by Nathan Faber, Newfound Research

- The benefit of including commodities in individual investor portfolios is often up for debate, focusing on aspects such as expected returns, volatility, access, and diversification.

- While we think that commodities can add value if the risks are understood, many passive ETFs that offer commodity exposure rely on indices that are significantly exposed to oil prices and energy, in general.

- One possible solution is to move away from standard passive indices that attempt to market-cap weight commodities and instead focus on balancing risk.

- Using a risk parity approach, we show how the dependence on energy commodities can systematically be reduced so that the full diversifying potential of commodities can be employed within a portfolio.

Whether investors should allocate to commodities is often a topic of debate. A few years back, the Wall Street Journal profiled 8 investment professionals on the issue.

The opinions were mixed.

Common arguments for including commodities in a portfolio are that they can act as an inflation hedge and that they diversify core equity and bond holdings.

Some of the arguments cited against commodity allocations are that they are too volatile and often mean reversionary, leading to large losses from poorly timed investments.

The arguments “for” make some good points. There is evidence that commodities can act as a hedge against unexpected, or surprise, inflation.

One would also expect that the price of something like lean hogs would not correlate very closely to the S&P 500 or Barclays Aggregate Bond index.

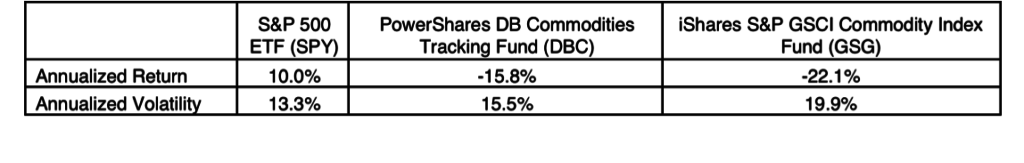

However, the “against” party has some valid points about the volatility and returns. Since the article was published in August 2013, the two largest ETPs tracking broad commodities indices, the PowerShares DB Commodities Tracking Fund (DBC) and the iShares S&P GSCI Commodity Index Fund (GSG), have had less than stellar performance.

Annualized Performance from August 2013 to September 2016 Source: Yahoo! Finance. Calculations by Newfound Research.

Source: Yahoo! Finance. Calculations by Newfound Research.

With such high volatility and low returns, a 0.35 correlation to the S&P 500 is little consolation for investors.

Which side of the argument is more compelling? To answer this question, we need to first understand how we invest in commodities.

How do we access commodities?

Everyone has an intuitive understanding of what commodities are. A barrel of oil, a bar of gold, a cow, a bushel of wheat – in some regards, these are easier to understand than equities or bonds. The tangible nature of commodities lends some concreteness to the discussion.

However, investing directly in commodities is rarely done. Of the $101.1 trillion invested in the global capital markets, commodities only comprised 0.3% according to a 2014 report by Hewitt EnnisKnupp.

The bulk of commodities trading takes place in the futures market.

Quick refresher: A futures contract is a financial derivative in which two parties agree to buy and sell the commodity on a set future date at the prevailing market price on the settlement date. Each party is obligated to exchange cash daily based on the current price of the contract.

Futures are nuanced investments that often seem very foreign (read: risky) to many investors. For one, it is more difficult for individual investors to access futures (similar to the difficulties associated with accessing options or hedge funds). ETFs and mutual funds make these investments much more accessible, but there comes a degree of obfuscation if the fund methodology and structure are not fully understood.

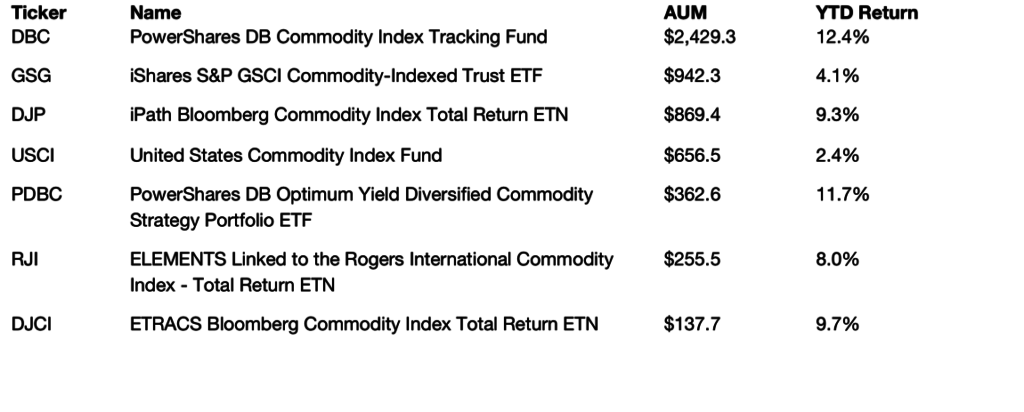

Consider the following list of broad market commodity ETFs.

Beyond the fact that the year-to-date returns point to some dramatically different holdings across the funds, they come in three different structural varieties: commodity pools, ETFs, and ETNs.

Beyond the fact that the year-to-date returns point to some dramatically different holdings across the funds, they come in three different structural varieties: commodity pools, ETFs, and ETNs.

