Understanding the Capital Gains Tax: A Case Study

by Commonwealth Financial Network

Capital gains play an important role in every advisor’s life—you are required to walk the tightrope between creating investment gains for clients and managing those gains in a tax-efficient manner. While you probably know the basics when it comes to understanding the capital gains tax (sale price – basis = capital gain [or loss]), you may not be familiar with the intricacies of the tax or how it interacts with the income tax.

Capital gains play an important role in every advisor’s life—you are required to walk the tightrope between creating investment gains for clients and managing those gains in a tax-efficient manner. While you probably know the basics when it comes to understanding the capital gains tax (sale price – basis = capital gain [or loss]), you may not be familiar with the intricacies of the tax or how it interacts with the income tax.

To give you a better understanding of capital gains, let’s take a look at Sally Client’s case. Sally is single and has wages of $100,000. Her capital gains and losses for the year are as follows:

- Short-term losses: $7,500

- Short-term gains: $2,500

- Long-term losses: $10,000

- Long-term gains: $65,000

You can begin by calculating Sally’s net capital gains for the year. The IRS has designated specific steps that investors must take when netting losses and gains on their returns. These steps differentiate between short-term gains and losses (from investments held less than one year) and long-term gains and losses (from investments held one year or more):

- Net short-term losses against short-term gains.

- Next, net long-term losses against long-term gains.

- If one step results in a gain and the other in a loss, they are netted against each other.

In Sally’s case, these steps would apply as follows:

- The $7,500 in short-term losses would be netted against the $2,500 in short-term gains for a net $5,000 short-term loss.

- The $10,000 in long-term losses would be netted against the $65,000 in long-term gains for a net $55,000 gain.

- The net $5,000 short-term loss would then be netted against the $55,000 net long-term gain, resulting in a net $50,000 long-term gain.

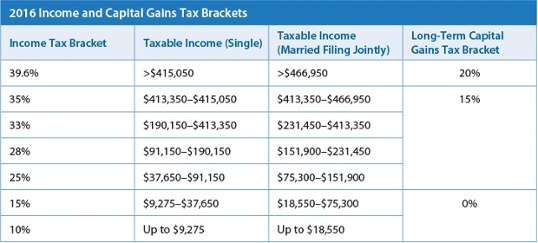

The next step is to determine the capital gains tax rates, which correspond to various income tax brackets. The 2016 rates are shown below.

Similar to the federal income tax, capital gains tax rates are graduated. This means that, depending on Sally’s tax bracket, a portion of her capital gains may be charged at 0 percent, a portion at 15 percent, and a portion at 20 percent. Capital gains and income taxes are intertwined—capital gains are considered income and factored in when determining a taxpayer’s overall taxable income rate. When determining how Sally will be taxed, her capital gains are “stacked” on top of her ordinary income: Deductions get applied to ordinary income first, and that ordinary income is taxed at the lowest brackets first, which provides for the most tax savings.

In Sally’s case, her $50,000 of capital gains will be “stacked” on top of her $100,000 of ordinary income for a total income of $150,000. She will be eligible for the $4,050 personal exemption and the $6,300 standard deduction, for a total of $10,350. Her ordinary income will be offset by those deductions: $100,000 – $10,350 = $89,650. Her $50,000 long-term gain will then be stacked on top. Therefore, Sally will be taxed as follows:

- First $9,275 of ordinary income is taxed at 10 percent.

- The next $28,375 of ordinary income is taxed at 15 percent.

- The remaining $52,000 of ordinary income is taxed at 25 percent.

Because the 0 percent capital gains rate applies only until the first two tax brackets are “used up,” Sally’s capital gains will all be subject to the 15-percent capital gains rate. If Sally had capital gains of, say, $350,000 instead of $50,000, giving her a total income of $450,000, she would have a portion of her gains taxed at 15 percent and a portion taxed at 20 percent.

The 20-percent capital gains rate kicks in when total income exceeds the upper end of the 35 percent income tax bracket—for 2016, $415,050. Therefore, Sally’s first $325,400 in capital gains ($415,050 – Sally’s $89,650 in ordinary income) will continue to be taxed at 15 percent, and then the remaining $24,600 will be taxed at 20 percent.

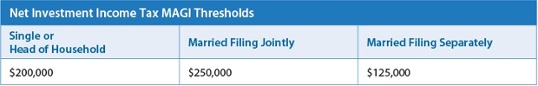

In the latter example, where Sally has income of $100,000 and net long-term capital gains of $350,000, you would also need to take into account the 3.8-percent net investment income tax (NIIT) or surtax that applies to investment income, including capital gains, for high-income individuals. It’s applied to the lesser of a taxpayer’s total net investment income or to the difference between the taxpayer’s modified adjusted gross income (MAGI) and the thresholds shown below.

Sally’s wages of $100,000 plus her capital gains of $350,000 amount to a $450,000 MAGI, which is $250,000 over the $200,000 surtax threshold for a single taxpayer. Therefore, the NIIT will be assessed on $250,000 (which is the lesser of $250,000 or $350,000), and Sally will owe a tax of $9,500.

Of course, Sally is just one example, and your clients will have other factors that may need to be considered. In any case, a keen understanding of the capital gains tax can position you as an expert to your clients and can assist you in effectively managing their tax bill!

What strategies do you use to minimize your clients’ tax exposure? Please share your thoughts with us below!

Commonwealth Financial Network® does not provide legal or tax advice. You should consult a legal or tax professional regarding your individual situation. All examples are hypothetical and are for illustrative purposes only. No specific investments were used. Actual results will vary. Past performance does not guarantee future results.

Commonwealth Financial Network is the nation’s largest privately held independent broker/dealer-RIA. This post originally appeared on Commonwealth Independent Advisor, the firm’s corporate blog.

Copyright © Commonwealth Financial Network