by Judy Baker, Argo Gold

In the first article on “What happened to the gold price? And why did gold bullion make a twenty percent gain in 2016?” I briefly mentioned that apparently “peak globalization” has passed and we are moving back into a world of protectionism. In the commodity world this is noted by all the players now seemingly trying to keep the supply of oil and mineral commodities in the gates.

For the world as a whole, globalization has been beneficial. World trade has resulted in the cost of goods decreasing and the purchasing power of the poorest people in the world increasing by the biggest percentage. Third world economies have been transformed by manufacturing for the world which in turn has led to an increase demand for worldwide goods from these economies which eventually benefits everyone.

Globalization includes migration whereby economies have been less impacted by their own demographics as a result of migration. In the high rate of change world we live in, the world has become “connected” and the components of the service economy have become globalized further contributing to lower costs and more benefits for everyone.

You can’t talk about globalization without addressing significant items that have not been properly addressed including job loss and re-training being the biggest and the impact of migration on government-funded services. Hence, the world is seeing the huge rise of protectionism in two big important countries and economies: the United States and Britain.

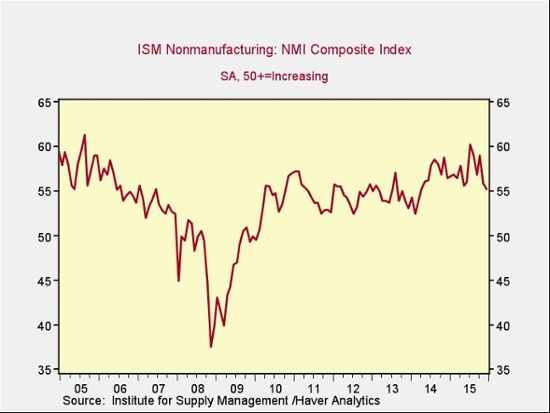

Globalization has resulted in the world becoming a source of commodities and subsequently accentuating the commodity cycle. Again, commodity prices have continued to be reasonable despite significant increased demand from a developing world economy. The negative impact has been too much supply was brought online and when the big growth economy – China with its second largest economy in the world – slowed down; the economic viability of whole commodity industry was pushed to the brink.

Although there have been loud calls to keep the supply of oil and mineral commodities in the gates, it is taking years to sort itself out. Invested capital, company debt service, closure costs and economic impact on communities and countries significantly complicate sorting out the oversupply in mineral commodities.

Fortunately, despite the sluggish world economic growth, the largest economy in the world – the US - has continued to be a bright spot. Low interest rates continue to minimize the pain of debt across the board. The richest economies in the world are running their printing presses fulltime to stimulate their economies. And there are glimmers of evidence that commodity prices may be not only past the bottom but very slowly on the rise again.

Did the world spend its way through the economic malaise – with low cost debt and increased money supply – to come out the other side?

Whatever the case, we know the value of a dollar isn’t what it used to be. Hence, the renewed investment interest in gold and silver.

Judy Baker

Argo Gold

Although the information in this commentary has been obtained from sources believed to be reliable, Argo Gold does not guarantee its accuracy and such information may be incomplete or condensed. The opinions expressed are subject to change without notice. Argo Gold will not be liable for any errors or omissions in this information nor for the availability of this information. All content provided in this article is for informational purposes only and should not be used to make buy or sell decisions for any type of precious metals.

Copyright © Argo Gold