Commodity pools are investment vehicles regulated by the U.S. Commodity Futures Trading Commission (CFTC), which trade futures (among other derivatives). While you can trade them like an ETF, you will get a K-1 come tax time, which is often viewed as a headache for many investors.

Exchange-traded notes (“ETNs”) are actually debt instruments and not only do not own the physical commodities, but also do not even own the futures contracts. They are merely guarantees of payments that follow a set of rules, generally based on an index. This structure eliminates tracking error to the index but exposes the purchaser to the counterparty credit risk of the issuer.

ETFs, of which PDBC is the only one, enjoy pass through taxation structure and freedom from counterparty risk. PDBC is described as an active ETF, so there is another layer of due diligence to ensure that the investment process is fully understood.

But aside from structural issues, what other factors come into play?

The futures curve

Futures contracts are tied to specific expiration dates. The prices of the contracts can vary widely across the different expiration dates (the “futures curve”), regardless of what the commodity currently costs (the “spot price”). The relationship among these prices has an important impact on commodity investments.

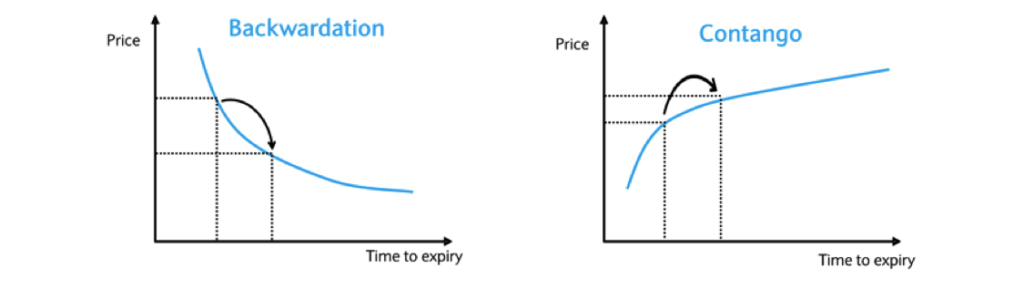

The two general states of futures curve are backwardation and contango. Backwardation refers to a state in which the futures are trading below the expected spot price in at maturity. Contango occurs when futures are trading above the expected spot price at contract maturity.

Contango is far more common for most futures contracts.

The reason for this can be rationalized by thinking about what it would take to replicate a futures contract.

Imagine that you are opening a bakery twelve months from now and want to lock in the price of 5,000 bushels of wheat. The crop was large this year, so rather than lock in at what seems like an exorbitant futures price, you go to the farmer down the road (possibly a long drive) and purchase the wheat at the current spot price.

But your basement is only so big, and you do not want the wheat to rot outside, so you rent some warehouse space. You also are a strong believer in Murphy’s Law and buy insurance to protect against mice, mold, fire, etc.

After factoring in transportation, storage, and insurance, the “cheap” wheat you bought turned out to cost more than the futures contract and came with quite a bit of hassle.

This toy example would rarely apply in today’s market where most commodities trading is done on speculation or for hedging purposes with no intent to actually take possession of the commodity, but it illustrates how futures contracts price in expectations for the spot price and the cost of carry (insurance, storage, transportation, etc.).

Backwardated markets can occur when there are short-term risks such as severe weather for crops, livestock diseases, and supply disruptions in the energy market. These are common with seasonal commodities.

Roll over, roll over

For our purposes, the important aspect to notice on the charts above is the arrows. One of the last things an ETF provider wants is to have 10,000 lean hogs sent to their office (although in the case of coffee, we might not mind). So most commodity ETPs invest in the nearest term contracts and must roll over into new contracts as the current ones become close to expiry.

When you rollover a contract in a backwardated market, you sell high and buy low. Rolling over in contango means you are purchasing more expensive contracts.

At a constant spot price, backwardation leads to positive roll yield as futures prices increase as maturity approaches. On the other hand, contango creates negative roll yield as futures prices are pulled down to the spot price over time.

These effects are much more than the typical investor wants to think about with commodity exposures.

So a common approach is to invest in an ETP that tracks an index.

Constructing commodity indices

As we saw in the varied YTD returns in the previous table of commodity ETPs, “broad commodity indices” must take different approaches to index construction.

There are many degrees of freedom in universe selection, asset weighting, liquidity screens, and sector caps. Regardless of the knobs that index providers turn, one common theme is attempting to gauge the economic importance of a given commodity.

