations that changes in the U.S. will lead to higher economic growth accompanied by rising inflation. Generally speaking, equity markets gained in local terms—although Canadian dollar strength negatively impacted most returns outside of North America.

As you can see in the chart below, many currencies lost ground to the high flying Loonie in 4Q16. This was largely a headwind for Mawer performance this quarter.

Canadian Dollar Translation Effect

Fiscal spending commitments, clarity on the U.S. election, and positive headlines in Energy (oil price recovery and pipeline decisions) drove investor sentiment. The primary result has been a re-pricing of bonds and “boring” equities in favour of those that could benefit most from inflationary conditions. The beneficiaries included investments in Energy, Materials, Industrials, and Banking and Insurance—the more cyclical areas of the economy.

While Mawer Funds have exposure to most of these cyclical sectors, our current emphasis on companies operating within these industries is noticeably less than the broad market. This is not new. Mawer’s portfolios often look very different than the underlying benchmarks, and it is this willingness to be different that has helped Mawer’s performance in the past. But unfortunately this can also lead to periods when the companies we emphasize (“boring,” wealth creating) underperform the broad market. This latest quarter was a clear example of this as many of our Funds lagged their respective benchmarks.

At Mawer, a permanent impairment of capital is the single biggest error to avoid and this is one of the key drivers of our discipline in finding high quality businesses, run by excellent management teams, purchased at a discount to fair value. This approach hasn’t provided a large return but it has produced a positive return of 3.2% for the year to Balanced Fund clients. We have done this by not betting on one scenario over another and using a diversified approach. Put into practice, while bonds had a tough quarter and international and global equities struggled, Canadian and U.S. equities performed well: therein lies the benefit of diversification.

Review of Issues and their Implications (the “So What?”) for 4Q16:

Issue—Investor expectations shifted materially over the quarter. In the aftermath of Donald Trump winning the Presidential election, market participants’ growth and inflation expectations moved higher.

So What?—While U.S. equities viewed this positively, the U.S. bond market saw price declines with yields correspondingly back up to the top of their 12-month range. This move was mirrored in a number of other bond markets, which saw comparable price volatility (i.e., yield curve shifts).

Trump’s platform, if executed, may have distinct winners and losers. U.S. companies may become more competitive due to a lower tax rate and a less stringent regulatory regime. A focus on American industry and infrastructure spending could benefit energy, building materials, construction, and engineering companies. But from a global standpoint, greater protectionism could hurt exporters to the U.S., foreign companies that rely on trading activity, and suppliers to the U.S. public sector. In the end, it isn’t clear to what extent many of Trump’s policies will be implemented, if at all. Markets thus far appear to have priced in some of the growth friendly policies and little of the protectionist picture. We expect volatility around policy implementation to continue.

Issue—The Federal Reserve increased interest rates in December and signaled a change to its intended schedule of increases; adding a hike to 2017 but removing one from 2018. The day after the announcement, yields moved up 10 basis points in 10-year U.S. treasuries. Equities appeared unaffected.

So What?—Inflationary expectations in the U.S. gained momentum from mid-2016 through the fourth quarter, pushing bond prices down. There is no guarantee of all scheduled Fed interest rate hikes being implemented, but bond valuations have come down enough to consider adding to positions.

Issue—OPEC finally agreed to a production cut. The agreement reduces global production to 32.5 million barrels per day, while giving Iran some room to nevertheless raise production. Non-OPEC countries were being asked to cut production by about 600,000 bpd.

So What?—The agreement was an incremental positive for oil producers and oil countries, and may help on the margin to boost inflation in some countries. Canadian equities look more attractive based on the outlook for Energy. Expanding margins are likely given a higher price level for commodities and a significantly lower (and sticky) cost base. That said, it remains to be seen whether all countries abide by their agreement.

Issue—Canada signed a free trade agreement with Europe. CETA will remove 98% of tariffs and officials hope it will generate an increase in trade worth $12B a year. Meanwhile, a number of countries in Asia—including China—signaled their intent to continue to pursue a free trade area in the Asia-Pacific region.

So What?—These moves stand in contrast to what looks like a potentially more protectionist U.S. under Trump. It could be incrementally positive for Canada.

