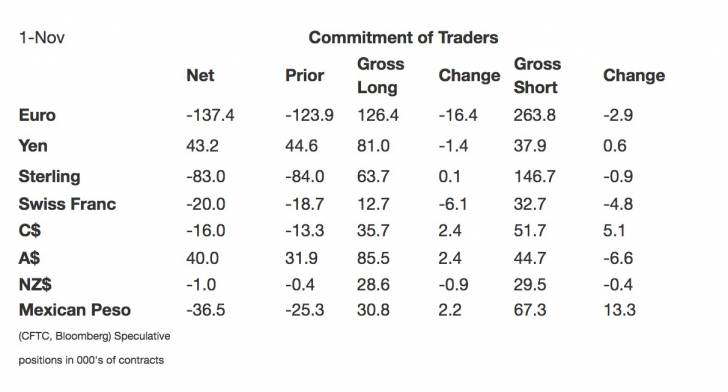

Speculators Did Little in the Futures Market but Cut Euro Longs and Build Peso Shorts

In a reporting period that covered a narrowing of the US Presidential polls and the run-up to FOMC meeting and US employment data, speculators made only small adjustments to their positions in the currency futures. We track 16 gross positions of eight currency futures. In the most recent reporting weeks, 10 of these 16 gross positions were changed by less than 3k contracts.

There were two notable exceptions to this generalization. First, speculators had been building a large gross long euro position. It had approached record levels, but in the reporting week ending November 1, speculators liquidated 16.4k contracts, snapped a six-week accumulation period. The gross long position stands at 126.4k contracts.

The speculative euro shorts had increased for four consecutive reporting weeks. This streak was also snapped in the most recent reporting period. The bears covered 2.9k contracts, leaving a gross short position of 263.8k contracts.

The conventional focus on the net position is misleading. It shows that the net short position increased to 1374k from 123.9k contracts. This is the fifth week that the net short position has increased. We think that the takeaway from the most recent period is that the gross long and short accumulation streaks were snapped.

The other exception to our generalization of small adjustments in speculative positioning was the Mexican peso. Speculators sold pesos into the bounce that had pushed the dollar toward MXN18.50. The bears increased the gross short position by 13.3k contracts to 67.3k. They snapped a four-week period in which gross shorts were covered. The bulls added 2.2k contracts, which raised the gross long position to 30.8k contracts.

Speculators in the 10-year Treasury note futures and the light sweet crude oil futures were more decisive. In particular, the bears took the whip hand.

In the US note futures, the bears added 51.5k contracts to their gross short position, lifting it to 608.3k contracts. The bulls liquidated 58.1k contracts, leaving them with 573.2k contracts. These gross adjustments produced a 109k contract swing in the net position, which is now short (35.1k contracts) for the first time in five months.

The adjustment in the oil future was similar but on a smaller scale, and the net speculative position remains long (354.4k contracts). The 49.2k contract reduction was a function of longs liquidating and shorts increasing. The bulls cut 28.7k contracts, leaving the gross long position of 543.1k contracts. The bears added 20.5k contracts, increasing the gross short position to 188.7k contracts.

This post was originally published by Marc Chandler at his blog, marctomarket.com

Copyright © Marc Chandler