by Lance Roberts, Clarity Financial

With the markets closed on Monday, there really isn’t much to update you on “technically” from this past weekend’s missive. However, I thought it would be useful to remind you of my “New Year’s Investor Resolutions” in case you missed it:

Investor Resolutions For 2017

Here are my annual resolutions for the coming year to be a better investor/portfolio manager:

- I will do more of what is working and less of what isn’t.

- I will remember that the “Trend Is My Friend.”

- I will be either bullish or bearish, but not “piggish.” (Pigs get slaughtered)

- I will remember it is “Okay” to pay taxes.

- I will maximize profits by staging my buys, working my orders and getting the best price.

- I will look to buy damaged opportunities, not damaged investments.

- I will diversify to control my risk.

- I will control my risk by always having pre-determined sell levels and stop-losses.

- I will do my homework. I will do my homework. I will do my homework.

- I will not allow panic to influence my buy/sell decisions.

- I will remember that “cash” is for winners.

- I will expect, but not fear, corrections.

- I will expect to be wrong and I will correct errors quickly.

- I will check “hope” at the door.

- I will be flexible.

- I will have the patience to allow my discipline and strategy to work.

- I will turn off the television, put down the newspaper, and focus on my own analysis.

These are the same resolutions I attempt to follow every year. There is no shortcut to being a successful investor. There are only the basic rules, discipline and focus that is required to succeed long-term.

The biggest problem for investors is the bull market itself.

When the “bull is running” we believe we are smarter and better than we actually are. We take on substantially more risk than we realize as we continue to chase market returns and allow “greed” to displace our rational logic. Just as with gambling, success breeds overconfidence as the rising tide disguises our investment mistakes.

Unfortunately, it is during the subsequent completion of the full-market cycle that our errors are revealed. Always too painfully and tragically as the loss of capital exceeds our capability to “hold on for the long-term.”

So Goes January

There is an abundance of “Wall Street Axioms” surrounding the first month of the New Year as investors anxiously try and predict what is in store for the next twelve months. You are likely familiar with many of them from the “Superbowl Indicator” to “What Happens In The First 5-days Predicts The Month.”

Considering that trying to predict the markets more than just a few days in advance is mostly an exercise in “folly,” it is nonetheless a traditional ritual as the old year passes into the new. While Wall Street espouses their always overly optimistic projections of year-end returns, reality has often tended to be rather different.

However, from an investment management perspective, we can take a look at some of the statistical evidence for the month of January to gain some insight into performance tendencies looking ahead. From this analysis, we can potentially gain some respect for the risks that might lay ahead.

According to StockTrader’s Almanac, the direction of January’s trading (gain/loss for the month) has predicted the course of the rest of the year 75% of the time.

Furthermore, twelve or the last sixteen presidential election years followed January’s direction. Every down January on the S&P 500 since 1950, without exception, preceded a new or extended bear market, flat market or a 10% correction.

Starting from a broad historical perspective, the chart below shows the January performance going back to 1900.

You will note that most of those consecutive negative returns coincided with bear markets such as 2002-2003 and 2008-2009. With January 2015 and 2016 posting negative returns, the year-end gain for the S&P 500 in 2016 bucked the historical trend. The negative return in January of 2016 was the second largest on record.

