by Eric Bush, CFA, Gavekal Capital

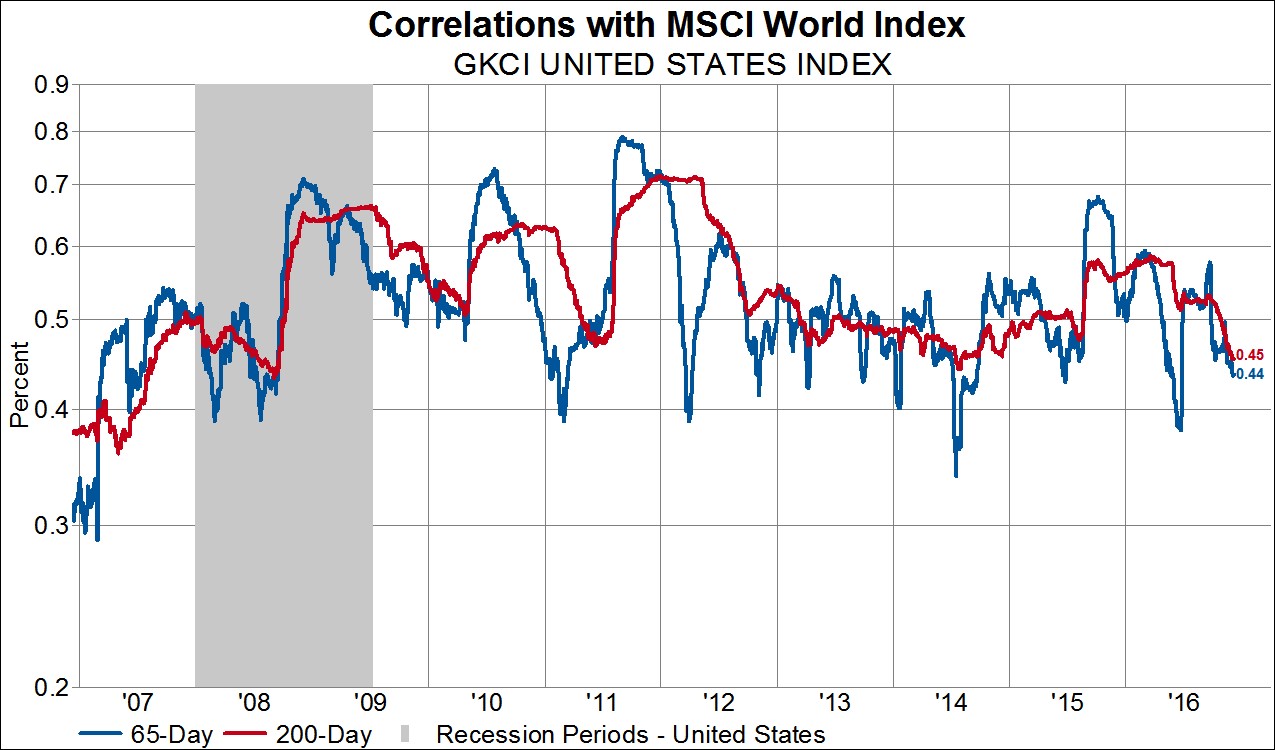

The 200-day correlation between US stocks and the MSCI World Index is currently 45%. This is the second lowest level since 2008. The only time the 200-day correlation was lower was in July 2014.