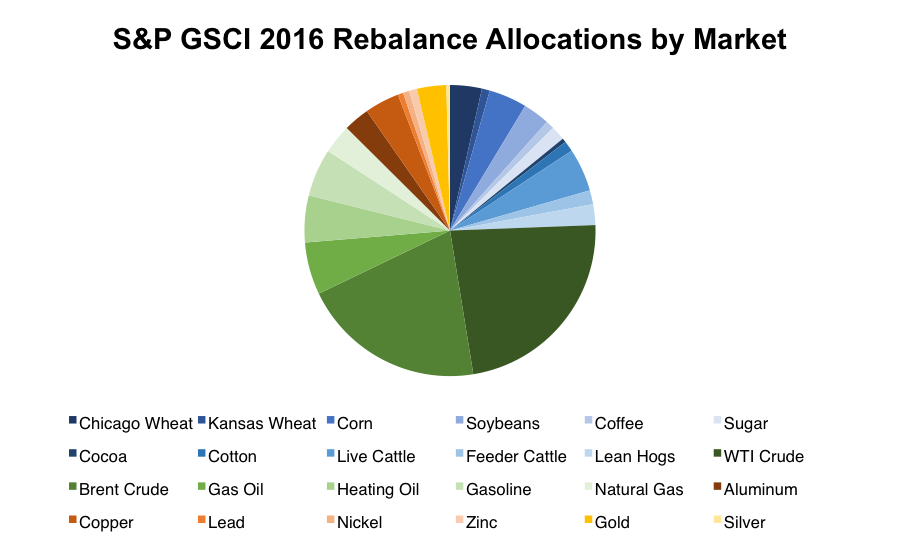

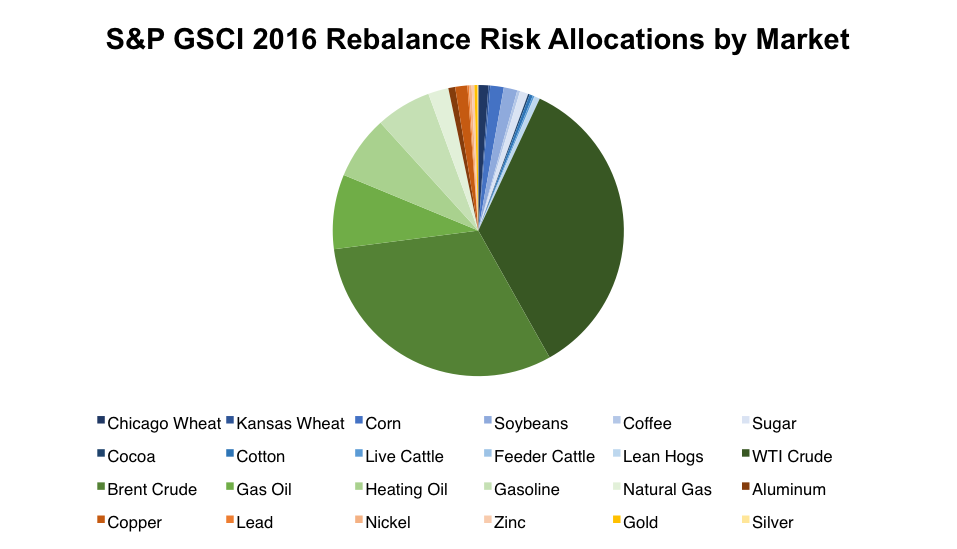

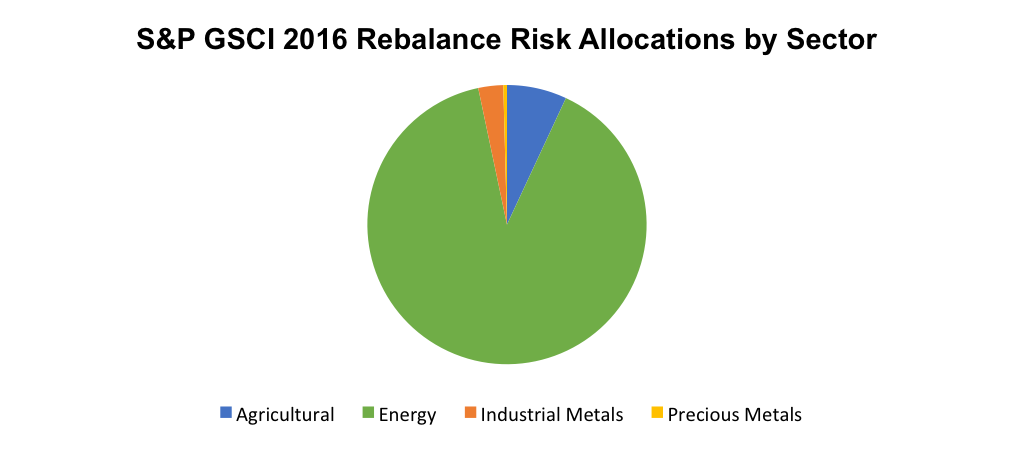

For example, the S&P GSCI, the index tracked by GSG, invests in 24 liquid commodities. Allocations are made in proportion to global production for each commodity. As of the 2016 rebalance, the allocations were heavily tilted to the energy sector (63%).

