Do senior loans outperform when interest rates rise?

by Kevin Petrovcik, Senior Client Portfolio Manager, Global Bank Loans, Invesco Fixed Income, Invesco Canada

The search for yield continues, as events over the last eight years have pushed interest rates to record lows. Globally, many investors hunting for yield and lower duration in the income sleeve of their portfolio are shifting their attention to floating-rate solutions – such as senior secured bank loans – to help dampen the volatility that a rising-rate environment will bring.

The backdrop

The U.S. Federal Reserve (the Fed) moved off its zero interest rate policy late last year and now U.S. 10-year Treasuries are trading at the same yield they were a year ago when rates were bumped by 0.25%. The recent U.S. election moved yields higher and steepened the curve with markets pricing in a Fed rate hike this week and a corresponding increase in the London Interbank Offered Rate (LIBOR).1 Meanwhile, GDP in the U.S. is supportive of this rate hike, showing stronger growth in Q3, just shy of 3% up from 1.4% in Q22, and revenue growth in S&P 500 companies is turning positive for the first time in six quarters.3

In November alone, after Federal Reserve Chair Janet Yellen signaled that a rate hike is near, 10-year Treasuries were negatively affected, returning -4.65% for the month, investment-grade bonds returned -2.68%, and the high-yield bond index was down 0.39%.4

Amid all of this volatility, senior secured bank loans were positive. Knowing that we are closer to a rise in interest rates has caused investors to take a sharp look at floating-rate assets, as these asset classes, such as senior secured bank loans, do not experience as much NAV volatility when rates rise. Strong demand for senior secured bank loans, coupled with a bounce back from lower prices at the end of last year have helped the asset class return 8.9% year-to-date.5

How do senior loans perform in a rising rate environment?

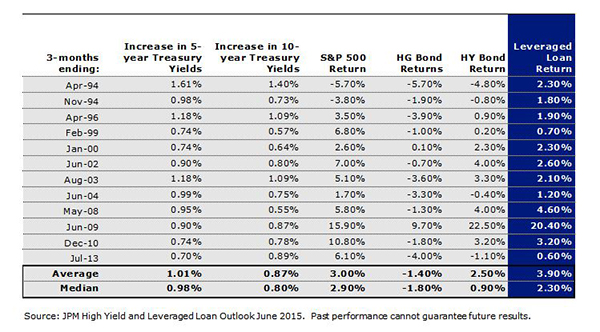

The following chart looks at historical returns of various asset classes in a rising interest rate environment. During periods when the treasury yields rise, senior secured bank loans typically have a positive return and the average return beats other fixed income assets. Post 1994, senior secured loans had positive returns in all periods when the 5-year Treasury yield increased by 0.7% or more.

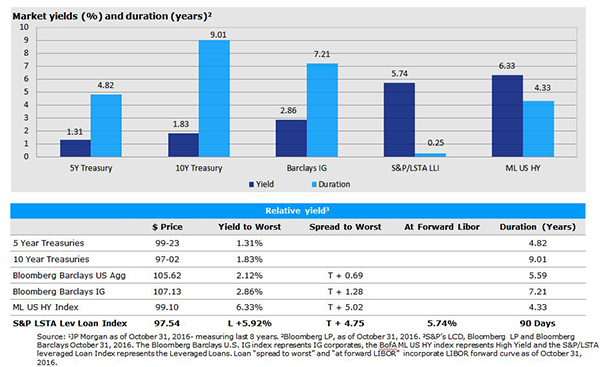

Meanwhile, if the Fed does not hike interest rates as expected, senior secured bank loans still offer investors an attractive 5.74% yield, as shown in the chart below.

How to access the senior secured loan market

At Invesco, our team in the U.S. has been investing in bank loans since 1989 – we were one of the original institutional managers in the asset class. In Canada, Invesco was the first asset manager to launch an actively managed floating-rate mutual fund and we added a senior loan ETF to our PowerShares Canada lineup in 2012.

Actively managed mutual fund:

Invesco Floating Rate Income Fund

ETF:

PowerShares Senior Loan (CAD Hedged) Index ETF (Ticker: BKL)

This post was originally published at Invesco Canada Blog

Copyright © Invesco Canada Blog