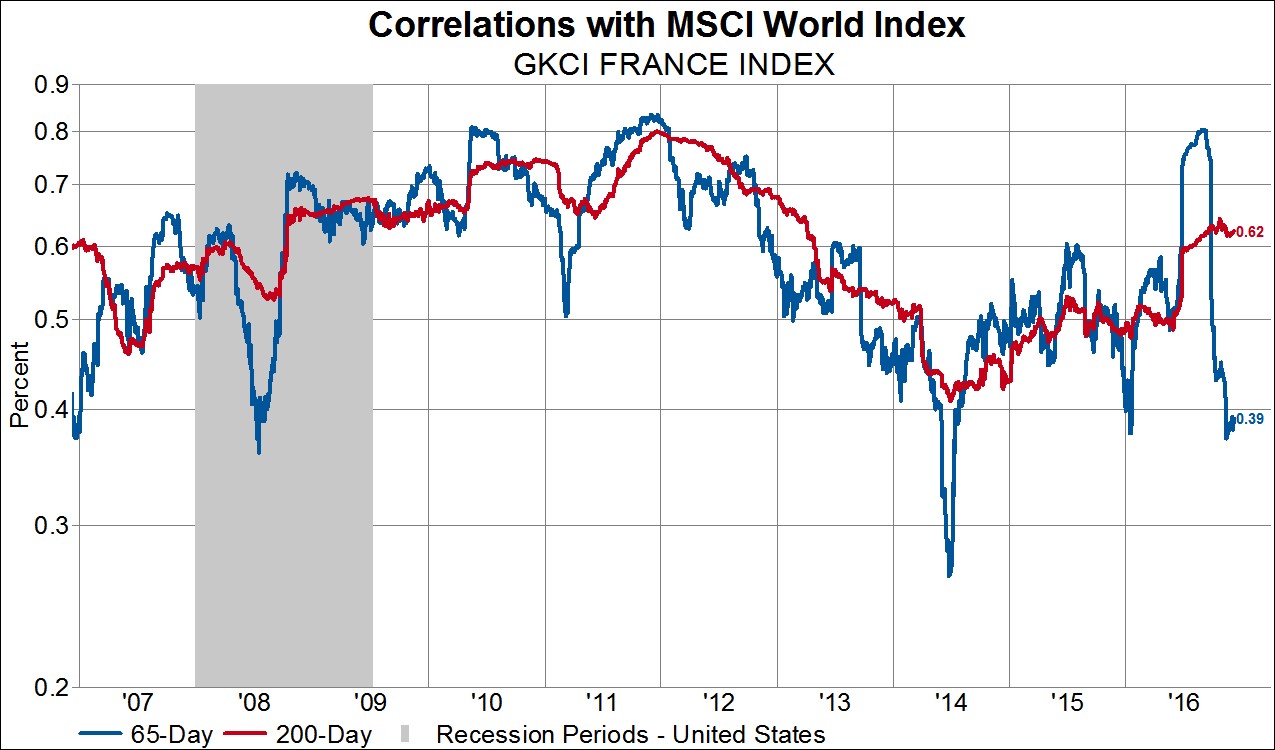

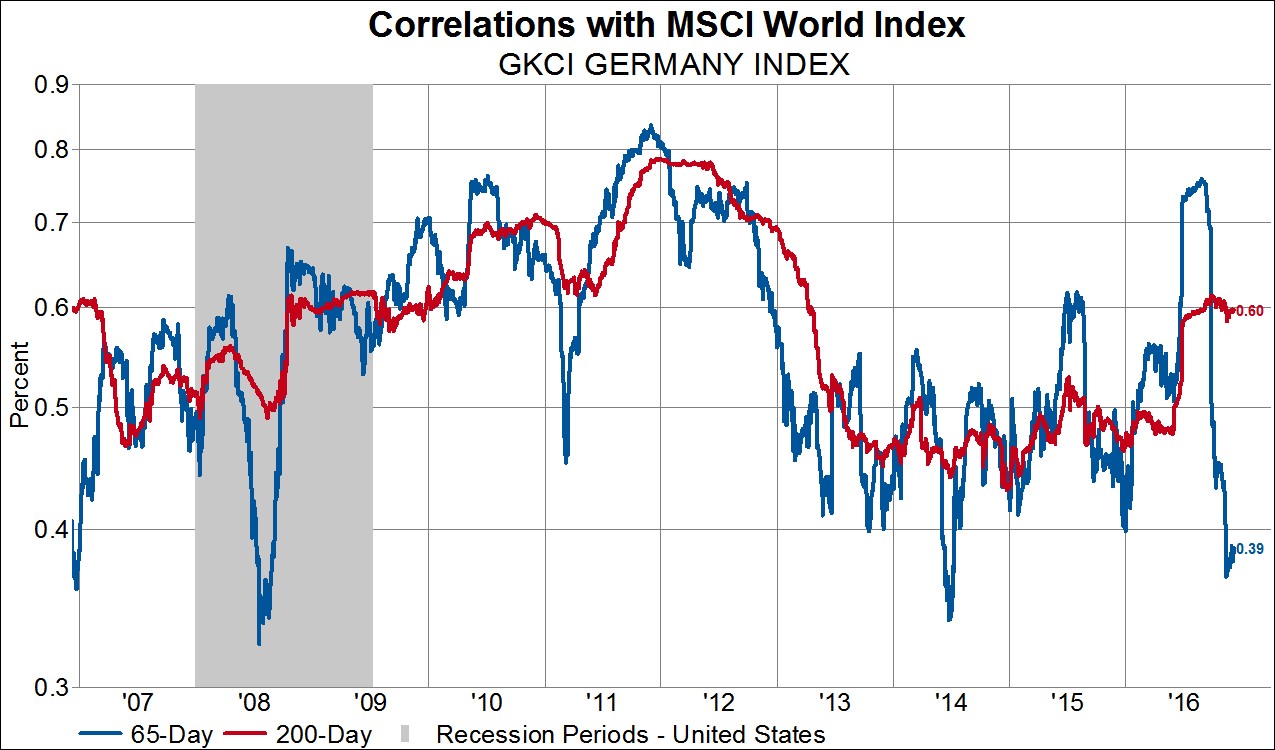

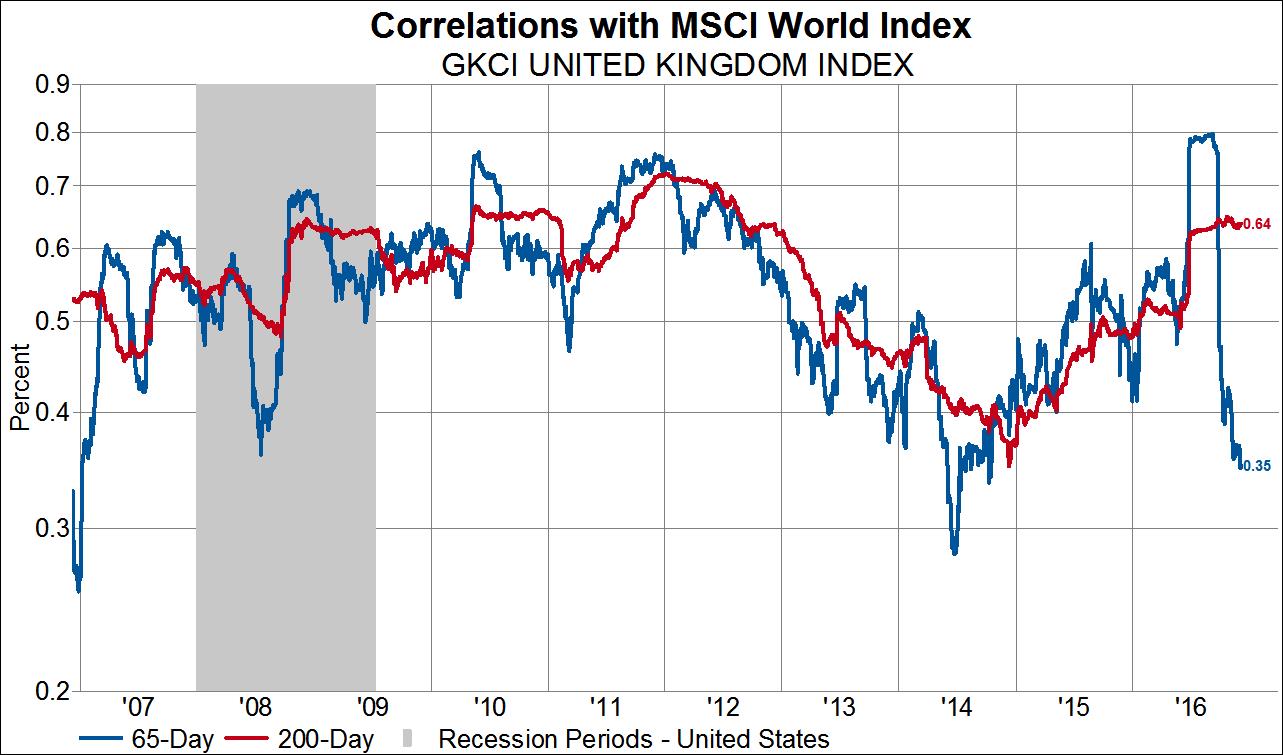

