by LPL Research

After a painful week for bondholders, with the U.S. 10-year bond down 20%, and the 30-year bond down 14%, investors are wondering if yields will stabilize or continue higher. The consensus view says that increased policy uncertainty and expectations for higher deficit spending by the incoming Trump administration will be inflationary and lead to higher rates. While we know this has played a major role in the yield run-up this week, it is also important to remember that lower global yields stemming from slow overseas growth, coupled with the negative interest rate programs (NIRP) from central banks in Japan and Europe, are likely to continue to put downward pressure on U.S. yields moving forward.

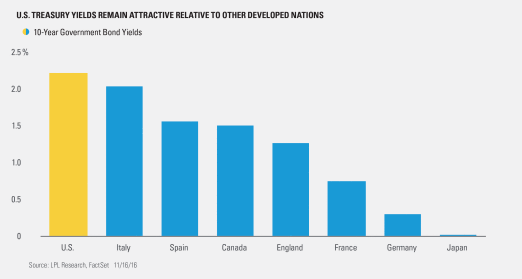

NIRPs in Europe and Japan were intended to provide banks with the incentive to make loans, but they have also greatly depressed yields overseas, which can easily be seen by comparing the Spanish 10-year bond with the U.S. 10-year. Spain’s credit rating is Baa2 according to Moody’s, well below the U.S. bond’s Aaa, the highest credit quality. Investors, however, can buy the higher quality, lower risk U.S. bond at a 2.22% yield, versus 1.54% for the Spanish bond. The normal assumption is that lower quality bonds must trade at a higher yield to compensate investors for the greater risk.

German 10-year bonds are yielding just 0.29%, France’s are yielding 0.74% and Italy’s stand at 2.04%. With the exception of Germany, these bonds are lower quality than U.S. bonds. We are not arguing that the 2.22% U.S. yield can’t go higher, quite the contrary, but that global bond yields are too low and should eventually increase. However, this may take some time as global central banks continue to provide liquidity over the near term, as the European Central Bank (ECB) isn’t scheduled to reduce its quantitative easing program until March 2017.

The total amount of negative yielding debt worldwide peaked in June at about $12.2 trillion, but has fallen to $8.7 trillion following the U.S. election (according to Bloomberg data), a large decline but still enough to put downward pressure on global yields. As we have recently seen, it’s possible for U.S. yields to move higher, but the still large amount of negative yielding debt worldwide may continue to keep U.S. yields lower than they would otherwise be in the near term.

IMPORTANT DISCLOSURES

Past performance is no guarantee of future results

The economic forecasts set forth in the presentation may not develop as predicted.

The opinions voiced in this material are for general information only and are not intended to provide or be construed as providing specific investment advice or recommendations for any individual security.

Stock investing involves risk including loss of principal.

Bonds are subject to market and interest rate risk if sold prior to maturity. Bond and bond mutual fund values and yields will decline as interest rates rise and bonds are subject to availability and change in price. Government bonds and Treasury bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate. Investing in foreign and emerging markets debt securities involves special additional risks. These risks include, but are not limited to, currency risk, geopolitical and regulatory risk, and risk associated with varying settlement standards.

Because of its narrow focus, specialty sector investing will be subject to greater volatility than investing more broadly across many sectors and companies.

An independent, unaffiliated research company that rates fixed income securities. Moody’s assigns ratings on the basis of risk and the borrower’s ability to make interest payments. Credit ratings are published rankings based on detailed financial analyses by a credit bureau specifically as it relates the bond issue’s ability to meet debt obligations. The highest rating is AAA, and the lowest is D. Securities with credit ratings of BBB and above are considered investment grade.

This research material has been prepared by LPL Financial LLC.

To the extent you are receiving investment advice from a separately registered independent investment advisor, please note that LPL Financial LLC is not an affiliate of and makes no representation with respect to such entity.

Not FDIC/NCUA Insured | Not Bank/Credit Union Guaranteed | May Lose Value | Not Guaranteed by any Government Agency | Not a Bank/Credit Union Deposit

Securities and Advisory services offered through LPL Financial LLC, a Registered Investment Advisor Member FINRA/SIPC

Tracking #1-556563 (Exp. 011/17)

Copyright © LPL Research