by Michael Lebowitz, 720 Global Research

When asset valuations are extended well beyond historical norms, as they are today, some investment managers elect to take a more defensive and cautious posture than the consensus. In “Bubbles and Elevators”, we discussed how behavioral instincts to follow the herd dominate human nature, but fighting those instincts is necessary to limit exposure to, or avoid entirely, market situations that pose abnormally high risks. Rational judgment, not emotion, should guide investment decisions, and investment professionals need to effectively impart this rationale to clients. As if this task is not hard enough, it is frequently made more challenging when their client’s perspective on market returns is not supported by the facts. At such times, it is incumbent upon the manager to help clients understand reality.

Currently, with equity markets sustained near all-time highs, there is a common perception that the equity market is “running”. As a result, many investors harbor concern of getting left behind. The reality is that equity markets are not surging, or “running”, and have actually been consolidating for almost two years.

Perception

Human perception is based on an incredible amount of sensory information. Some of our perception may be based on fact but quite often it is more heavily influenced by the opinions of other people – friends, strangers, the media, and the so-called “experts”.

Currently, many investors have a perception that the equity markets are exhibiting powerful momentum higher and generating above average returns. For investors who are taking a more conservative stance towards equities, this perception may create discomfort and dissatisfaction. Such investors tend to believe that their portfolio strategy is causing them to underperform the equity indices and the portfolios of their friends and neighbors. Marking time and avoiding risk, in their minds, is coming at great opportunity cost.

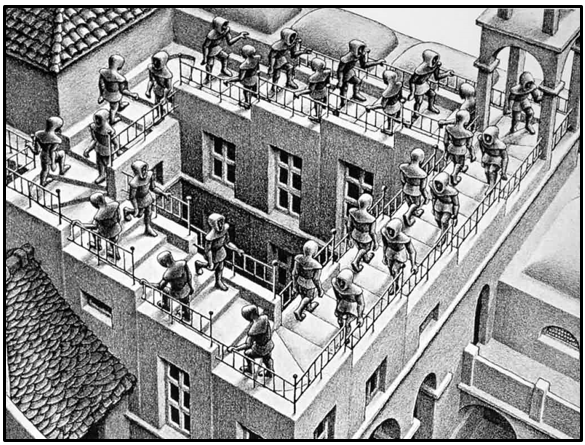

This perception of recent robust market returns is not only based on how others describe the markets, but is also likely based on the bullish market trend that started in the wake of the financial crisis. The graph below shows the tremendous gains achieved since 2009 and a cursory glance supports the perception that the bull is still running strong.

S&P 500 – 2009 to Current

Data Courtesy: Bloomberg

Reality

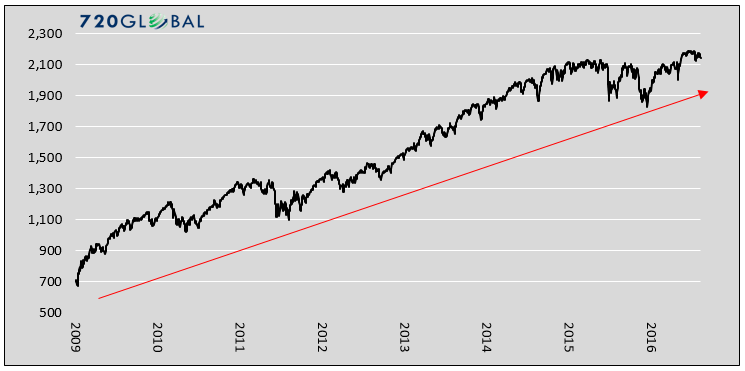

The stock market has certainly posted impressive returns since 2009, but for the better part of the last two years it has consolidated. Although near all-time highs, the S&P 500, has only generated a 2.13% annualized return since the end of 2014.

S&P 500 – 2015 to Current

Data Courtesy: Bloomberg

While positive, that return is well below historical averages and was accompanied by two gut wrenching downturns. One should also appreciate that such a meager return could have easily been earned by taking a far less risky position. A simple portfolio consisting of U.S. Treasury bonds and cash would have earned a similar return while taking a small fraction of the risk.

Technically speaking, the longer-term bullish trend in equities is still intact, but terms like consolidating or meandering are much more appropriate descriptors of the current trend. For those sitting on the so-called sidelines, take solace in reality. What you missed were sub-par returns and two 10% declines.

The total returns of well-diversified and well-run major pension funds and endowments provide further insight into the current divergence between perception and reality. The Trust Universal Comparison Service (TUCS) index from Wilshire tracks the performance of major endowments in the U.S. and reports quarterly on $3.6 trillion in assets covering 1,300 plans. As reported in August, the index through fiscal year June 30, 2016 lost a median 0.74%, marking the worst annual decline since 2009. The troubling performance of 2016 follows a meager 2.8% return in 2015, marking two consecutive years endowments have failed to achieve their target returns. As conveyed by most fund managers, the outlook is equally poor given current valuations on major asset classes and comparative hedge fund performance. These funds are run by some of the best and brightest investment managers in the world. Their returns speak volumes to the challenges of generating returns over the last two years.

Summary

M.C. Escher’s famous painting “Ascending and Descending”, shown above, and recent market trends have a lot in common. They both portray a lot of up and down movement and what many may perceive to be trends. However, when studied closely, they both show little to no absolute change in direction.

Combating perception-driven narratives and conveying reality to your clients is vital, especially in markets such as today that pose significant risks. Frequently a dose, or two, of reality can help clients diminish the behavioral pressure of taking an “alternative” stance and more importantly help them stick to their long term plan and achieve their financial goals. Although the Federal Reserve depends on managers “throwing in the towel” and chasing returns, your clients’ wealth depends on your unemotional decision-making and clear communication.

Michael Lebowitz, CFA

Investment Analyst and Portfolio Manager for Clarity Financial, LLC. specializing in macroeconomic research, valuations, asset allocation, and risk management. RIA Contributing Editor and Research Director. Co-founder of 720 Global Research.

Follow Michael on Twitter or go to 720global.com for more research and analysis.