by Bob Simpson, Synchronicity Performance Consultants

Building a strong investment portfolio is similar to a general manager of a National Hockey League team building a Stanley Cup champion.

In the 2006 draft, the Chicago Black Hawks chose Jonathan Toews third overall and followed that by choosing Patrick Kane the following year with the first overall pick. It took a couple of years for their good draft selections to bring Chicago the Stanley Cup but with Toews and Kane, they won the Cup in the 2009 – 2010, 2012 – 2013 and 2014 – 2015 seasons.

Drafting has become much more complex and quantitative since a young Bobby Orr was first spotted by a scout for the Bruins in Parry Sound, ON. Today, many teams compare every player available, based on analysis through a broad range of lenses to determine which are the best players available in each year’s draft. The goal is to not only use your first round pick most effectively but also to find hidden gems in the fourth or fifth round.

When Bobby Orr was selected, it was based on reports from scouts who spent every evening sipping coffee in arenas that could freeze you to the bone across Canada.

Investment management is following a similar path to building great hockey teams. There is a tremendous amount of information available to advisors to find potential all-stars for your investment portfolios.

One of the first things that a hockey general manager looks for when he is building his team is players who can light up a scoreboard. The equivalent to a highly skilled goal and assist leader is total return to investors. If I were to ask you to name the larger cap stocks (greater than $500 million market cap) with the highest total return to shareholders over the past 10-years, listed on the Toronto Stock Exchange, you might have a difficult time. You might name Royal Bank, Canada’s biggest company and you would have named the company with an annualized return of 10.11%, sitting in the number 62 position.

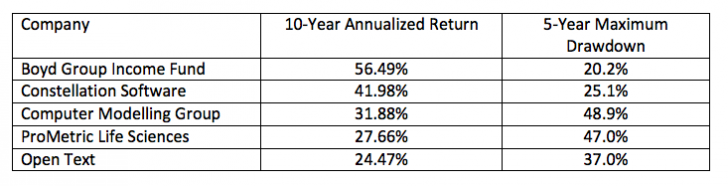

The top 5 companies are:

Download YCharts Reports

Boyd Group Charts Report

Constellation Charts Report

Computer Modelling Group Charts Report

ProMetric Life Sciences Charts Report

Open Text Charts Report

It is interesting that three of the five companies are listed in “Software – Application”. You could also add The Descartes Systems Group to that list, in the number 11 spot on the 10-year chart. I have attached YCharts multi-page reports for your convenience, which you can download by clicking on the company name above.

When was the right time to buy these companies? Like the old saying “When you had the money.”

The problem for most advisors is living with the fear that what goes up must come down and as you can see by the table above these companies have experienced drawdowns ranging from 20.2% to 48.9%. There were 116 companies on the Toronto Stock Exchange with market caps greater than $500 million that beat the TSX 60 over the past 10-years and the average 5-year drawdown was 46.2%, so most of this list not only beat the benchmark but also had lower drawdowns.

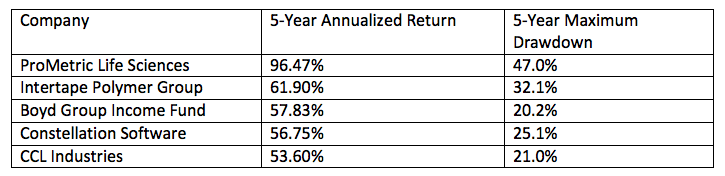

Maybe 10-years is too long for you so let’s look at the top 5-year scoring leaders:

Not much change. By the way, we left off Cynapsus Therapeutics because of a recent takeover/merger.

As a good GM, you are going to dig deeper than simply looking at shareholder performance. You may choose Constellation Software because it has the best 10-year EPS growth or Constellation or Open Text because they have the best ROE. You should also look at other factors such as ability to manage debt because you want your players to be strong in the defensive end of the rink.

We take a number of factors into consideration when building our “sandbox” of great companies. Unfortunately, Canada is a less developed country than our neighbor to the south and we have to be much more relaxed in our factors.

Our goal is to help our advisor clients is to build growth portfolios with Patrick Kane and Jonathan Toews-like companies in growth portfolio or more mature dividend paying companies in our income portfolios.

By the way, you don’t see too many cyclicals on the list of beating the TSX 60 over the past 10-years but the odd stock, like Torex Gold or Fortuna Silver, have made the top 50. Cyclicals may fill a spot for shorter-term timeframes but tend to trade sideways with volatility and may not make it into a growth portfolio for longer-term general managers.

When you build a portfolio, ask yourself the question “Would I rather have Jonathan Toews or Patrick Kane as the nucleus of your team or somebody learning to play in the AHL?” Too many advisors choose stocks that are either highly volatile, like the cyclicals and try to play the swings, buy stocks that are down thinking that there must be a profit opportunity on the horizon and avoid the proven winners because of the fear that what goes up must come down. That’s like saying that you should avoid Toews or Kane in the draft because they are likely to revert to becoming average.

For more details, watch today's Huddle recording below:

This article originally appeared at the Synchronicity Performance Consultants' Blog

Copyright © Synchronicity Performance Consultants