Source: Goldman Sachs

Source: Goldman Sachs

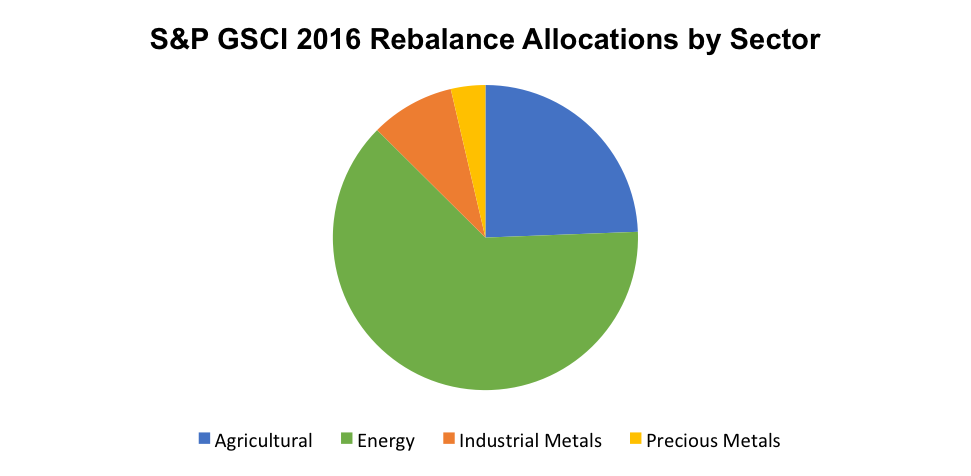

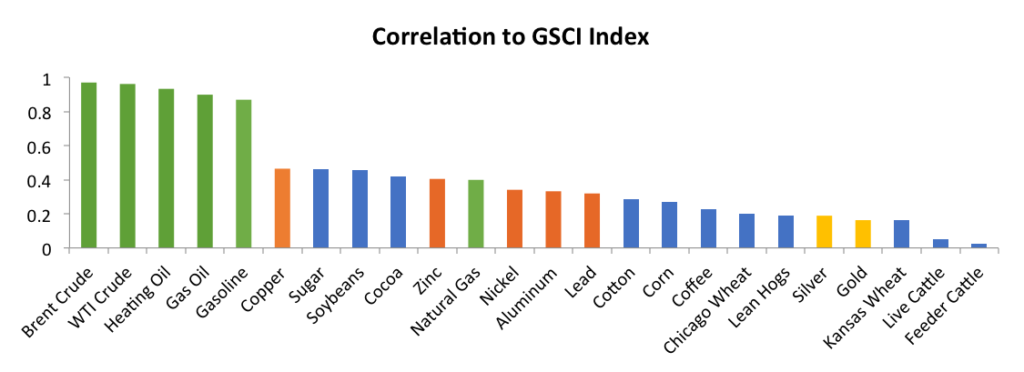

The main problem with production weighting is that the world relies on and produces so much energy, that there is little room left for truly diversifying exposures in other commodity sectors. The chart below shows the correlation of each asset class to the overall GCI index.

Source: Goldman Sachs. Calculations by Newfound Research.

Other indices weight based on factors such as open interest in the futures market.

Weighting based on open interest is essentially favoring the assets that most people like, somewhat like market-capitalization weighting. We wrote previously how this is a poor idea in fixed income, and a similar argument applies to commodities. Consider the fact that theoretically an unlimited amount of futures contracts could be opened on one lot of a thousand barrels of oil, and you will see that speculation can greatly influence the index allocations.

Then there are other indices that use hybrid weighting methods and subject sectors to certain caps, which is a step in the right direction to maintain diversified exposure.

In these weighting schemes, the key issue is that the commodities are weighted based on a measure of economic importance without considering investor importance.

Economic indicator or investment?

While gauging economic importance may be a good idea for an indicator of the macro-economic climate, it is not appropriate for investors looking for true diversification.

Many equity indices (e.g. the S&P 500 or Russell 1000) are market-cap weighted and are used as both economic indicators of the U.S. economy and investment vehicles. In our opinion, market-cap weighting in equities can be sub-optimal for investors, but it is not the worst thing in the world. Because equities are primarily exposed to one risk factor (the traditional “beta”), you can only do so much to reduce beta exposure while still investing in equities.

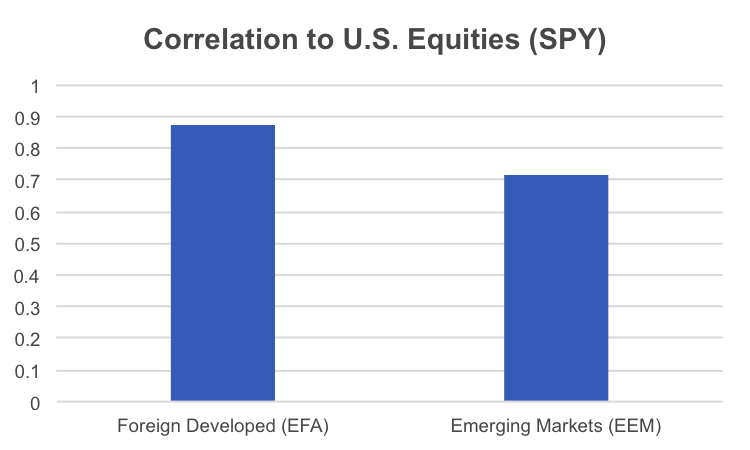

Diversifying a U.S.-based equity portfolio to include foreign developed and emerging market equities is one way to tilt toward other return sources that are not affected solely by the U.S. economy.

But with market-cap weighted indices, there is still a high correlation between the sleeves.

Source: Yahoo! Finance. Calculations by Newfound Research.

In order to reduce these correlations, you could loosen the restrictions of a market-cap weighted approach. For example, you could adjust the allocations to certain sectors or countries in an effort to increase internal diversification.

Incorporating alternative betas by titling toward factors such as value, momentum, quality, or low volatility to harvest premiums is another way to move away from the market-cap index and increase potential diversification. This is the main objective of many smart beta equity funds.

