It has now been just over a month since Donald Trump surprised most with his President Elect victory and a week since OPEC confounded its doubters by agreeing to its first production cut in eight years. In this time, U.S. markets have hit new highs, and oil prices have rallied. Let’s dig a little deeper into two sectors that have exhibited strength through all of this, financials and energy. These two sectors, representing just over 20 percent of the S&P500 market cap, have accounted for the majority of the gains since one month ago.

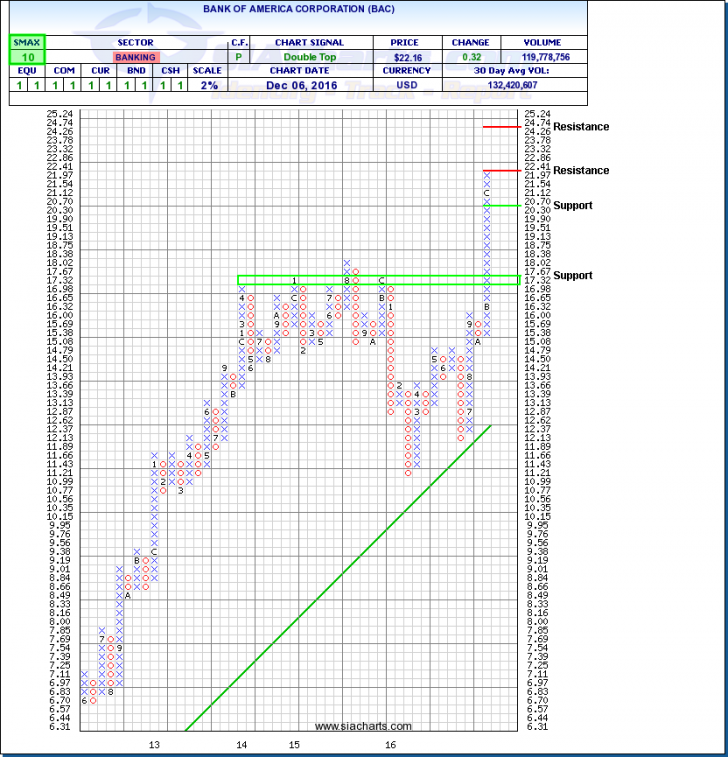

Bank of America (BAC)

Heading into the election there was no doubt that many aspects of Trump’s agenda were good for stocks and bad for bonds near term – tax cuts, deregulation, fiscal stimulus, etc. Financials were one of the few sectors that was undervalued before the election, and now, financials have accounted for approximately 64% of the gains in the market since the polls closed on Nov 8. No one knows how long this rally will last and how much further it can extend itself, but movement has been strong, and we can see this in names such as Bank of America.

BAC closed on November 8th at $17, and as of December 6th, closed at $22.16. That is a total return of approximately 30%, or about 1% a day. Looking at the chart, this move has broken some serious longer term resistance levels. Moving through $17-$18 we left behind a significant level of resistance dating back to 2013. This prior resistance has now turned into support between $17.04 and $17.39. Currently another important level of support will be found just above $20 at $20.30. Resistance first comes in at $22.41 and then again at $24.74. Residing in 3rd spot in the SIA S&P100 Index Report, and with a positive SMAX of 10, BAC is continuing to exhibit considerable strength across all asset classes.

Click on Image to Enlarge

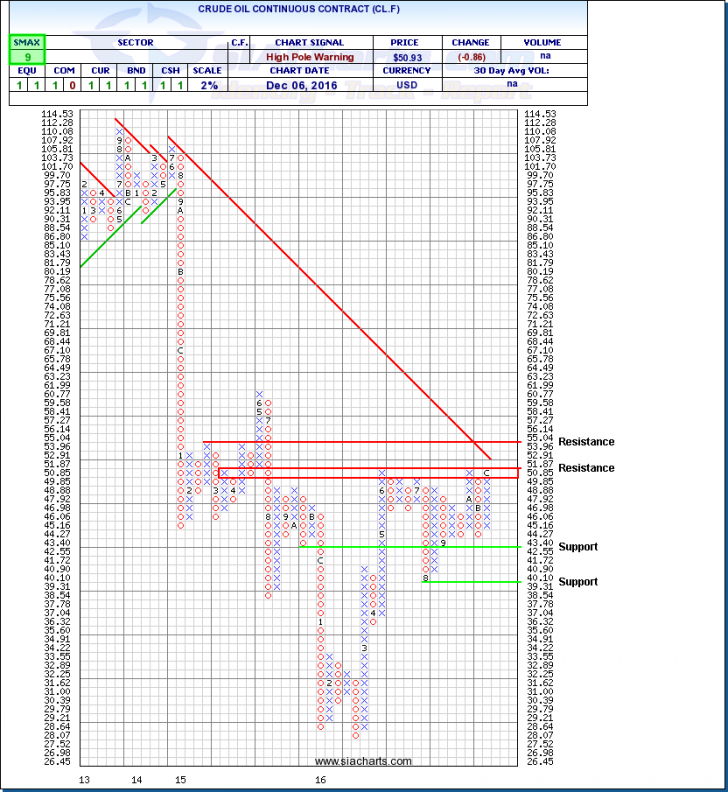

Crude Oil Continuous Contract (CL.F)

Turning to energy we have seen significant movement and strength coming not only from oil prices but the equities as well. With the news from OPEC that they have agreed to their first production cut in 8 years, the impact was immediate. Benchmark oil prices gained as much as 10 percent in New York and the shares of energy companies around the globe jumped. For our purpose, we are going to dig a little deeper into the commodity and look at the Crude Oil Continuous Contract (CL.F).

Although considerable gains have been made, we see resistance levels have held strong between $50.85 and $51.87. The next major level of resistance coming in at $55.04. Although prices have moved higher in a relatively short period, it would be positive to see CL.F push through resistance at $55 and break the extended downtrend we can see started back in 2014. If weakness is to present itself again, watch for support at $42.55 and between $39-$40. With an SMAX of 9, CL.F is exhibiting near term strength.

Click on Image to Enlarge

SIACharts.com specifically represents that it does not give investment advice or advocate the purchase or sale of any security or investment. None of the information contained in this website or document constitutes an offer to sell or the solicitation of an offer to buy any security or other investment or an offer to provide investment services of any kind. Neither SIACharts.com (FundCharts Inc.) nor its third party content providers shall be liable for any errors, inaccuracies or delays in content, or for any actions taken in reliance thereon.

For a more in-depth analysis on the relative strength of the equity markets, bonds, commodities, currencies, etc. or for more information on SIACharts.com, you can contact our customer support at 1-877-668-1332 or at siateam@siacharts.com.

Copyright © SIACharts.com