by Samuel Rines, Managing Director, Corbu LLC & Jeremy Schwartz, CFA, Global Chief Investment Officer, WisdomTree

This article is relevant to financial professionals who are considering offering model portfolios to their clients. If you are an individual investor interested in WisdomTree ETF Model Portfolios, please inquire with your financial professional. Not all financial professionals have access to these Model Portfolios.

Signposts & Frameworks > Outlooks

Bottom Line: I see no usefulness in making point estimate guesses about the outcome of the various risk markets for the upcoming year. This note puts together signposts for the transition of the major themes dominating markets.

Companies have pushed price increases onto consumers and shown a willingness to sacrifice lower volumes (theme: price over volume or POV). Now, I see companies pushing prices and focusing on cutting costs to increase margins (a theme I call PAM). We call the resulting monetary policy volatility that comes from various uncertainties on this transition MonPolVol.

Can the transition from price over volume to price AND margin overpower the FOMC’s institutionalization of MonPolVol? Building a framework to be able to consistently question and iterate is worthwhile for the coming 3, 6 and 12 months.

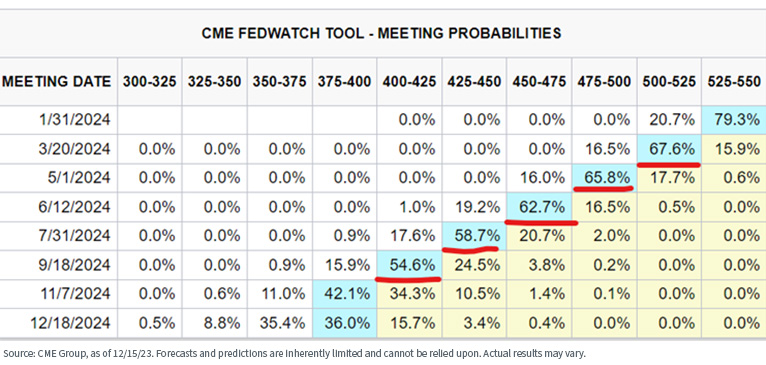

After the December FOMC announcement and Powell’s press conference, the doves are flying. Markets began pricing a straight-line series of cuts to the perceived level of neutral.

And—while it is both enjoyable and tempting to judge the FOMC on its level of incorrectness over the years—market pricing has not exactly been accurate, either. But it sets the initial condition. Post-December FOMC, a cut is currently priced for every meeting between March and November. And it is a perfect setup for a year of MonPolVol.

The relevant signposts –

- Do the incoming inflation readings sufficiently corroborate the current market expectations?

- Does the labor market matter?

- Is the FOMC comfortable with cutting in the face of 2.5% to 3% inflation prints?

And this is where it becomes difficult to disentangle the themes from one another. After all, price over volume contributed to the inflation readings. As the transition to price AND margin gathers steam, there is a disinflationary impulse—to an extent.

That plays into the framework through a few channels –

- POV held margins steady during the 2022–2023 timeframe.

- Supply chain/input cost normalization is beginning to contribute to margins.

- Some of the increase in gross margin dollars will be used to claw back some of the lost volumes.

- That requires “brand investment” and “advertising.”

- But much of it will flow to the bottom line.

There is disinflation being guided through the system (at least by the major brands) as the price elasticities have been tested and found. That is positive for the disinflation narrative and positive for corporate earnings.

And—to be clear—none of that is reliant on rate cuts or deterred by hikes. The “return to the algo” of 2% pricing and moderate volume gains from the consumer packaged goods group is not going to be dramatically altered by 25 basis points or 50 bps or 100 bps of cuts by the FOMC. It is what it is.

This is partly why the transition to PAM is an attractive theme for 2024. It is not reliant on a less restrictive policy to work. But it would be enhanced by it. Less restrictive policy = less gross margin spent on brand investment to regain volumes. Restrictive policy = status quo.

[Which—counterintuitively—indicates tighter policy being potentially better for the large tech advertising platforms like Meta/Alphabet.]But that does not diminish the problem of MonPolVol. Initially, it was an issue of every new data point in 2022 and 1H 23 moving the terminal rate higher or lower by 25bps. MonPolVol may be even more sinister in 2024 since it has more victims to claim. Given current pricing, the risk is asymmetric (unlike the FOMC’s supposed framework).

- Hotter-than-expected CPI report? Push out the cut cycle and take out a 2024 cut.

- Softer-than-expected CPI report? No change to market pricing.

- And a similar dynamic could be applied to employment data (but with less influence on pricing).

- Repeat after every new data point.

MonPolVol is not to be trifled with in 2024. But it should not be feared either. There will be plenty of opportunities to exploit it as the data pushes the pricing around. But do not ignore PAM. PAM will happily ignore MonPolVol.

And this is directly related to the CORBU x WisdomTree Model Portfolio positioning. As PAM and MonPolVol come to dominate the equity investment narrative, consistency and quality of earnings and capital returns to shareholders will become increasingly valuable. This applies to U.S. businesses as well as their international counterparts. With the elevated volatility of yields and FOMC policy, maintaining a modest duration portfolio should help reduce the exposure to policy and market whipsaws.

Copyright © WisdomTree