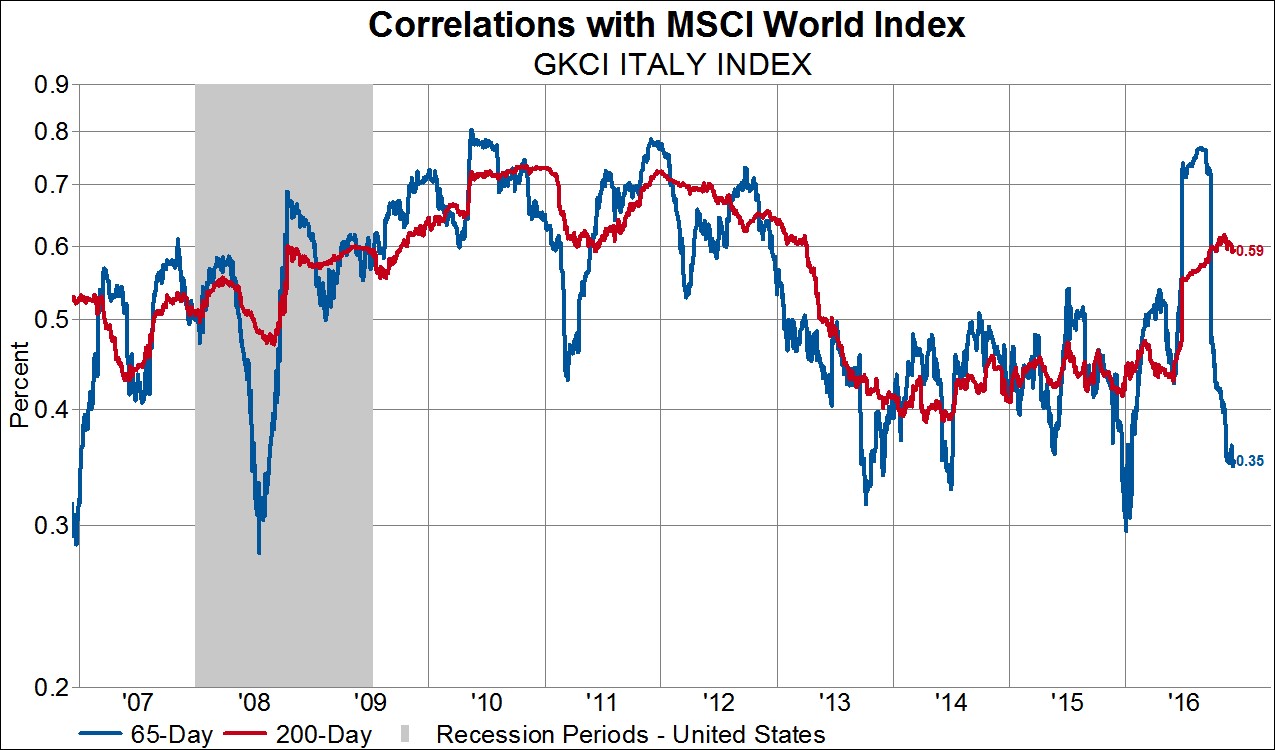

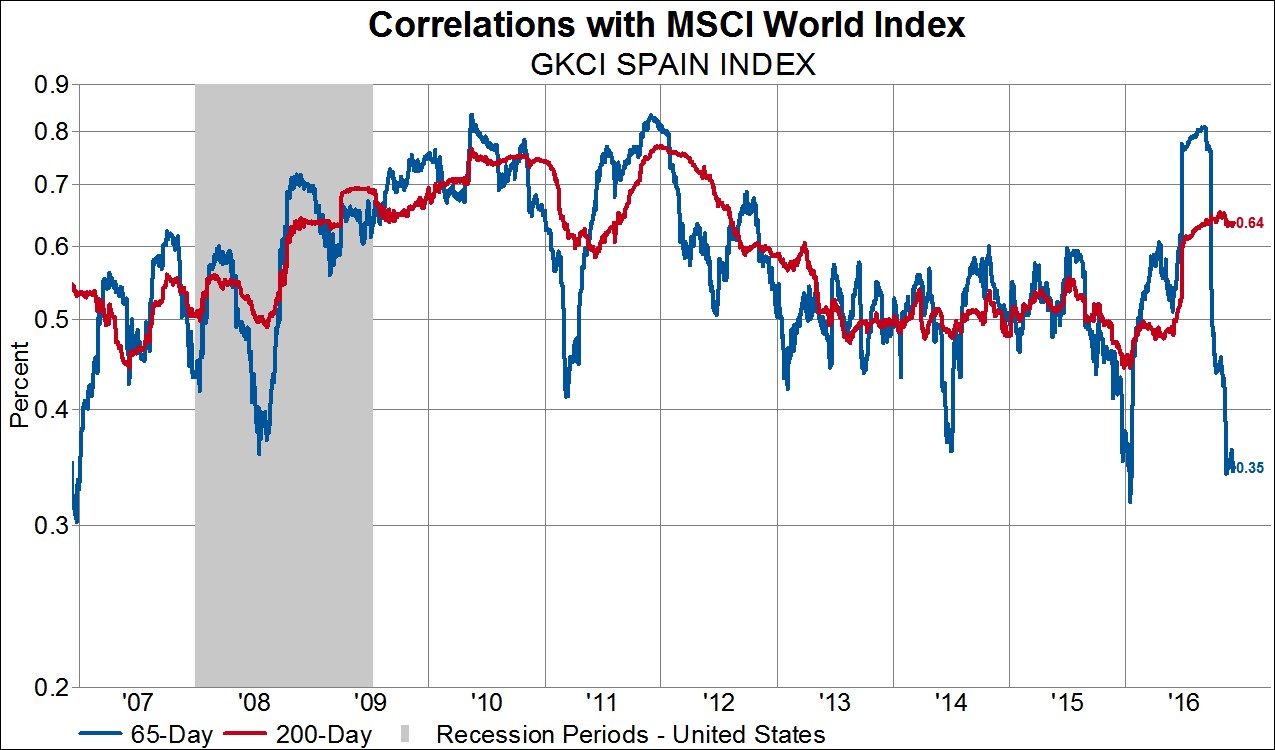

Correlations between European stocks and the MSCI World Index are also at low levels when looking at the 65-day correlation. What is even more striking about European equity correlations is that in September we saw some of the highest correlations that we have seen since the GFC hit the global economy.