Regardless of how equity portfolios are allocated, in the end, equity market beta is still the largest risk. The alternative betas are the icing on the cake.

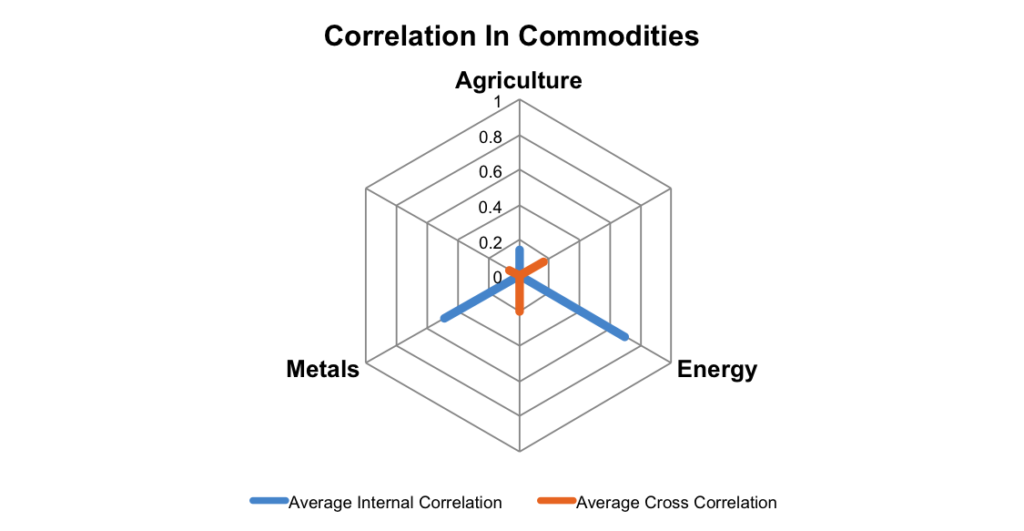

In commodities, the picture is much more varied. With such a variety of markets to trade in, diversification opportunities, abound, especially in the agriculture sector. There are many ways to allocate to different risk factors while still investing in “commodities”.

Source: Goldman Sachs. Calculations by Newfound Research.

Internal correlations and cross correlations are low for each sector except within energy.

By weighting based on production or open interest (essentially market-cap weighting), these diversification opportunities are overshadowed since they occur in much smaller markets. As we said previously, capping individual positions mitigates this issue somewhat, but there is a more systematic way of approaching the problem.

Balancing risk in commodities

Risk parity is generally regarded as a total portfolio strategy geared more towards institutional investors. The central idea is that risk, rather than dollars, should be balanced within a portfolio. The popular example often cited is the 60/40 portfolio, in which approximately 90% of the risk comes from the equity allocation.

A risk parity approach would shift the allocation more toward bonds so that the risk contribution from each asset was equal. Doing this means holding a very sizable position in bonds, which dampens the absolute return. To circumvent this issue, the portfolio is typically levered up to have the same volatility as the original 60/40 portfolio.

This overweight to bonds combined with leverage scares many investors away, which may be a behavioral and/or structural reason that risk parity portfolios have historically outperformed.

In our current discussion about commodities, we can employ the same process of portfolio construction. However, since the portfolio is comprised only of commodities, which are each quite volatile, leverage won’t be necessary.

Rather than having to manually filter the universe or impose position caps, the risk parity methodology will selectively allocate to balance risk contributions.

Our baseline production based portfolio looks even more skewed toward energy when viewed through the risk lens.

Source: Goldman Sachs. Calculations by Newfound Research.

Source: Goldman Sachs. Calculations by Newfound Research.