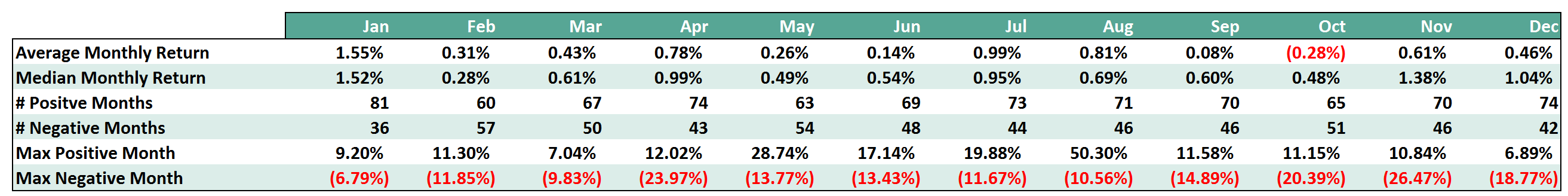

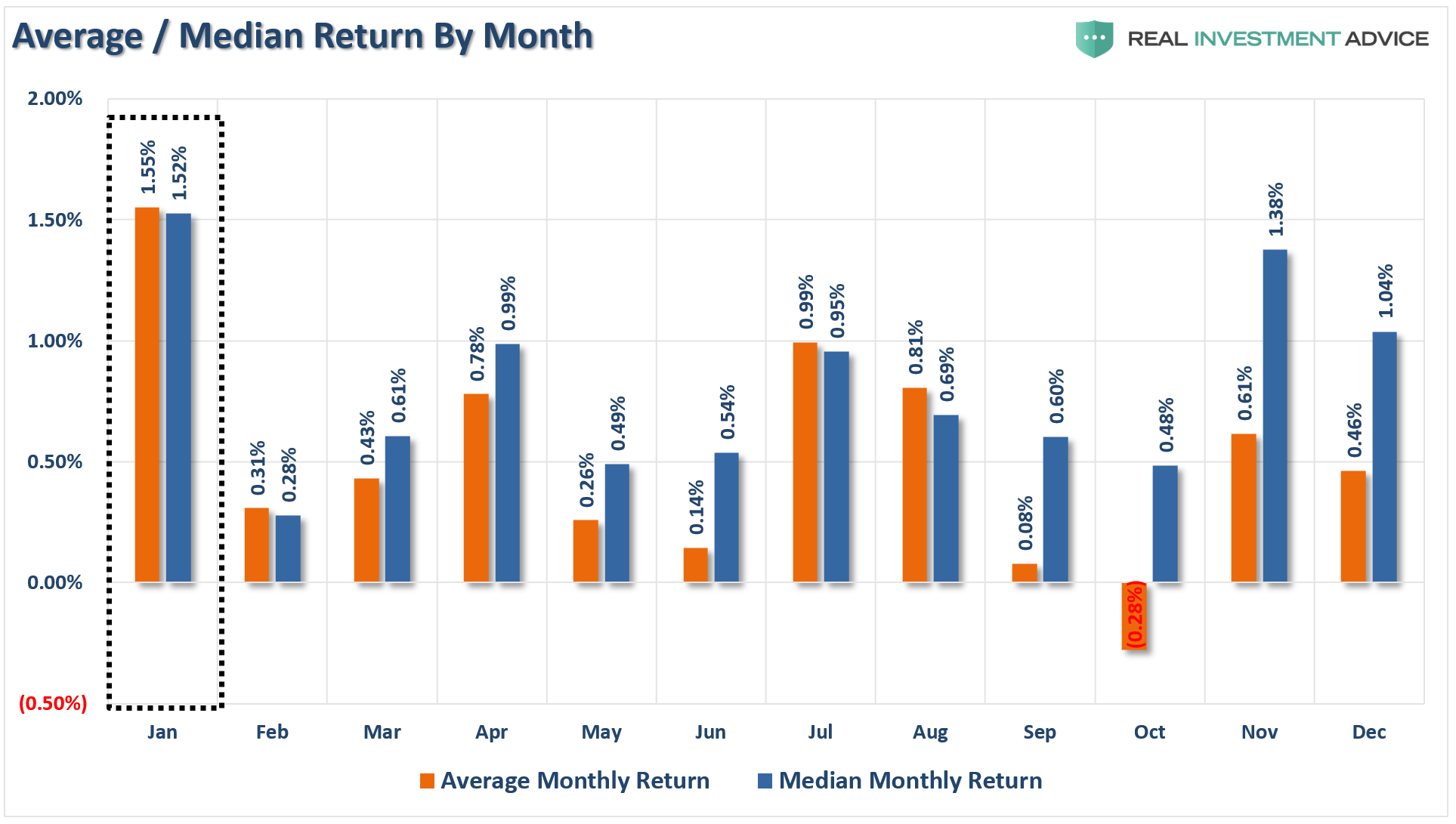

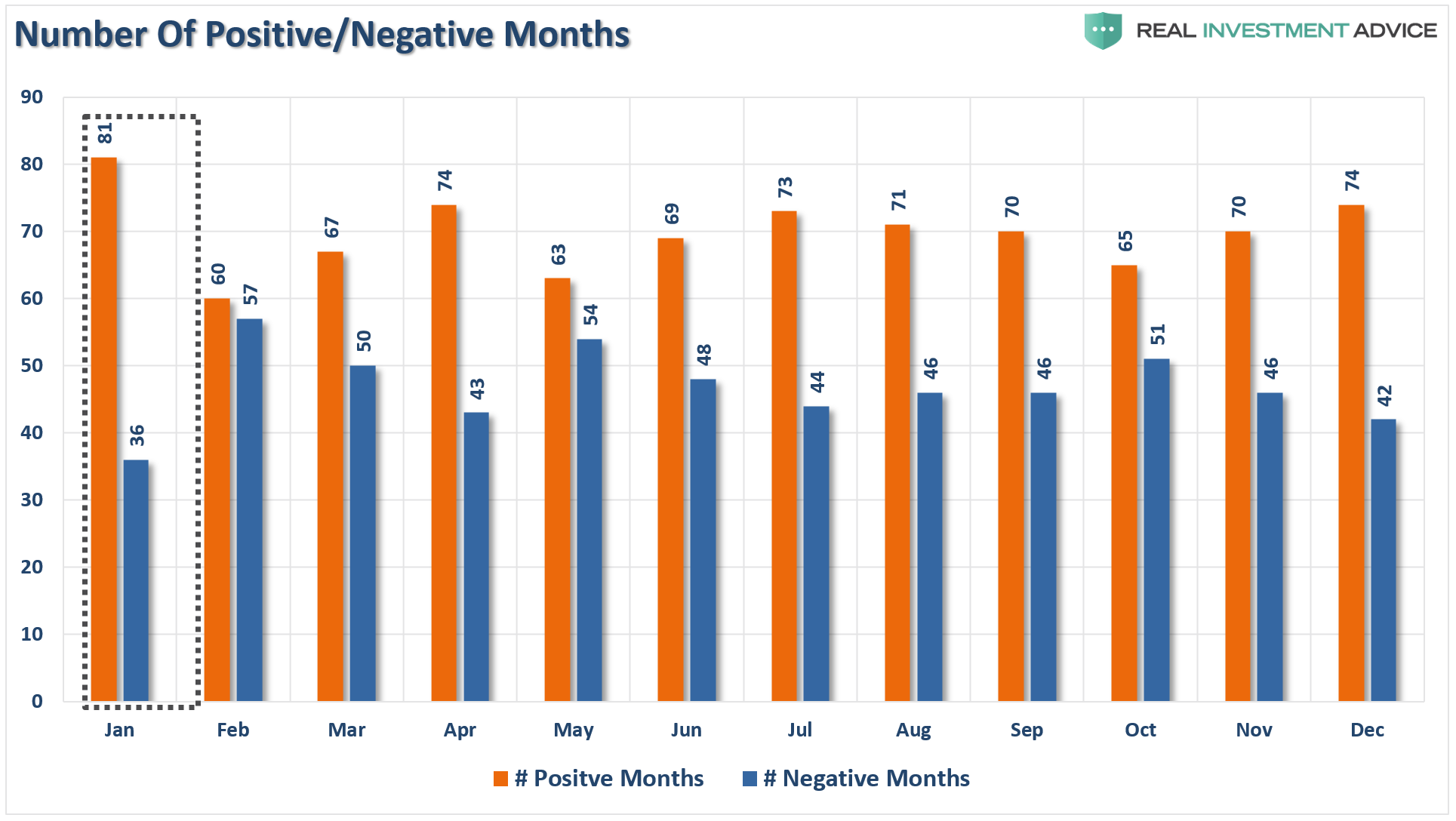

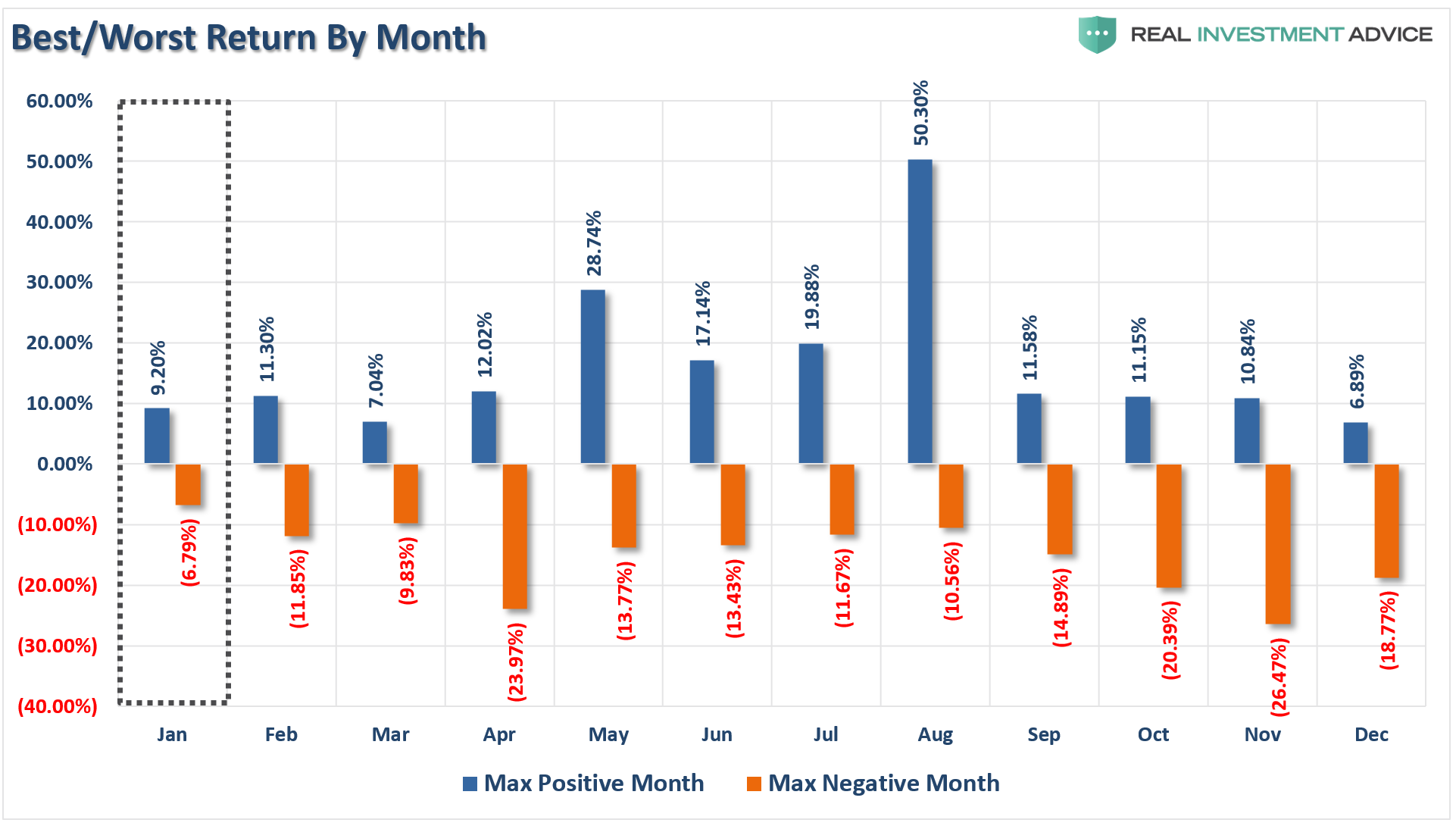

The table and chart below show the statistics by month for the S&P 500.

The good news is the month of January has the highest average and median return of all months of the year. It also boasts the highest number of positive return months followed by December and April.

Furthermore, while January’s maximum positive return was just 9.2%, the maximum drawdown for the month was the lowest for all months at -6.79%.

While I don’t directly make asset allocation decisions based on monthly returns from a portfolio management perspective, the statistical weight of evidence suggests a couple of things worth considering.

The odds of January being a positive month greatly outweigh those of it being negative. Furthermore, given that January sported negative returns over the two previous years suggests this year will likely sport a positive return overall. February is potentially a different animal. Therefore, allocations should remain weighted more heavily towards risk currently but with attention paid to the overall risks.

However, given the length of the current bull market run from 2009 to present, the risks are mounting the current bull market cycle will end sooner rather than later and will most likely coincide with the onset of a recession. Such fundamental realities suggest a more conservative approach to investment allocations.

