Is It Too Late to Catch the Emerging-Market Rally?

by Fixed Income AllianceBernstein

October 21, 2016

After a strong stretch for emerging markets so far in 2016, some investors wonder whether the rally still has legs. Although stock valuations have risen, we think signs point to yes.

Year to date through September, the MSCI Emerging Markets Index returned 16.4%. That showing outpaced the 6.1% gain of the MSCI World Index and the 7.8% gain of the S&P 500 Index. Although there are risks, we believe the emerging-market (EM) rally could continue with improving opportunities, driven in part by Chinese monetary stimulus, and supported by stabilization in commodity prices, continued growth in the US and firming exports from EM economies.

What are some of the risks on the horizon? They include another possible US Federal Reserve rate hike, a presidential election with global trade as a major issue, and simmering geopolitical tensions involving Russia and China.

It’s understandable that some investors might want to take their recent gains and go home, while others might be reluctant to invest new money. But we see good reasons to stay committed—and we believe certain EM investments have considerable room to run.

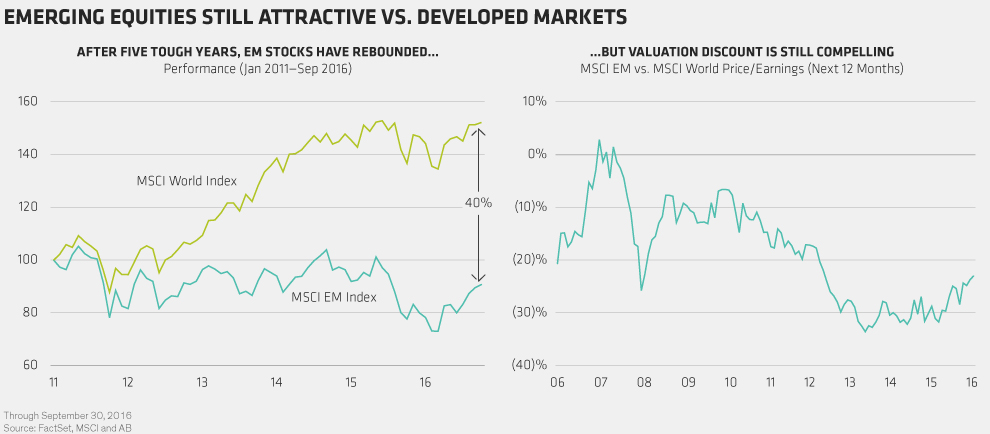

In January, we said that EM equities and debt would generate strong returns based on attractive valuations, still-intact fundamentals and positive technical factors. Even after the rally, EM equities haven’t caught up with developed-world equities after five tough years (Display, left). And while the price-to-earnings discount of EM stocks relative to developed-market stocks has narrowed, the valuation gap of 23% is still sizable (Display, right).

With higher valuations, it’s important to be selective, to control for risks and to avoid markets where valuations are stretched. These markets tend to be more volatile, so investors have to ask whether the quest for higher returns is worth the extra risk. Actively searching across asset classes offers the flexibility to stay nimble and manage risks.

Brazil and Indonesia Lead EM Debt Opportunities

As EM equity and debt markets have recovered, we’ve seen the opportunity shift. After last year’s 15% decline, local-currency EM bonds have become increasingly attractive. Countries like Brazil and Indonesia offer the world’s highest real interest rates as inflation pressures ease, which leaves scope for rates to fall. That could boost returns from potential price gains and lucrative coupons.

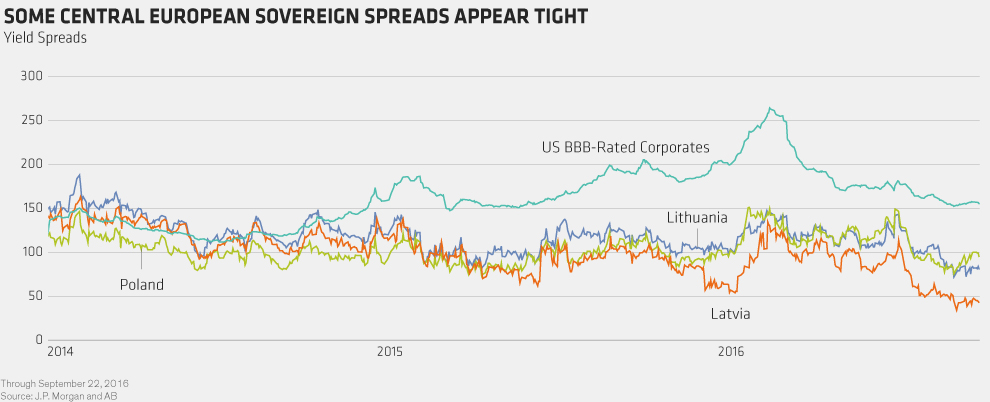

On the other hand, some EM debt markets have become crowded, pushing yields below those of comparably rated developed-market bonds. US dollar–denominated EM bonds issued by central and eastern European governments, for example, now trade at much tighter credit spreads than do similarly rated US corporate issues (Display).

China’s Economic Stabilization Boosts Global Stocks

A shift is also under way within equities. After a “safety trade” in the first half of the year sent lower-volatility stocks higher, investors are starting to find bargains in more cyclical areas. One reason: improvement in China.

In early 2016, China’s economic outlook appeared quite uncertain. Policymakers were providing stimulus, but we hadn’t seen signs of traction yet, and producer prices were in decline. Now, we’re seeing the effects of that stimulus: Chinese economic activity is stabilizing, company pricing power is strengthening, and the country’s real estate market has picked up steam. So has the stock market: Chinese stocks, which were trading at a five-year low in February, have returned 8.8% year to date through September.

As concerns about debt sustainability ease, Chinese financials and real estate stocks are doing especially well, with gains in the mid-teens over the last quarter. Technology companies that are focused on the country’s burgeoning e-commerce segment are also up smartly. In some cases, they continue to offer value based on strong cash flows and growth potential. We’re finding plenty of Chinese stocks with strong cash flows, good valuations and higher yield.

Latin American Turnaround

Brazil and Argentina are also posting good performance, with their equity markets up 62.9% and 19.5% year to date through September, respectively. Both countries are pursuing more sustainable macroeconomic policies. And inflation is down from highs in both countries, enabling their central banks to start lowering interest rates. Lower rates reduce borrowing costs as well as discount rates on assets in those markets. Although economic growth hasn’t taken off yet, equity markets are starting to anticipate a recovery, supporting strong returns.

Across emerging markets more broadly, energy has been this year’s best-performing sector, with oil prices up from their first-quarter lows. Global integrated companies have acted decisively to shore up cash flows after last year’s oil-price decline. This leaves them able to sustain dividend yields of 6% or higher while trading at discounts to major global oil firms.

Developing Conviction in Complex Conditions

EM investments can present attractive return potential but often with elevated risk. We think investors must focus on high-conviction ideas that don’t hinge on difficult-to-forecast macroeconomic risks—or on individual countries or companies that face issuer-specific political or governance risk.

These factors often affect broad EM volatility. Indices can create unintended risks, because they tend to become concentrated in, and tied to, riskier countries or sectors. That’s why we think an active approach can make sense, separating investors’ success from the index’s construction and volatility.

The bottom line: Investments within emerging markets continue to offer plenty of potential for investors who look beyond benchmarks. It’s not too late to make the most of those opportunities.

1S&P, Morningstar Direct and MSCI; MSCI returns in US dollars

MSCI makes no express or implied warranties or representations, and shall have no liability whatsoever with respect to any MSCI data contained herein.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams.

Copyright © AllianceBernstein