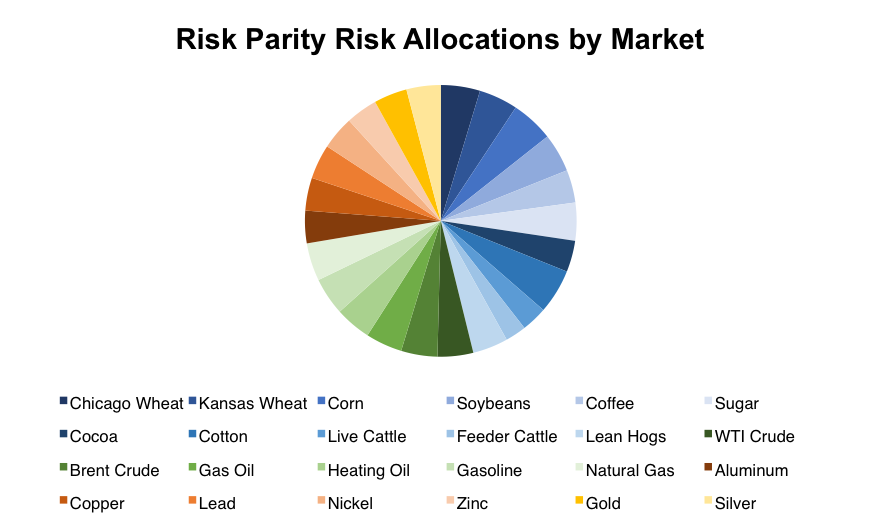

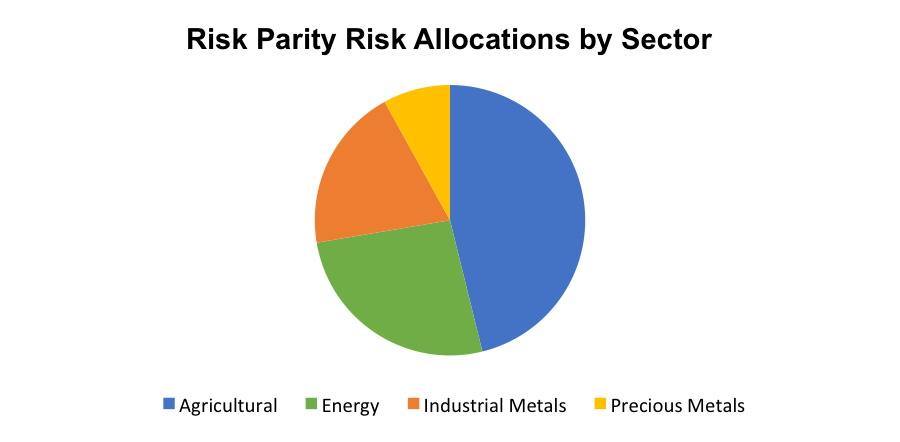

The risk parity risk allocations are shown below.

Note: For this version of risk parity, we used what is also commonly called Equal Risk Contribution (ERC). Oftentimes, “risk parity” refers to weighting assets based on the inverse of their volatility. ERC accounts for the correlation between assets when balancing the contribution to the overall risk.

Source: Goldman Sachs. Calculations by Newfound Research.

Source: Goldman Sachs. Calculations by Newfound Research.

Since we balanced the risk on a per asset class basis and had a different number of asset classes within each sector, the sector risk weightings are necessarily out of balance. It is entirely possible to tweak the algorithm to balance risk on a sector basis, which is what many risk parity funds do with equities, bonds, commodities, etc.

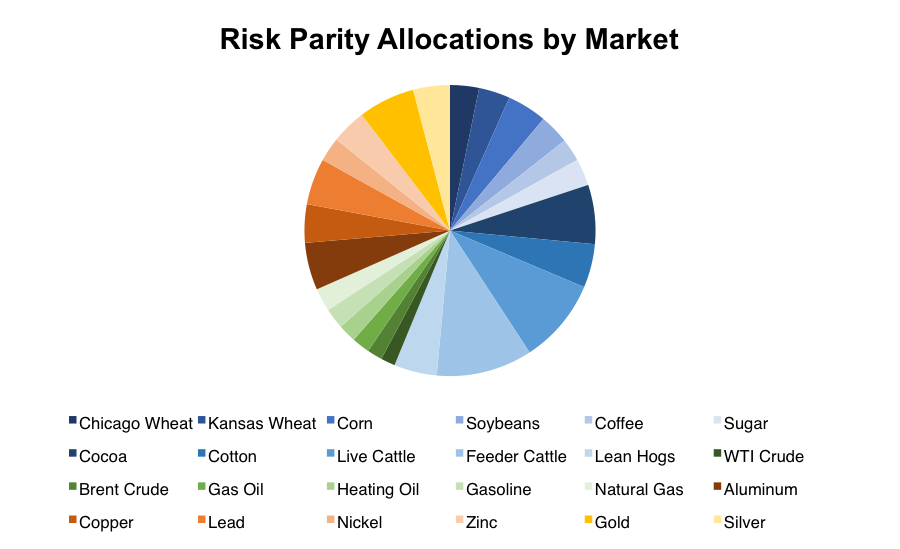

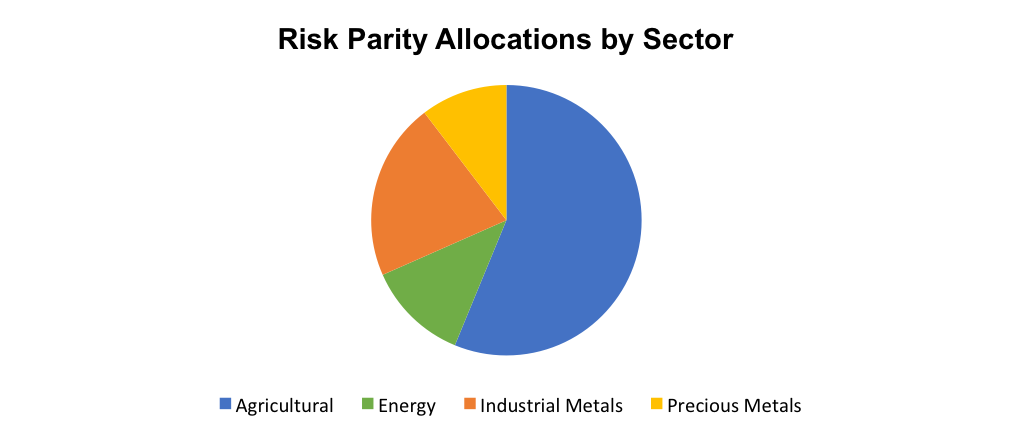

We can also see how the raw allocations are affected in the risk parity portfolio. Each of the energy assets receives a much lower weight, while the diversifying exposures (e.g. cattle) receive larger allocations.