Issue—Indian Prime Minister Narendra Modi surprised markets when he announced the country will remove all existing 500 and 1,000 rupee notes out of circulation to curb corruption and thwart counterfeiters. The move was an attempt to bring billions of dollars of income hidden in the underground economy into (taxable) view. GDP growth looks like it will be negatively impacted in the near-term as a result.

So What?—While the Indian stock market reacted negatively to this news, it is an incrementally positive indication from India that it is moving to make the structural changes necessary to remove red tape that hampers economic growth. We view the removal of red tape as a significant growth catalyst for India and continue to travel to India to evaluate at what stage the country is at. We own select businesses in India where competitive advantages outweigh the red tape roadblocks. It is likely to continue on a select basis unless reform momentum surges.

How Did We Do?

The overall theme for this quarter is that quality is underperforming the overall market. Given that we always want to buy quality companies (wealth-creating companies with excellent management teams) some of our funds have struggled on a relative basis.

(All performance is for Series A Funds, net of fees and expressed in Canadian dollars for the period October 1-December 31, 2016. Please note: some of our benchmarks have changed this quarter. Refer to Benchmark History for more information.)

Mawer International Equity Fund: -5.5 %

MSCI ACWI (Net) Excluding U.S. Index: 0.8%

In practical terms, what this has meant for the International Equity Fund is a rotation out of “quality-biased” sectors, like Consumer Staples (which we are overweight) and into more cyclical sectors like Energy, Materials and Financials that have continued to bounce back. Within Consumer Staples, our Japanese holdings, such as convenience store operator Seven & I and pharmacy chain Tsuruha, were impacted as their sell-off was compounded by the decline in the Japanese Yen.

Within Financials, the lower-quality rally was evident as European banks continued their rebound. For example, Deutsche Bank and Société Générale—both stocks we don’t own—jumped 43% and 45% respectively during the quarter while our top weight in the sector, reinsurance broker Aon, gained a mere 1.5%. Avoiding European banks had helped us a lot earlier in the year, as they were under pressure from low interest rates and souring loan books. We did not own these banks because the competitive and regulatory environments in Europe make it very difficult for them to differentiate themselves or to earn a sustainable return on equity. In short, European banks by and large don’t meet our definition of wealth-creating businesses, a key component of our investment philosophy. While the valuation of these banks had become more attractive by the summer, the conditions highlighted above have not changed and we continue to keep our distance.

Mawer Global Equity Fund: -1.4 %

MSCI ACWI (Net) Index: 3.3%

Similar to the performance drivers for our International Equity Fund, we fell victim to the trend of quality companies underperforming. Within Financials, the European banks theme described in the previous section was very much at play here as well. Within Industrials, most of our exposure is in professional services companies like Intertek and Bureau Veritas, both global leaders in certification and testing, as well as data providers like Verisk (which aggregates and provides data to the insurance industry) and IHS Markit (which is more broad but is mostly concentrated in the Financial sector). All of these companies command premium multiples due to the resilience of their business models and they corrected during the quarter (on average down about 3%); by contrast, other subsectors that are more cyclical in nature, like Industrial Conglomerates, Machinery and Aerospace and Defence, delivered moderate to strong returns.

In the Materials sector, we have tended to avoid metals and mining in favour of specialty chemicals companies like Croda (see sidebar) as well as flavours and fragrances companies. These businesses are able to deliver steady returns that are protected by strong barriers to entry which gives them pricing power, a key criteria that their metals and mining peers lack. Unfortunately, these higher quality, steadier companies corrected this quarter, in stark contrast to mining companies like Glencore, Vale and Freeport McMoran which were up anywhere between 30% and 55%.

Mawer Canadian Equity Fund: 5.0%

S&P/TSX Composite Index: 4.5%

Mawer New Canada Fund: 4.9%

S&P/TSX SmallCap Index: 3.1%

The Canadian equity market saw strong performance from more cyclical sectors—Financials, Energy and Industrials—with one notable exception: Materials. Contrary to what happened in other markets, Materials actually delivered a negative return in Canada primarily due to the large concentration of precious metal companies in the sector (one of the indirect impacts of the U.S. election was the unwinding of the gold trade). This is the main reason why the Canadian Equity Fund outperformed the benchmark. Readers who are familiar with our approach will know that we are not big fans of metals and mining companies (although we do own Potash and Agrium, both of which performed quite well this quarter). This positive performance helped offset the weakness we saw in a few of our Industrials holdings (specifically, MacDonald Dettwiler, Richelieu Hardware and CP Rail).

