by LPL Research

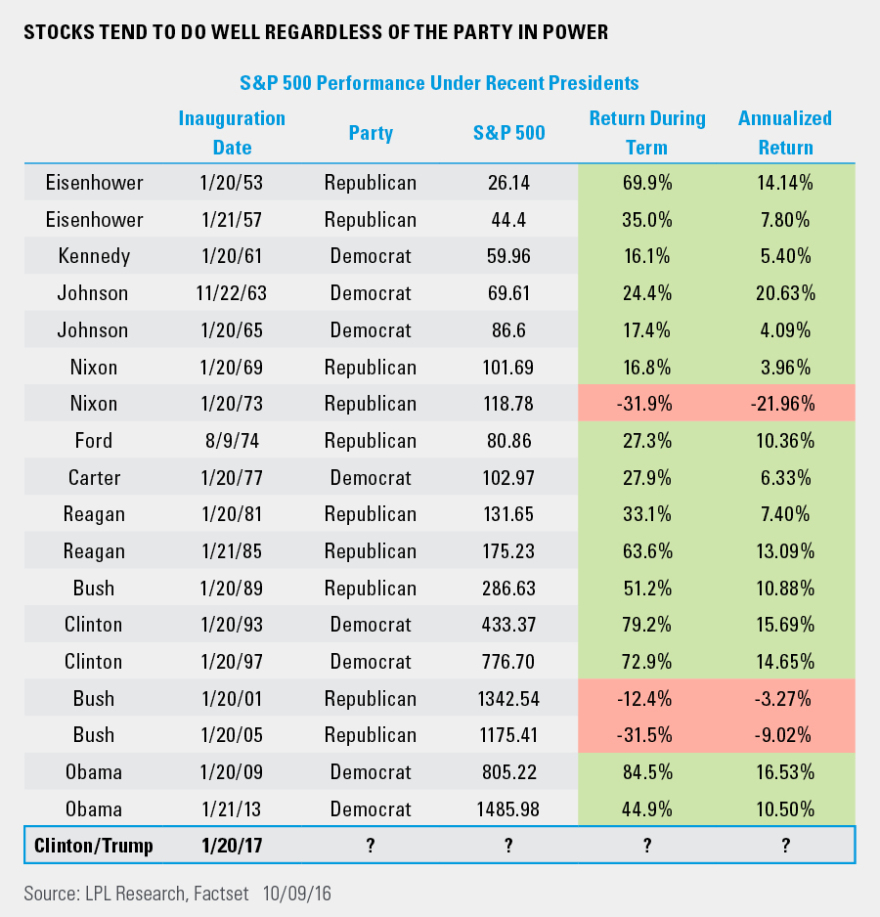

After the second presidential debate last night, the race continues to heat up. According to Senior Market Strategist Ryan Detrick, “‘Under which party do stocks perform better, Democrats or Republicans?’ is always a popular question. As we discussed in our Midyear Outlook, going back to 1900, the Dow has done slightly better under a Democratic president than a Republican president. Although stocks have performed slightly better under Democrats over time, the bottom line is that gridlock is the best case for stocks.” Gridlock is a split Congress or a president from the party opposite the one in control of both houses of Congress.

Here is how the S&P 500 has done under various presidents going back to President Eisenhower. Only three times has the S&P 500 been negative during a president’s term, with all three happening under a Republican president, and all three taking place during an economic recession. History has shown that economic recessions usually lead to lower equity prices. The best total return was the 84.5% gain during President Obama’s first term, which came on the heels of the Great Recession and the rebound from a deep bear market.

Copyright © LPL Research

*****