by Bob Simpson, Synchronicity Performance Consultants

In Part 1, we took a simple factor (10-year total return) and identified the top 100 companies. In Part 2, we looked at a broader range of factors, such as 3, 5 and 10-year EPS growth, return on equity and profit margin.

In Part 3, we demonstrated how to select the top 100 companies in each of these categories and added dividend growth as a new factor. To build a list of qualifiers for Canada's Top 100 Companies, we simply took the top 100 from each factor and added them to a master list. Our qualifier's list contains 246 companies and is a great place to start.

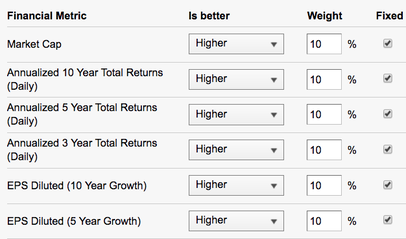

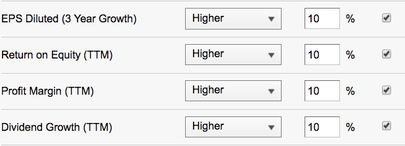

Next, we need to find a way to sort this list on a combination of factors. We do this by building a Scoring Model. For demonstration purposes, we took the factors used to identify our qualifiers. The graphic below shows the scoring model that we developed. It is relatively simple and follows the principle of being approximately correct instead of precisely wrong. Different factors work better during specific periods of an economic cycle. In this case, we equal weighted the factors so we don't put all our eggs in one basket.

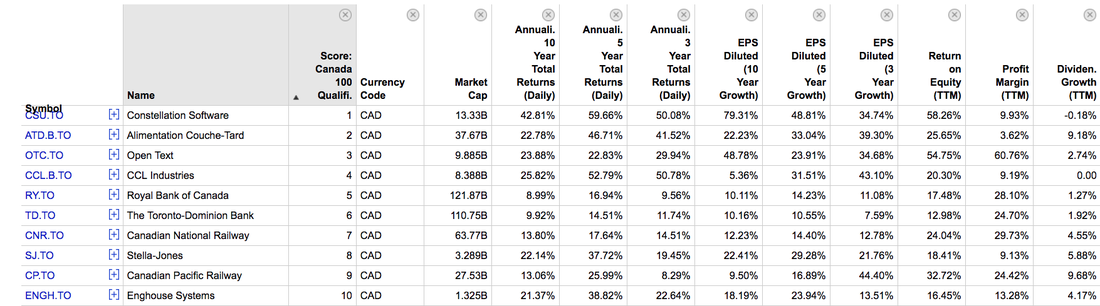

Based on our scoring model, the top 10 stocks on the list are:

In our next session, we are going to use a proprietary YCharts fundamental score to eliminate companies from the list that score poorly to identify Canada's Top 100 Companies.

In our next session, we are going to use a proprietary YCharts fundamental score to eliminate companies from the list that score poorly to identify Canada's Top 100 Companies.

To view this week's Huddle, please see the video below. Please note: We are changing the name of The Huddle to "Inside The Numbers" next week. If you would like to participate in live "Inside The Numbers" sessions or have us set up a free 7-day trial to YCharts, e-mail bob.simpson@synchronicity.ca. There is no cost or obligation.

This article originally appeared at the Synchronicity Performance Consultants' Blog