Canadian Small Cap is a very similar story and most of our positive performance came from our positioning within the Materials sector (not owning metals and mining companies) which more than offset the detraction caused by our Energy exposure (underweight the strong performing sector combined with not owning the companies that are more leveraged to the oil price).

Mawer U.S. Equity Fund: 2.7%

S&P 500 Index: 5.9%

Buoyed by higher interest rates, strong markets, and the prospect of a more lenient regulatory environment, U.S. Financials were by far the strongest performing sector in the S&P 500 Index, up 24%. We benefitted from an overweight position in Financials, with holdings JPMorgan Chase and Wells Fargo up considerably, but this was more than offset by some of the other securities we held within the sector. Most notably, we lacked any direct exposure to insurance companies, which enjoyed a respite in the form of higher interest rates. Our position in rating agency and index provider S&P Global also corrected after a strong year, perhaps due to the prospect of lower expected bond issuance going forward.

Mawer Global Small Cap Fund: -3.2%

MSCI ACWI Small Cap (Net) Index: 3.8%

The Global Small Cap Fund had a tough quarter. A significant underweight exposure to domestically-oriented U.S. companies was one factor, but there were a few stocks that also weighed heavily on the portfolio. The biggest contributor to the Fund’s underperformance compared to the benchmark was NCC Group, a UK-based cyber-security company. During the quarter, it announced three unrelated but significant cancellations in its assurance division (where NCC is hired to test a client’s system to identify any potential breaches) and one contract deferral. The stock reacted quite negatively to this announcement and ended the quarter down 50%. What have we done in response? Nothing. Or at least that’s what it may look like on the surface. However, rest assured that not selling down our position (although we had been trimming it ahead of the quarter) or adding to it has very much been a conscious, active decision. Though we’re obviously not thrilled with the news, we have spoken to management at length; our interpretation is that the underlying business is healthy and that the issues appear temporary. However, we recognize that it is a competitive industry and these cancellations may be a sign of additional issues.

Another detractor was PC Jeweller, an Indian jewelry company. The stock suffered along with the rest of the Indian market following Narendra Modi’s announcement to take 500 and 1,000 rupee notes out of circulation for ones with better counterfeit measures. PC Jeweller suffered as a large portion of its transactions are cash based which has affected sales in the short-term.

Mawer Canadian Bond Fund: -3.8%

FTSE TMX Canadian Universe Bond Index: -3.4%

Mawer Global Bond Fund: -4.4%

Citi World Government Bond Index: -6.7%

Bond yields in Canada increased meaningfully, returning to year-high levels in sympathy with the global trend. The 10-year Government of Canada yield jumped from 1.0% to 1.7% resulting in a quarter of negative returns for bond investors. The portfolio’s position in corporate bonds helped to soften the impact of rising yields due to a yield premium and a narrowing in credit spreads, particularly within the lower-rated communications industry.

The Global Bond Fund was down along with most fixed income securities around the world as it was impacted by the higher rates that were observed globally following the U.S. election and the then upcoming (now in the books) Fed rate hike. However, relative to the Citi World Government Bond Index, the Fund was not as severely impacted due to its lower duration (a measure of a fixed income portfolio’s sensitivity to interest rates). From a currency perspective, our lack of direct exposure to Japanese bonds proved beneficial as they suffered along with their global peers, but their decline was compounded by a weakening currency. By contrast, our meaningful U.S. dollar position added value given the greenback’s strength.

Mawer Balanced Fund: -1.2%

Mawer Balanced Benchmark: 0.8%

The Balanced Fund’s asset mix positioning’s impact was roughly neutral. Being underweight Canadian equities was a negative, as it has been all year, but this was offset by our lower allocation to Global Bonds, which suffered from the rising yields across the globe, and higher allocation to U.S. equities which benefited from the optimism that followed Trump’s victory. All of this was overshadowed by the underperformance compared to the benchmark of our foreign equity mandates which were impacted by the transition from a market that favours quality companies to one that favours more cyclical companies and sectors.

