by Benjamin Streed, CFA, Raymond James

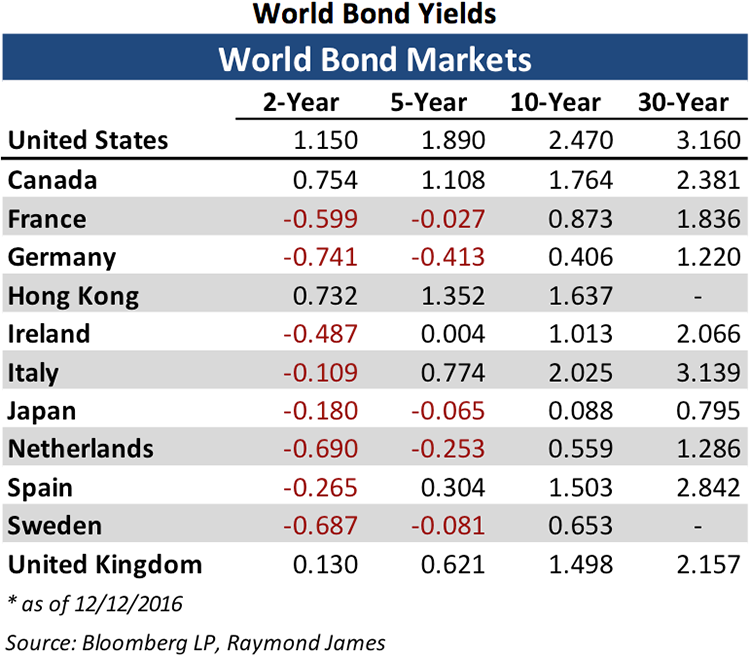

US 10-year Treasury yields jumped above 2.50% for the first time in more than two years, adding further fuel to the “rates are rising” trend we’ve seen since the election. This of course is the market’s way of attempting to factor in higher inflation as well as significant fiscal stimulus in the coming years, both of which are highly uncertain but being priced in as forgone conclusions. Building on this theme, this week the Federal Open Market Committee (FOMC) is expected to raise their benchmark rate by 25 basis points (bp) on the 14th, with the market once again pricing this in with 100% certainty according to Bloomberg futures data. Starting to see a trend yet? Markets are seemingly convinced that Trump’s campaign promises are the catalyst that will shake the multi-decade decline in global interest rates.

Kudos to the optimism, but is it possible the markets went a little too far, too fast? It’s possible that the Fed tempers some of this optimism and reiterates its post-recession commitment to being data-dependent with any future hikes, and could throw some cold water on the anticipation for several hikes in 2017 (many are expecting up to four moves next year). Remember, the last hike was December of last year, and with all the back-and-forth we saw in 2016 there was little willingness from the central bank to pursue tighter monetary policy. A recommitment to a dovish hiking cycle could cause the markets to reconsider the current state of euphoria, so pay close attention to how the Fed chooses to communicate its forward guidance. It’s likely that someone in the media will press Chair Janet Yellen on the recent rise in Treasury yields and attempt to prod the committee into giving some insight on the forward path of inflation expectations and whether the economy could “run hot” (above 2%) inflation in the coming years. Markets will pay close attention to the Fed, but don’t be surprised if the post-election environment continues to be a volatile one. Until we get clarity around future fiscal policy from the Trump administration the markets could have a proverbial “mind of their own”.

Copyright © Raymond James