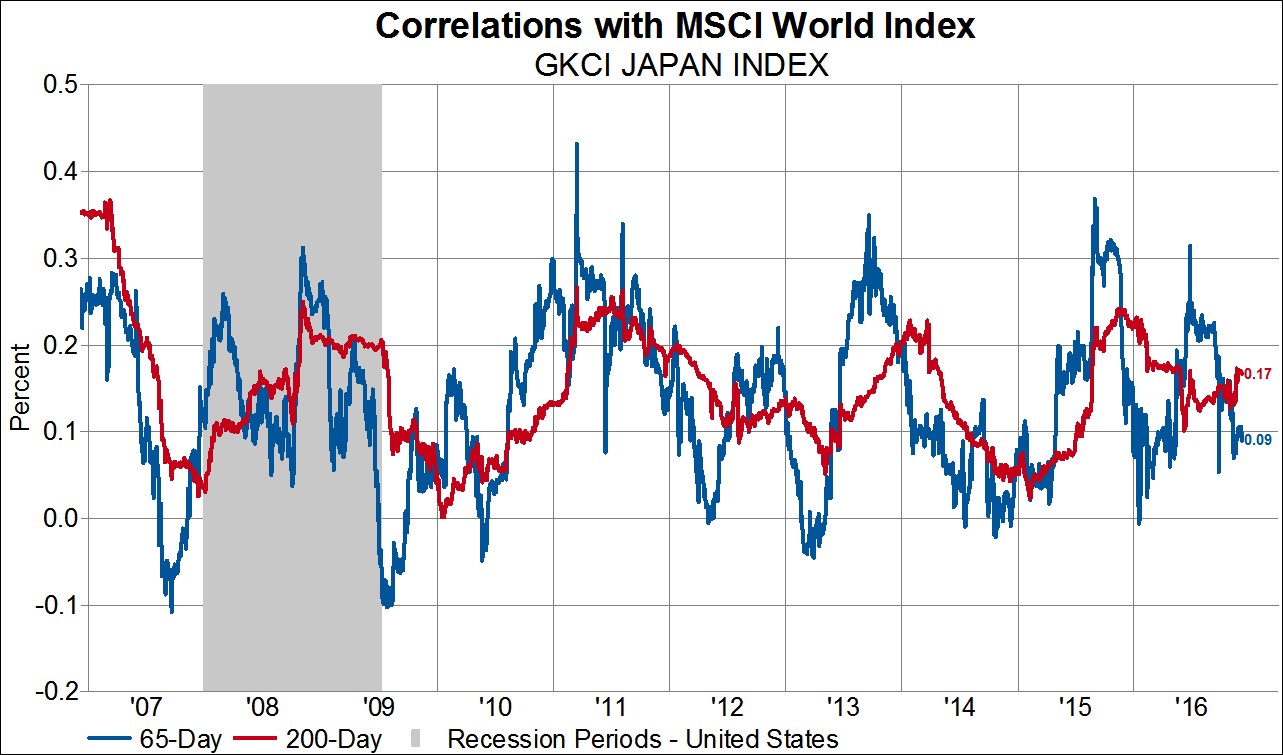

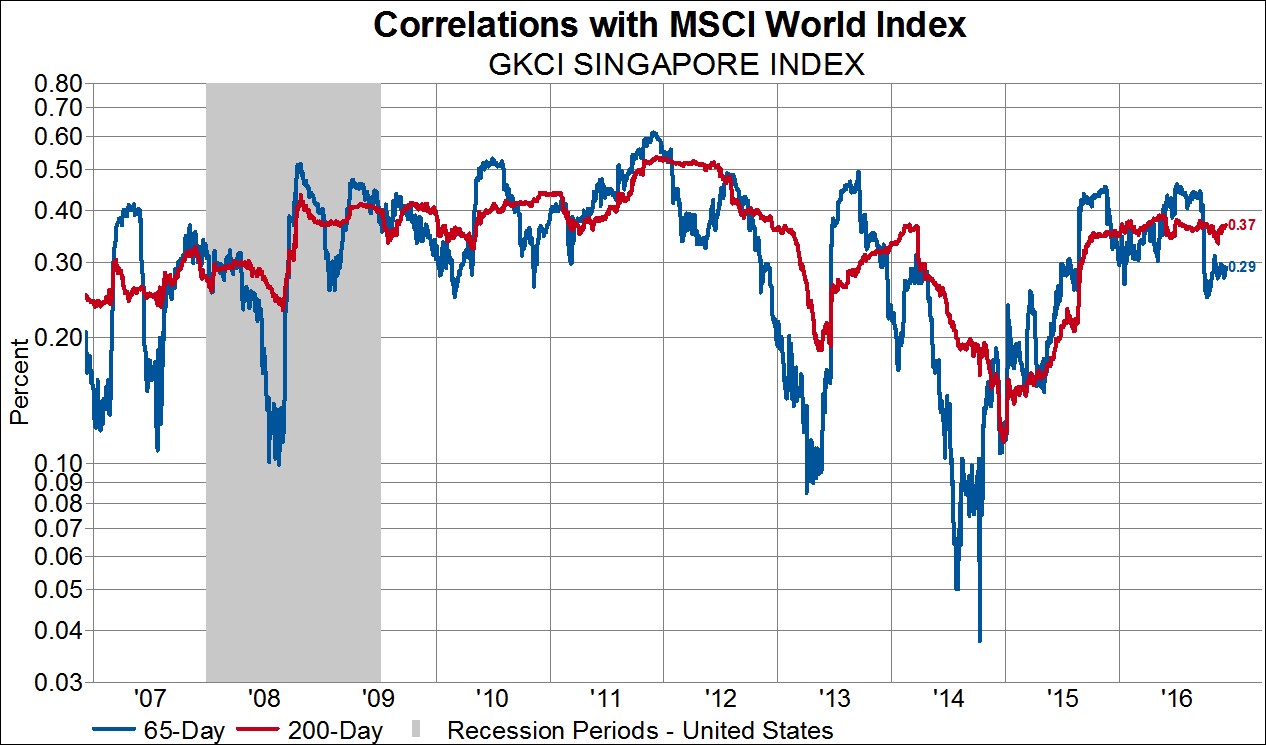

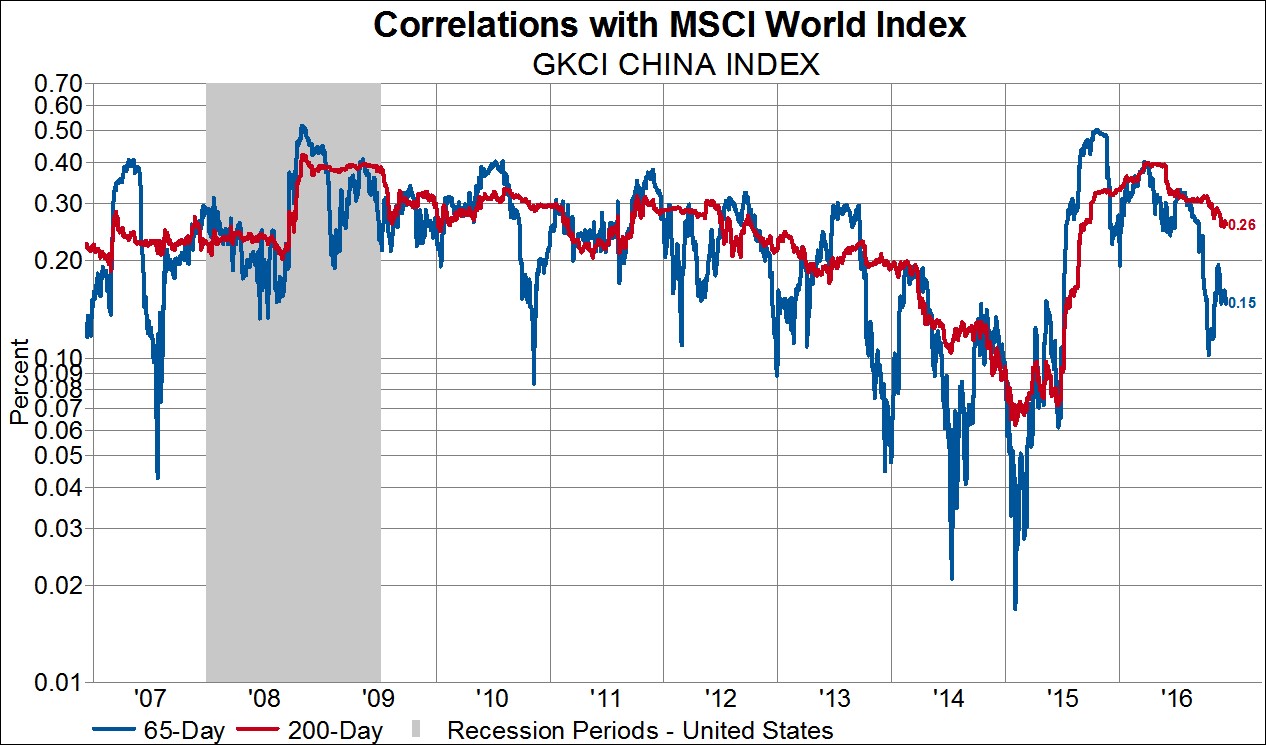

Finally, as usual, Asia is beating to its own (low correlation) drummer.

Copyright © Gavekal Capital