by LPL Research

The last few months of 2016 were volatile for the bond market, as the election of Donald Trump led markets to price in higher growth and inflation expectations. A largely expected Federal Reserve (Fed) interest rate hike in December and continued foreign sales of Treasuries (mainly from China, as it sells assets in order to avoid a further devaluation of its currency) also put further upward pressure on rates. These factors caused the 10-year Treasury yield to move to 2.50% as of December 28, approximately 0.7% higher than its pre-election levels, and more than 1.1% above its all-time low of 1.36% reached in July 2016.

Moving into 2017, we believe the bond market has priced in much of the potential good news from a Trump administration, including tax reform, fiscal stimulus, and decreased regulation, which should lead to a moderation in the pace of rate moves. Importantly, while the focus in recent months has been on rising rates, factors exist that could push rates lower, including low overseas rates pushing foreign buyers toward now-higher Treasury yields, or the possibility that Trump may not be able to push through all the reforms that markets expect in a timely manner. These factors, combined with the potential for two to three Fed rate hikes in 2017, lead us to expect the 10-year Treasury yield may end 2017 in its current range of 2.25% to 2.75%, with the potential for as high as 3% if meaningful fiscal stimulus is enacted.

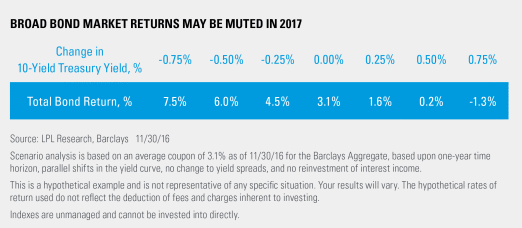

Scenario analysis based on this potential interest rate range and the duration of the index indicate low- to mid-single-digit returns for the Barclays Aggregate Bond Index for 2017. Given our bias toward rising rates, we are targeting below-benchmark duration, with a focus on a core of high-quality intermediate-term bonds, such as investment-grade corporate bonds and mortgage-backed securities (MBS). With low odds of a recession in 2017, we also believe a small allocation to economically sensitive areas of the bond market, such as bank loans and high-yield bonds, may make sense for appropriate investors. For more details surrounding our sector views and fixed income outlook, please see our recently published Outlook 2017: Gauging Market Milestones.

*****

IMPORTANT DISCLOSURES

Past performance is no guarantee of future results. All indexes are unmanaged and cannot be invested into directly.

The opinions voiced in this material are for general information only and are not intended to provide or be construed as providing specific investment advice or recommendations for any individual security.

The economic forecasts set forth in the presentation may not develop as predicted.

Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values and yields will decline as interest rates rise, and bonds are subject to availability and change in price.

The Barclays U.S. Aggregate Bond Index is a broad-based flagship benchmark that measures the investment-grade, U.S. dollar-denominated, fixed-rate taxable bond market. The index includes Treasuries, government-related and corporate securities, MBS (agency fixed-rate and hybrid ARM pass-throughs), ABS, and CMBS (agency and non-agency).

Mortgage-backed securities are subject to credit, default, prepayment risk that acts much like call risk when you get your principal back sooner than the stated maturity, extension risk, the opposite of prepayment risk, market and interest rate risk.

Government bonds and Treasury bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate.

This research material has been prepared by LPL Financial LLC.

To the extent you are receiving investment advice from a separately registered independent investment advisor, please note that LPL Financial LLC is not an affiliate of and makes no representation with respect to such entity.

Not FDIC/NCUA Insured | Not Bank/Credit Union Guaranteed | May Lose Value | Not Guaranteed by any Government Agency | Not a Bank/Credit Union Deposit

Securities and Advisory services offered through LPL Financial LLC, a Registered Investment Advisor Member FINRA/SIPC

Tracking # 1-567462 (Exp. 12/17)

Copyright © LPL Research