This dichotomy reminds me of the scene from “The Princess Bride” where the “Sicilian” is in a “Battle Of Wits” with “The Dread Pirate Roberts.”

While it may seem confusing, for investors it comes down to time frames.

For short-term traders, the odds are high that January will post a positive trading month, therefore, allocations should remain tilted towards equity related exposure. If you are a nimble trader and can adjust for the swings in the market, the “odds are in your favor.”

For longer-term investors, particularly those that are nearing retirement, risks are mounting to the downside. Such potential outcomes suggest a more cautious approach to equity allocations in portfolios.

While the majority of the financial media and blogosphere suggest that investors should only “buy and hold” for the long-term, the reality of capital destruction during major market declines is a far more pernicious issue.

It is ALWAYS okay to miss out on an opportunity, as opportunities come along as often as a taxi-cab in New York City. However, it is IMPOSSIBLE to make up losses as you can never regain the time lost getting back to even.

It only took six years for the markets to get back to where they were prior to the financial crisis. It took just about as long to get back to even following the “Dot.com” crash in 2000.

Ladies and gentlemen – getting back to ‘even’ is NOT an investment strategy. It is a game that has been played out since the turn of the century and investors have lost out on time and inflation.

The problem for investors is 15 years to grow and compound your money for retirement is GONE. You can never regain that time. While the financial press is full of hope, optimism, and advice that staying fully invested is the only way to win the long-term investing game; the reality is that most won’t live long enough to see that play out.”

With market valuations elevated, leverage high, economic weakness pervasive and profit margins deteriorating, investors should be watching the month of January carefully for clues. The weight of evidence suggests that despite ongoing “bullish calls” for the markets in the year ahead, this could be a year of disappointment.

Pay attention, things are beginning to get interesting.

Lance Roberts

Lance Roberts is a Chief Portfolio Strategist/Economist for Clarity Financial. He is also the host of “The Lance Roberts Show” and Chief Editor of the “Real Investment Advice” website and author of “Real Investment Daily” blog and “Real Investment Report“. Follow Lance on Facebook, Twitter and Linked-In

Copyright © Clarity Financial