Source: Goldman Sachs. Calculations by Newfound Research.

Source: Goldman Sachs. Calculations by Newfound Research.

Now that we have seen how the allocations, both by dollar and risk, are affected, how would the performance have changed?

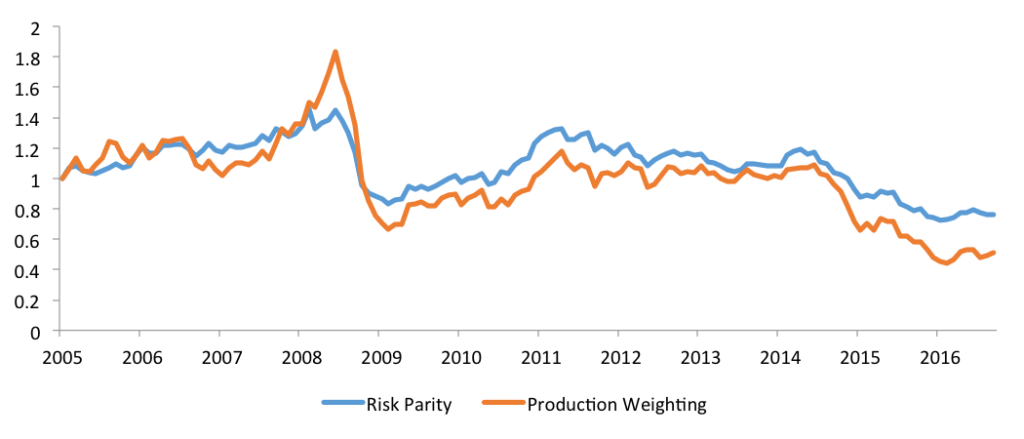

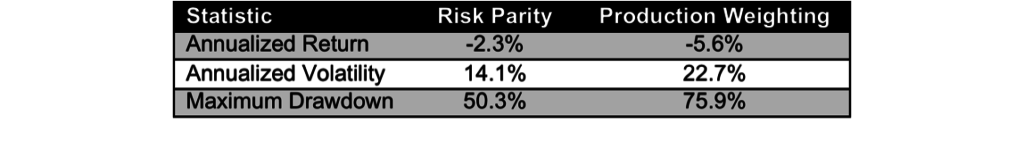

Source: Goldman Sachs. Calculations by Newfound Research. The start date is January 2005 because that is when a 36-month correlation matrix could be calculated for all 24 futures contracts.

Note: In order to get an apples-to-apples comparison, we used the current production weights in the GSCI index back through time for the “Production Weight” index. This hypothetical index outperformed the GSCI index over the time period but still have a 0.99 correlation, so comparing against it is a more conservative approach.

The performance metrics show that risk parity limited both the volatility and maximum drawdown during a tough period for commodities. It also improved on risk-adjusted returns, which is a primary objective of unlevered risk parity.

Source: Goldman Sachs. Calculations by Newfound Research.

Source: Goldman Sachs. Calculations by Newfound Research.

What are you exposed to?

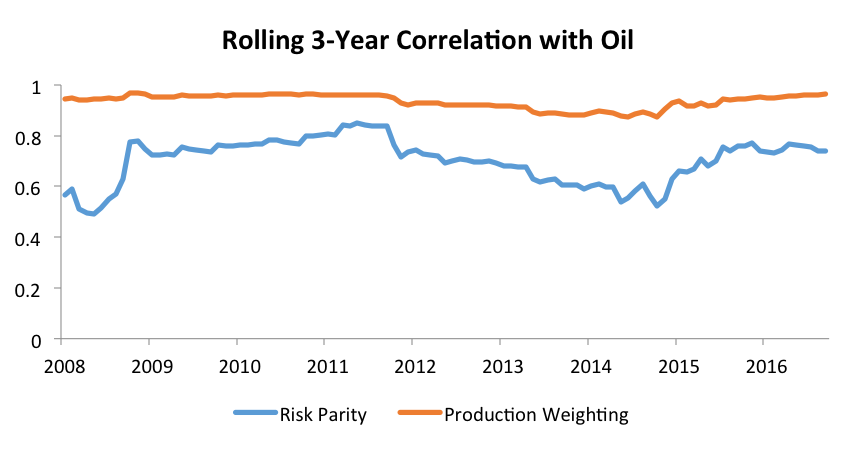

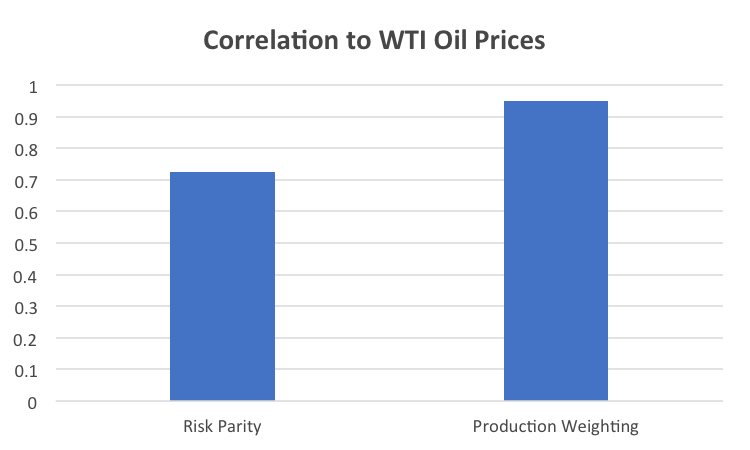

Aside from the performance, we previously saw that the correlation between oil and the GSCI index was very high.

