Becoming the Trusted Advisor

by Commonwealth Financial Network

In our fast-paced, ever-changing industry, we know you are working hard. You're striving to keep up with new products, software, procedures, and a ceaseless flow of information, while at the same time overseeing the day-to-day operations of your practice. But there's one aspect that remains a timeless aspiration for many advisors: becoming the trusted advisor.

So, what does this mean, how do you get there, and what are the potential benefits?

Merriam-Webster defines trust as "assured reliance on the character, ability, strength, or truth of someone or something." But the term trusted advisor has a relatively loose definition in our industry. Many (not surprisingly) boast that they are trusted advisors to their clients. But getting to this level is no small task. To properly define it, we need to take a closer look at where the client relationship begins.

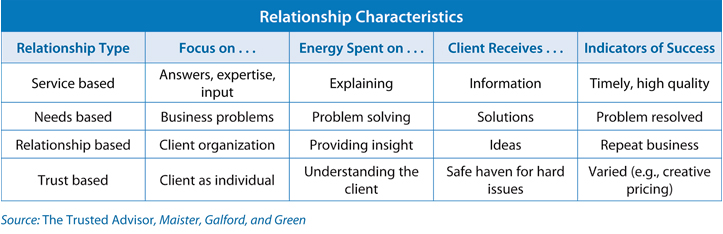

In The Trusted Advisor, David H. Maister, Charles H. Green, and Robert M. Galford discuss four different types of client relationships:

Type 1. At the beginning of a relationship, some clients may view you as a product vendor or as someone who performs one-off tasks requiring a certain technical skill. This is the stage at which most advisors begin their careers, and it's the easiest type of relationship to master. More important, however, it's where you can introduce and then build upon your expertise.

Type 2. At this level, your clients realize that you possess capabilities beyond the technical skills related to the original task you were hired to perform. You can focus on solving more general financial problems using few products and services. In turn, your clients can start to view you as a reliable resource and problem solver for more in-depth financial issues.

Type 3. Here, you're looked upon in terms of your ability to put issues into context and to provide perspective. You offer advice and identify client issues as part of an organizational process. At this stage, you can more easily transition to the highest level within the relationship—that of a trusted advisor.

Type 4. Once you've reached the level of trusted advisor, virtually all issues—emotional or rational, personal or professional—are on the table for discussion and exploration. You will be the person the client turns to when issues first arise—times of great accomplishments, triumphs, defeats, and crises. This level is often the most time consuming but also the most rewarding.

The chart below shows how your relationship characteristics can be based on a broad range of business and personal issues. By focusing on these characteristics, you can help further define your role as you evolve from the service-based advisor to trusted advisor.

To state the obvious, you benefit through repeat business, as well as new referrals and introductions to your clients' other professional advisors. When you're the trusted advisor, you don't need to "sell" your products or your expertise. Instead, you can employ the most-prized skills you have—your ability to listen, reason, imagine, and proactively solve client issues. Here are just a few scenarios where your role of trusted advisor can reap benefits, for both you and your clients.

Protecting senior clients. Your senior clients are a prime target for financial abuse, and as their trusted advisor, you can be their first line of defense. Keep in mind that within 13 years, 75 million people will be at least 65 years old, and this likely includes many of your baby-boomer clients. The concentration of wealth in this group is tremendous, and by establishing a trusting relationship now, you will be well positioned to handle this wealth for future generations.

Keeping the human connection. We’ve all heard about the rise of the robo-advisor, and there’s no doubt they are a cost-effective technology solution. But as a trusted advisor, you offer value to your clients in ways that robos simply cannot. This includes, although certainly isn’t limited to, using your experience and intuition when risk profiling, managing your clients’ emotions in turbulent market cycles, and providing holistic financial planning across the financial planning spectrum.

Developing your niche. Did you know that up to 70 percent of top financial advisors—defined as those earning at least $1 million annually—have a niche? Developing a niche is a process, of course. But you may find that, over time, your reputation as a trusted advisor will not only help strengthen your credibility but also help establish you as an expert in your chosen area of specialization.

Growing your business organically. For many advisors, building their business means the prospect of acquiring another practice. But the importance of organic growth should not be overlooked. One of the best ways to grow organically, while maintaining the continued health of your practice, is to keep existing clients satisfied by being their number-one trusted resource. With happy and engaged clients, you will be on the pathway to increased assets and more referral opportunities.

First, take a look at where you spend your time now and where you'd like to spend it in the future. Many business models are built around speed, efficiencies, and a one-size-fits-all approach, which means the individual attention required to build trust is often compromised. As you assess your client relationships, ask yourself the following questions to determine where you spend the greatest amount of time and effort.

- Are you focusing on quantity of clients rather than quality? If so, you might want to consider doing just the opposite.

- Have you created a business plan? Writing down your goals is a valuable step toward achieving them.

- Does your strength lie in building portfolios or forming strong client relationships? To find more time to focus on relationships, consider outsourcing your investment management.

- Are you spending valuable time analyzing the cost of everything instead of evaluating the value those services offer your clients and your practice? Remember, cost isn't the only factor affecting your decision-making process.

How do you envision your practice? If you'd like to focus primarily on relationships and trust, it will take time, effort, and a whole lot of wisdom. But as you grow your business and seek those quality relationships, positioning yourself as a trusted advisor is a clear path to success now and in the future.

Do you consider yourself to be a trusted advisor? Has it benefited your client relationships?

Editor's Note: This post was originally published in February 2015, but we've updated it to bring you more relevant and timely information.

Commonwealth Financial Network is the nation’s largest privately held independent broker/dealer-RIA. This post originally appeared on Commonwealth Independent Advisor, the firm’s corporate blog.

Copyright © Commonwealth Financial Network