by LPL Research

Europe has been in the news this week, with Italy voting down the country’s constitutional referendum on Sunday, December 4, and the European Central Bank (ECB) announcing yesterday a surprise tapering by extending its quantitative easing (QE) policy from March 2017 until at least December 2017, while unexpectedly reducing the amount of the monthly bond purchases.

News is one thing; it is how the markets react to the news that matters more, and the technical picture is surprisingly looking a lot better in Europe lately. As Ryan Detrick, Senior Market Strategist, put it, “European markets have trailed the U.S. over the past decade, as a slowing economy, debt crises, and aging populations have hurt equity performance, but we are now seeing some technical signs things could finally be improving across the pond.”

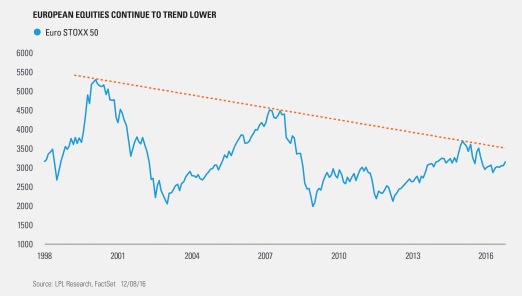

From a longer-term perspective, the EURO STOXX 50 (a basket of European blue chip equities) has traded lower for the past 16 years and, as you can see below, continues to have trouble with this long-term bearish trend line. Until it can clearly break above this trend line, an aggressive bullish stance on European equities is risky.

Now for the good news; we are seeing some signs of life for Europe from a technical viewpoint. The EURO STOXX 50 spiked higher after the Italian vote and is now above a two-year bearish trend line.

The German DAX, the largest and most influential stock market in Europe, has broken out to its highest level in a year. The French CAC 40 and Austrian ATX Index are both breaking out to new 2016 highs as well. Meanwhile, the big laggard in Europe all year has been Italy. Even after the “no” vote over the weekend, the FTSE MIB is back to flat on the year and at its highest level since early May. In fact, for the week (as of Thursday, December 8’s close) it was up 7.8%, which would be the best weekly gain in more than five years.

This doesn’t mean European stocks will finally start to outperform U.S. stocks, but it is a major step in the right direction.

*******

IMPORTANT DISCLOSURES

Past performance is no guarantee of future results. All indexes are unmanaged and cannot be invested into directly.

The opinions voiced in this material are for general information only and are not intended to provide or be construed as providing specific investment advice or recommendations for any individual security.

The economic forecasts set forth in the presentation may not develop as predicted.

Investing in stock includes numerous specific risks including: the fluctuation of dividend, loss of principal and potential illiquidity of the investment in a falling market.

Quantitative Easing (QE) refers to the Federal Reserve’s (Fed) current and/or past programs whereby the Fed purchases a set amount of Treasury and/or Mortgage-Backed securities each month from banks. This inserts more money in the economy (known as easing), which is intended to encourage economic growth.

The EURO STOXX 50 Index is a blue-chip index for the Eurozone, which covers 50 stocks from 12 Eurozone countries: Austria, Belgium, Finland, France, Germany, Greece, Ireland, Italy, Luxembourg, the Netherlands, Portugal, and Spain.

The CAC 40 is a capitalization-weighted index of the 40 largest French equities designed to measure the overall performance of the Paris Bourse, the French stock exchange.

The Deutscher Aktien Index (DAX) is a stock index that represents 30 of the largest and most liquid German companies that trade on the Frankfurt Exchange.

The Austrian Traded Index (ATX) is a stock index that represents 20 Austrian stocks; it is the leading index of the Vienna Stock Exchange.

This research material has been prepared by LPL Financial LLC.

To the extent you are receiving investment advice from a separately registered independent investment advisor, please note that LPL Financial LLC is not an affiliate of and makes no representation with respect to such entity.

Not FDIC/NCUA Insured | Not Bank/Credit Union Guaranteed | May Lose Value | Not Guaranteed by any Government Agency | Not a Bank/Credit Union Deposit

Securities and Advisory services offered through LPL Financial LLC, a Registered Investment Advisor Member FINRA/SIPC

Tracking # 1-562717 (Exp. 12/17)

Copyright © LPL Research