Looking Ahead

After many quarters of much of the same story, the investment landscape appears to be changing. A multitude of geopolitical events—such as Brexit, the U.S. election result, and the OPEC agreement—have shifted the political and economic trajectories of many nations, as well as investor expectations. These shifts, many of which were unexpected, remind us why diversified portfolios are so important to client success in the long run.

Three important shifts can be noted in this environment. First, inflation expectations have been on the rise, which has caused volatility in bond markets. As bond yields have increased (with bond investors demanding more compensation for the possibility of greater inflation), the price of government bonds has commensurately fallen. Second, equity markets appear to be favouring certain sectors and styles; for example, it has been a good quarter for European bank stocks and for commodity stocks overall. Third, correlations between equities and bonds finally appear to be decreasing. After years in which central bank intervention helped bond and equity prices move in tandem, we are seeing returns between these two asset classes decouple.

From an asset mix perspective, the approach we take is, as always, to be resilient. In recent months, we have allocated some cash to Canadian bonds and Canadian equities, which puts us closer to a more even distribution among asset classes. Our asset mix actions this quarter included:

Increase Canadian Bond Weight.

For some time now, we have noted what seemed like elevated bond valuations and an asymmetric return profile for the asset class. The recent decline in bond prices appears to have created a more appealing risk/reward position in Canadian bonds than we’ve had for a while. Valuations simply look a little more reasonable now. In addition, while the Federal Reserve looks to increase interest rates over the next year, economic conditions in Canada still appear sluggish and the Bank of Canada may struggle to follow the Federal Reserve’s lead. This matters because historically Canadian bond yields have followed U.S. bond yields fairly closely. We therefore anticipate more of a disconnect between relative interest rate movements in shorter maturities now than in the past. We have moved some cash to bonds as a result.

Increase Canadian Large-Mid Cap Equity Weight.

We increased our weight in Canadian equities to move it closer to a neutral weight (but remain underweight).

The opportunities we are finding in Canada are attractive enough to increase our weight in the region. In particular, the outlook for the Canadian companies we own appears more positive as the price of oil has increased. At the margin, recent policy decisions around pipelines and fiscal spending may also be a positive. Overall, we believed it was prudent to modestly increase our Canadian holdings and reduce cash.

No change to remaining asset classes.

We continue to hold S. equities at a modest overweight position based on the region’s brighter growth outlook. In small cap equities, we remain slightly underweight due to liquidity conditions and relative valuation after multiple years of significant gains. Global bonds are underweight and remain so based on a higher volatility profile than Canadian bonds.

These are constructive conditions for active management. Divergences and falling correlations lead to changes in valuation and offer opportunity to take advantage over the long-term. Our view of markets is that a diversified approach remains the one that places the odds in clients’ favour.

Non-performance related material in this document reflects the opinions of the writer, and does not reflect fact or predictions of actual events or impacts, and cannot be relied upon for investing purposes or as investment advice or guarantees of any kind.

Index returns are supplied by a third party – we believe the data to be accurate, however, cannot guarantee its accuracy.

This document is for information purposes only. Before investing, please consult the simplified prospectus, available at www.sedar.com, and the Fund Facts. Mutual funds are not guaranteed, their values change frequently, and past performance is not indicative of future performance. Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. (Mutual fund securities are not covered by the Canada Deposit Insurance Corporation or by any other government deposit insurer. There can be no assurances that the fund will be able to maintain its net asset value per share at a constant amount or that the full amount of your investment in the fund will be returned to you.)

Performance returns for the Mawer Mutual Funds are calculated by Mawer Investment Management Ltd. These returns are historical simple returns for the 3 month, YTD and 1 year periods, and annualized compounded total returns for periods after 1 year. They include changes in unit value and reinvestment of all distributions and do not take into account sales, redemption, distribution or optional charges or income taxes payable by any security holder that would have reduced returns.

Download (PDF – 129KB)

(Download includes 4Q 2016 Performance Overview)

This post was originally published at Mawer Investment Management