by Warren Lovely and Krishen Rangasamy, National Bank Financial Economic Analysis

HOT CHARTS

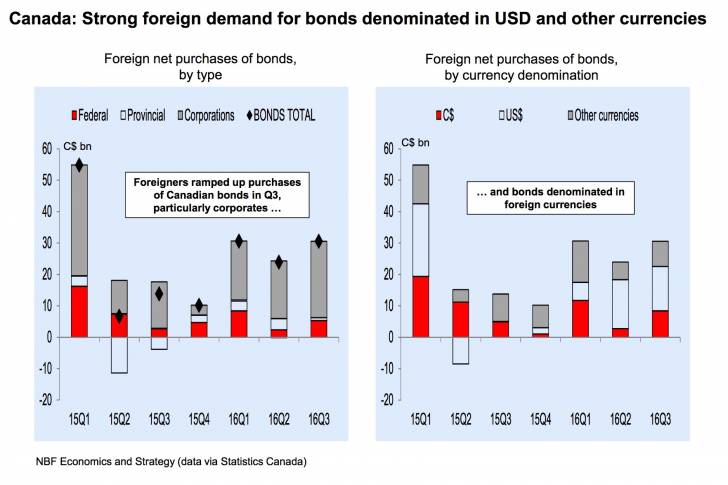

Foreign appetite for Canadian assets is not letting up. Latest data from Statistics Canada showed foreign investors increasing their holdings of Canadian securities by C$33.6 bn in the third quarter, with net buying of bonds (+C$30.6 bn), equities/investment funds (+C$10.2 bn) dwarfing divestment from money market instruments (-C$7.1 bn).

Bond net inflows last quarter were due to increases for corporates (+C$24.3 bn, of which C$7.6 bn were in government enterprises), federal government bonds (+C$5.3 bn), provis (+C$949 million) and munis (+C$10 million). Despite those strong inflows, the Canadian dollar depreciated in Q3. The positive impact of those flows on the loonie was blunted by the fact that most of the bonds purchased were not denominated in C$’s.

As today’s Hot Charts show, for the fifth consecutive quarter, the majority of bonds purchased by foreigners were denominated in foreign currencies, very much capturing the steady diet of Canadian corporate paper that was issued south of the border and in Europe.

Read/Download the complete report below:

Hot Charts 17nov2016 by dpbasic on Scribd

Copyright © National Bank Economic Analysis