By Jeff Moser and John Campbell, Wells Fargo Asset Management

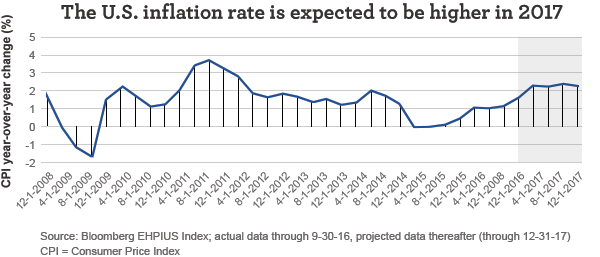

Expectations of lower taxes, higher infrastructure spending, and fewer regulations, along with hopes for fiscal stimulus and economic growth, have buoyed investors in recent weeks and pushed multiple stock indexes to all-time highs. In this environment, attention increasingly has been drawn to inflation, which is expected to rise this year.

When it comes to handling inflation, all companies aren’t equal. Investors could be well served by focusing on what might be one of the most important variables in a rising interest rate environment: a company’s ability to raise its prices.

Stocks may do better than bonds when inflation rises … but maybe not all stocks

According to conventional wisdom, bonds tend to perform poorly in an inflationary environment as rising prices erode the purchasing power of future interest and principal payments.

Conventional wisdom also contends that investments in stocks may be a good hedge against inflation; while rising costs can negatively affect corporate profits in the shorter term, over the longer term many companies may be able to transfer the added costs of inflation to consumers through higher prices.

However, in reality, different companies incur wide variations in their respective short-term costs, and the amount of inflation costs that they can pass through to customers varies widely among firms as well. Those with higher short-term costs and lower pass-through capability can struggle during inflationary periods, while other companies not in that situation may thrive. For example, apparel companies that experience cost pressure from items such as rising wages, higher prices for materials, and locked-in lease terms may have difficulty raising prices without losing business; grocery stores and pharmacy distributors, though, tend to have more flexibility to quickly pass their cost increases on to consumers.

When considering stock investments in an inflationary environment, investors can learn a great deal by evaluating the risks and advantages presented by each stock.

Select stocks may serve as a hedge against inflation

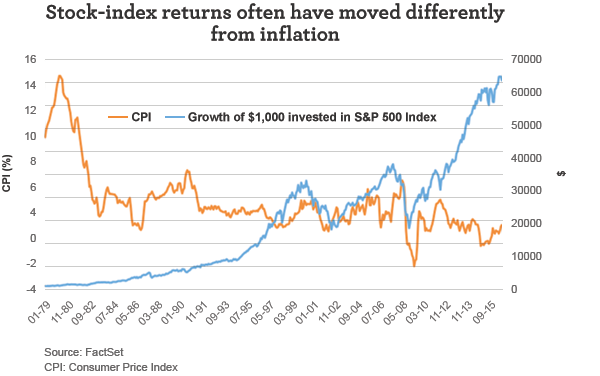

Although stock-index returns have tended to move differently from inflation over time—especially in recent years—careful stock picking may help investors hedge against this inflation risk, as research recently published by the Financial Analysts Journal indicates.

The research also points out, however, that there’s a downside to picking stocks solely based on how they’ve performed in the past when inflation has risen or fallen. Many stocks have exhibited an unstable relationship with inflation—sometimes performing better as inflation rises, but other times worse.

To gain a better sense of how a company may perform in a rising-rate environment, it’s critical to study the company’s pricing power—how much latitude does it have to raise prices without adversely affecting sales?

In an inflationary environment, pricing power is key

Strong pricing power is one of the main qualities that can help a company sustain its performance as rising inflation drives expenses higher. A company that can retain customer demand while raising prices to offset higher production costs is typically able to pass on the negative effects of inflation—such as higher commodity prices and labor costs—to its customers. The greater a company’s pricing power, the lower the impact inflation typically has on the company’s profitability.

Below are general observations about the potential pricing power of companies with certain characteristics or in certain sectors:

+ Select companies with strong brands may find their customers readily willing to accept price increases.

+ Certain larger companies, due to economies of scale, tend to have greater control over their production costs, which in turn can reduce the impact of inflation on profitability.

+ Companies selling products that other companies need in order to create finished goods may find it relatively easier to pass along price increases. It’s often harder for companies that sell to end users to raise prices without risking loss of customers.

+ Within the technology sector, companies offering cutting-edge solutions may generate revenue-growth rates above the rate of inflation. This sector, known for innovation, is home to numerous companies producing unique, high-demand products and services that command premium prices.

+ Select stocks related to natural resources and commodities historically have performed well in the early stages of an inflationary environment because prices for these materials often can be quickly adjusted based on market forces.

– Many electric utilities are highly regulated, with limited ability to raise prices when their expenses increase.

Takeaways

- Investing broadly in the overall stock market may not provide sufficient results to offset the negative impact of inflation.

- Whether a company’s stock can generate returns that keep pace with inflation depends largely on the strength of the company’s pricing power—its ability to pass rising costs through to customers without suffering a material loss in demand.

- Innovative companies, companies in industries with limited alternatives, and companies that are minimally constrained by regulations tend to have more flexibility to raise the prices of their goods and services to keep inflation from eroding profitability.

1 Ang, A., Briere, M., and Signori, O. “Inflation and Individual Equities;” Financial Analysts Journal, vol. 68, no. 4 (July/August 2012): 36-55.

Copyright © Wells Fargo Asset Management