by Michael Lebowitz, CFA, 720 Global Research

Janet Yellen

At the December 14, 2016 FOMC press conference, Federal Reserve Chairwoman Janet Yellen responded to a reporter’s question about equity valuations and the possibility that equities are in a bubble by stating the following: “I believe it’s fair to say that they (valuations) remain within normal ranges”. She further justified her statement, by comparing equity valuations to historically low interest rates.

On May 5, 2015, Janet Yellen stated the following: “I would highlight that equity-market valuations at this point generally are quite high,” Ms. Yellen said. “Not so high when you compare returns on equity to returns on safe assets like bonds, which are also very low, but there are potential dangers there.”

In both instances, she hedged her comments on equity valuations by comparing them with the interest rate environment. In May of 2015, Yellen said equity-market valuations “are quite high” and today she claims they are “within normal ranges”? The data shown in the table below clearly argues otherwise.

Interestingly, not only are equity valuations currently higher than in May of 2015 but so too are interest rates.

Further concerning, how does one define “normal”? Does a price-to-earnings ratio that has only been experienced twice in over hundred years represent normal? Do interest rates near historical lows with the unemployment rate approaching 40-year lows represent normal? Is there anything normal about a zero-interest rate monetary policy and quadrupling of the Fed’s balance sheet?

Does the Federal Reserve, more so than the collective wisdom of millions of market participants, now think that it not only knows where interest rates should be but also what equity valuations are “normal”?

One should expect that the person in the seat of Chair of the Federal Reserve would have the decency to present facts in an honest, consistent and coherent manner. It is not only her job but her duty and obligation.

Homebuilders

On December 15, 2016, CNBC reported the following: “The National Association of Home Builders/Wells Fargo Housing Market Index (HMI) rose to 70, the highest level since July 2005. Fifty is the line between positive and negative sentiment. The index has not jumped by this much in one month in 20 years.”

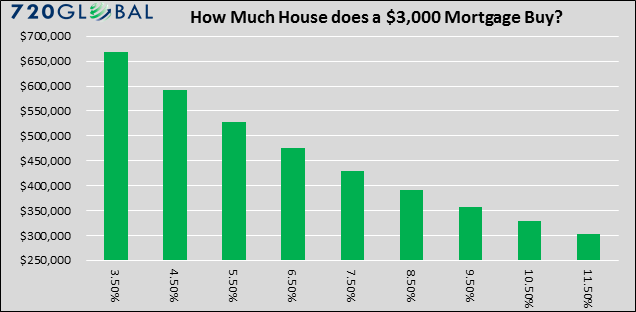

The graph below shows how much house one can afford at various interest rates assuming a $3,000 mortgage payment.

Over the past two months U.S. mortgage rates increased almost a full percent from 3.50% to 4.375%. Given such an increase, a prospective homeowner determined to limit their mortgage payment to $3,000 a month would need to seek a 10% reduction in the price of a house. In the current interest rate environment, this equates to drop from $668,000 to $601,000 in order to achieve a $3,000 a month mortgage payment. One would expect that homebuilders temper their optimism, given that a key determinant of housing demand and ultimately their companies’ bottom lines is facing a sturdy headwind.

Advice/Summary

The point in highlighting these examples is to remind you that people’s opinions, especially those with a vested interest in a certain outcome, may not always be trustworthy. We simply urge you to examine the facts and data before blindly relying on others.

We leave you with historical insight from a few so-called experts:

- “We will not have any more crashes in our time.”: John Maynard Keynes 1927

- “There is no cause to worry. The high tide of prosperity will continue” : Andrew Mellon 1929

- “Stock prices are likely to moderate in the coming year but that doesn’t mean the party is coming to an end.” : Phil Dow 1999

- “The Federal Reserve is not currently forecasting a recession.” : Ben Bernanke 2008

Michael Lebowitz, CFA

Investment Analyst and Portfolio Manager for Clarity Financial, LLC. specializing in macroeconomic research, valuations, asset allocation, and risk management. RIA Contributing Editor and Research Director.Co-founder of 720 Global Research.

Follow Michael on Twitter or go to 720global.com for more research and analysis.

Copyright © 720 Global Research