by LPL Research

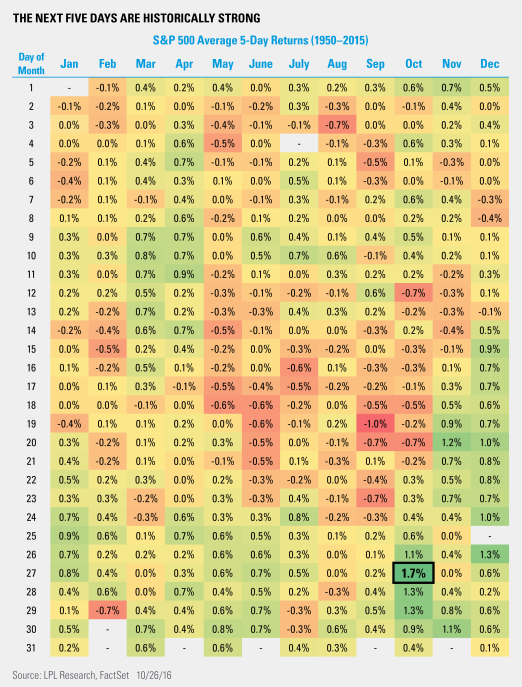

Did you know the strongest five days of the year are set to kick off at the end of today? That’s right, buying the close on October 27 and holding the next five full trading days has produced an average return of +1.7%, better than any other five day combination – even stronger than the well-known Santa Claus rally that takes place right after Christmas.

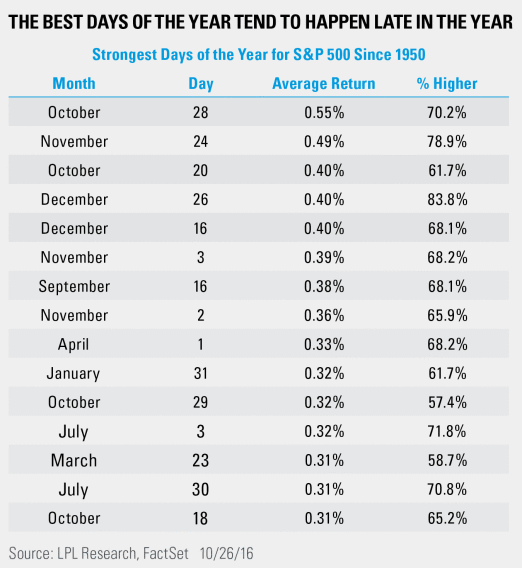

Why is this? Well, the second half of October has some of the single best performing days as well, which helps. In fact, tomorrow (October 28) sports the best average daily return out of any day of the year back to 1950. According to Ryan Detrick, Senior Market Strategist, “Why is late October historically strong? It is the end of the worst six months of the year and we all know that October has also seen some big sell-offs, but nice recoveries late in the month. Specifically, why is October 28 such a strong day? It is probably random, unless you consider the fact this is also my birthday – then maybe we have the real reason.”

Bigger picture, equities have been caught in one of their tightest ranges ever. With the historically best six months of the year nearly upon us, could seasonality be what is needed to break out of this range?

****

IMPORTANT DISCLOSURES

Past performance is no guarantee of future results.

The economic forecasts set forth in the presentation may not develop as predicted.

The opinions voiced in this material are for general information only and are not intended to provide or be construed as providing specific investment advice or recommendations for any individual security.

Investing in stock includes numerous specific risks including: the fluctuation of dividend, loss of principal and potential illiquidity of the investment in a falling market.

The S&P 500 Index is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

Indices are unmanaged index and cannot be invested into directly. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment.

This research material has been prepared by LPL Financial LLC.

To the extent you are receiving investment advice from a separately registered independent investment advisor, please note that LPL Financial LLC is not an affiliate of and makes no representation with respect to such entity.

Not FDIC/NCUA Insured | Not Bank/Credit Union Guaranteed | May Lose Value | Not Guaranteed by any Government Agency | Not a Bank/Credit Union Deposit

Securities and Advisory services offered through LPL Financial LLC, a Registered Investment Advisor Member FINRA/SIPC

Tracking # 1-549802 (Exp. 10/17)

Copyright © LPL Research