Source: Goldman Sachs. Calculations by Newfound Research.

Risk parity reduces that correlation, and it has done so consistently on a rolling basis.

Source: Goldman Sachs. Calculations by Newfound Research

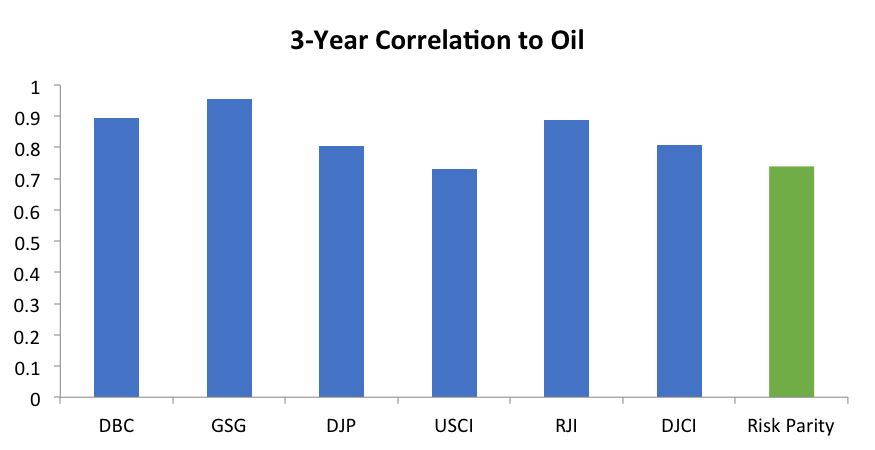

So what about other indices? We have picked on the GSCI for much of this analysis, but we can see that many others are also highly correlated with oil.

Source: Yahoo! Finance, Goldman Sachs. Calculations by Newfound Research. PDBC was excluded from the analysis since it did not have a three-year track record and is technically an active ETF.

Source: Yahoo! Finance, Goldman Sachs. Calculations by Newfound Research. PDBC was excluded from the analysis since it did not have a three-year track record and is technically an active ETF.

However, some of these ETPs break the mold and have a lower correlation. For instance, USCI utilizes backwardation and momentum to select its portfolio.

Ultimately, it is up to the investor to define the risks they want to take. Just know that many of the common passive commodity exposure indices are heavily tilted toward oil.

Conclusion

While equities and bonds are driven by a limited set of risk factors, commodities may expand the risk palette when investors are constructing portfolios. But investing in commodities is not as straightforward at it seems at first blush. Beyond the structural risks that come with accessing them, there is a question as to whether indices that are constructed to function as economic indicators are beneficial to investors.

Many passive commodity indices are heavily weighted toward oil and other energy commodities, which makes energy prices a primary driver of their returns. Taking a risk parity approach is one possible way to transfer the focus from a dollar allocation to a risk allocation, which may make the commodity exposure more robust to sudden market shocks and more fully exploit diversification opportunities that exist in the market.

The outlook for commodities is not exceptionally rosy.

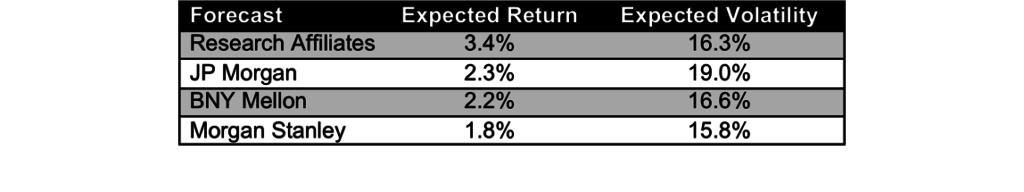

Source: BNY Mellon, JP Morgan, Morgan Stanley, and Research Affiliates. Data obtained from each company’s Capital Market Assumptions.

Source: BNY Mellon, JP Morgan, Morgan Stanley, and Research Affiliates. Data obtained from each company’s Capital Market Assumptions.

These volatility numbers are higher than most estimates for equities, but the forecasted returns are either lower or right in line with those of equities. But we must not underestimate the power of diversification. Low correlations can lead to favoring a small allocation to a lower return, higher volatility asset.

Indeed, under our strategic asset allocation methodology (discussed previously in part here, here, and here), commodities receive a 1%-6% allocation depending on the volatility target. This may not seem like a large allocation, but with such a volatile asset class, it may be enough to benefit to our portfolios given the low expected growth in both core equities and fixed income.

Client Talking Points

- Commodities are exposed to many risks that equities and bonds are not as sensitive to, but this can make them beneficial when equities and bonds are not performing well.

- However, we have to be careful not to over expose ourselves to any one risk factor (for example: oil prices).

- Using techniques that balance out risk exposure across a variety of sources can lead to smoother rides when market volatility and capital risk are elevated.

This blog post is available as a PDF here. This blog post originally appeared at the Newfound Research Blog.

Copyright © Newfound Research