The S&P 500 just made an all-time high for the 11th time this year, and the 1134th time since 1928. Today, the Dow Jones Industrial Average crossed 19,000 for the first time ever. The natural inclination is that now might not be the best time to put new money to work. The data doesn’t support this, at least not in the short term.

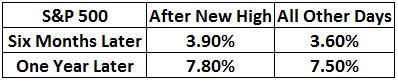

The table below shows that average returns six months and one year following an all-time high has been stronger compared with all other days.

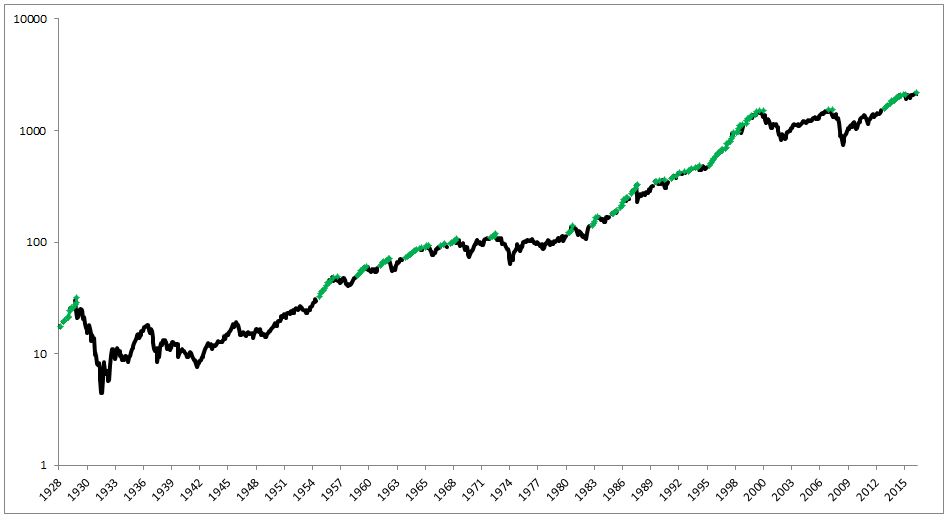

Taking a longer-term view, 18% of all months have closed at a new all-time high. You can see them represented below by the green dots. New highs are nothing to fear, in fact they are the cornerstone of every great bull market.

Taking a longer-term view, 18% of all months have closed at a new all-time high. You can see them represented below by the green dots. New highs are nothing to fear, in fact they are the cornerstone of every great bull market.

The people that use all-time highs to scare you are the same people who told you that the 27% selloff in the Russell 2000 earlier this year was the canary in the coalmine. Small-cap stocks are now at all-time highs and 40% off their February lows. The main takeaway is this; it’s true that every nasty bear market we’ve ever had followed an all-time high, but all time highs on their own is not a harbinger of bad things to come.

The people that use all-time highs to scare you are the same people who told you that the 27% selloff in the Russell 2000 earlier this year was the canary in the coalmine. Small-cap stocks are now at all-time highs and 40% off their February lows. The main takeaway is this; it’s true that every nasty bear market we’ve ever had followed an all-time high, but all time highs on their own is not a harbinger of bad things to come.

Copyright © The Irrelevant Investor